Small Range Stocks (ATR 7)This indicator identifies stocks with a small daily range relative to their ATR(7). It plots a small green tick below candles where the daily range is ≤ 0.9 × ATR(7), helping traders spot consolidation zones for potential breakouts.

Candlestick analysis

Candle Body % ChangeThis indicator shows the relative price change in candle bodies. I use this to track daily relative changes in markets like NYSE or NASDAQ where discontinued price action regularly happens.

Hypersonic MAIN Intersection IndicatorIndicator that shows the intersection point of two Items of Interest. Backtesting showed the best was Candle/EMA 9.

1. I added 2 auxiliary EMA's that you can view or hide becuase I know some people like to see the EMA 200

2. You select the First and Second Item of Interest and it'll plot it in the background. First EMA and Second EMA correspond to whether you select them or not. The BWMA stuff is near the bottom. And in the middle is how you can show/hide the data table in the top-right.

3. you can show/hide different lines in the Style section

4. on the Style tab of Settings, you can turn off the whole table as well as the Trades, just the signal of the trade, or just the quantity of the trade

Gold Futures vs Spot (Candlestick + Line Overlay)📝 Script Description: Gold Futures vs Spot

This script was developed to compare the price movements between Gold Futures and Spot Gold within a specific time frame. The primary goals of this script are:

To analyze the price spread between Gold Futures and Spot

To identify potential arbitrage opportunities caused by price discrepancies

To assist in decision-making and enhance the accuracy of gold market analysis

🔧 Key Features:

Fetches price data from both Spot and Futures markets (from APIs or chart sources)

Converts and aligns data for direct comparison

Calculates the price spread (Futures - Spot)

Visualizes the spread over time or exports the data for further analysis

📅 Date Created:

🧠 Additional Notes:

This script is ideal for investors, gold traders, or analysts who want to understand the relationship between the Futures and Spot markets—especially during periods of high volatility. Unusual spreads may signal shifts in market sentiment or the actions of institutional players.

Billafx(trend) High/Lowthis indicator is gonna help you to spot the market strecture in advanced way, created by billafx

Mickey's BBMickey's BB – Smart Reversal Detector with SL Tracking 🔁

This indicator combines the power of Bollinger Bands with engulfing candle patterns to identify high-probability reversal points.

✅ Buy Signal: Triggered when a red candle touches the lower Bollinger Band and is engulfed by a green candle within the next few candles.

✅ Sell Signal: Triggered when a green candle touches the upper Bollinger Band and is engulfed by a red candle within the next few candles.

✅ Smart Lookahead: Scans up to X candles ahead (user-defined) to confirm engulfing reversals — reducing noise in sideways markets.

✅ Dynamic Stop-Loss & Target: Automatically plots SL/TP levels based on user-defined % thresholds.

✅ SL HIT Labels: Highlights exactly when a stop-loss is breached, giving clear visual feedback on trade failures.

✅ Adaptive Market Filter: Signals are only shown when Bollinger Band width exceeds a minimum threshold — filtering out weak/noise signals in low volatility.

🔍 Ideal for reversal traders, scalpers, and those who love combining price action with volatility-based setups.

🛠️ Customizable Parameters:

SMA Period & Std Dev Multiplier (for BB)

SL/Target % levels

Engulf Lookahead range

Minimum BB width to filter signals

🎯 Build it into your strategy, set alerts, or just use it visually to time your entries and exits with clarity.

Pinbar DetectorFinding a pinbars on m5 timeframe. In order for the indicator to search for pinbars specifically on the M5 timeframe (5 minutes), you need to set this value in the tf parameter by default. In the current code, the timeframe is set via input.timeframe, and you can either change it manually in the indicator settings after adding it to the chart, or set M5 directly in the code.

Here's how to do it:

Change in code: In the line with input.timeframe, replace the default value "D" with "5" (in Pine Script, timeframes are designated as follows: "5" for 5 minutes, "15" for 15 minutes, "60" for 1 hour, etc.).

Volume Delta Divergence + Bollinger Bands (Filtered)📌 Volume Delta Divergence with Bollinger Bands (Filtered)

This script combines Volume Delta Divergence detection with Bollinger Bands to help identify high-probability buy and sell signals based on volume behavior and price action.

🔍 Key Features:

✅ Divergence Detection: Identifies when price moves in one direction (green/red candle), but the delta volume (buy vs sell volume) moves in the opposite direction — a common sign of hidden weakness or strength.

✅ Volume Strength Filter: Filters out weak divergence signals by checking if the delta volume is significantly larger than its historical average (user-defined lookback).

✅ Breakout Confirmation: A signal is only triggered when the next candle breaks the high or low of the divergence candle.

✅ Bollinger Bands Overlay: Adds standard Bollinger Bands (20-period SMA ± 2 standard deviations by default) for trend and volatility analysis.

✅ Clean Signal Display: Plots "BUY" and "SELL" labels only when strong divergences occur, reducing noise and false signals.

⚙️ User Inputs:

Custom timeframe for volume delta analysis

Delta volume average lookback period

Bollinger Band settings (length & deviation)

🧠 How to Use:

Use the divergence signals in conjunction with Bollinger Band positioning.

Consider SELL signals stronger when they occur near the upper Bollinger Band, and BUY signals near the lower band.

Combine with price action or RSI for added confluence.

Bi Trend signalauto bot MT5 for XAU, BTC ETH, liên hệ tôi để biết thêm chi tiết cho các hạng mục coppy trade

Price action plus//The system combines the divergence of A/D and OBV with identifying reversal points using Japanese candlestick patterns, creating an enhanced version of price action. This helps investors more easily and accurately recognize reversal patterns in technical analysis.

Divergence of A/D vs. OBV includes:

Positive divergence: Identifies smart money leaving the market.

Negative divergence: Identifies smart money entering the market.

Reversal candlestick patterns include:

Buy signals: Morning Star, Bullish Engulfing, Hammer.

Strong Buy signals: Buy signals + Negative divergence

Sell signals: Evening Star, Bearish Engulfing, Shooting Star.

Strong Sell signals : Sell signals + Positive divergence

//Hope this system will be helpful for you!

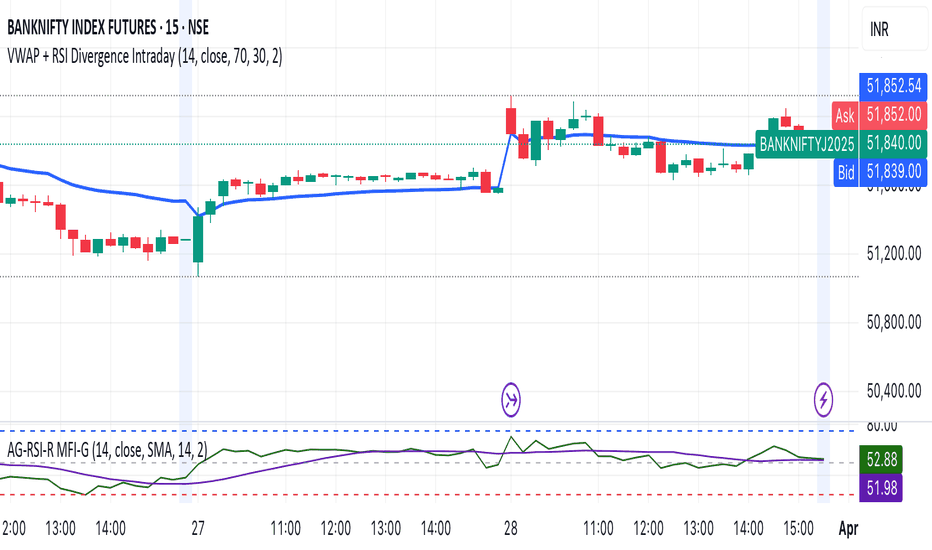

VWAP + RSI Divergence Intraday

VWAP for trend confirmation

RSI divergence detection

Entry signals when price breaks above VWAP with increasing volume

Stop-loss & take-profit levels

Open Price on Selected TimeframeIndicator Name: Open Price on Selected Timeframe

Short Title: Open Price mtf

Type: Technical Indicator

Description:

Open Price on Selected Timeframe is an indicator that displays the Open price of a specific timeframe on your chart, with the ability to dynamically change the color of the open price line based on the change between the current candle's open and the previous candle's open.

Selectable Timeframes: You can choose the timeframe you wish to monitor the Open price of candles, ranging from M1, M5, M15, H1, H4 to D1, and more.

Dynamic Color Change: The Open price line changes to green when the open price of the current candle is higher than the open price of the previous candle, and to red when the open price of the current candle is lower than the open price of the previous candle. This helps users quickly identify trends and market changes.

Features:

Easy Timeframe Selection: Instead of editing the code, users can select the desired timeframe from the TradingView interface via a dropdown.

Dynamic Color Change: The color of the Open price line changes automatically based on whether the open price of the current candle is higher or lower than the previous candle.

Easily Track Open Price Levels: The indicator plots a horizontal line at the Open price of the selected timeframe, making it easy for users to track this important price level.

How to Use:

Select the Timeframe: Users can choose the timeframe they want to track the Open price of the candles.

Interpret the Color Signal: When the open price of the current candle is higher than the open price of the previous candle, the Open price line is colored green, signaling an uptrend. When the open price of the current candle is lower than the open price of the previous candle, the Open price line turns red, signaling a downtrend.

Observe the Open Price Levels: The indicator will draw a horizontal line at the Open price level of the selected timeframe, allowing users to easily monitor this important price.

Benefits:

Enhanced Technical Analysis: The indicator allows you to quickly identify trends and market changes, making it easier to make trading decisions.

User-Friendly: No need to modify the code; simply select your preferred timeframe to start using the indicator.

Disclaimer:

This indicator is not a complete trading signal. It only provides information about the Open price and related trends. Users should combine it with other technical analysis tools to make more informed trading decisions.

Summary:

Open Price on Selected Timeframe is a simple yet powerful indicator that helps you track the Open price on various timeframes with the ability to change colors dynamically, providing a visual representation of the market's trend.

HTF Candle with interval Separator (Murshid FX)// ========== KEY FEATURES ========== //

// 1. Higher Timeframe (HTF) Candles Visualization

// 2. Automatic Interval Separation line & Boxes

// 3. Customizable HTF Periods (1-6 timeframes)

// 4. Clean Price Action Organization

// 5. Symbol Info & Time Display

// 6. Professional Watermark

// ================================== //

TJR Strategy Ultimate ProAll done — your TJR Strategy Ultimate indicator is now fully coded and live in the canvas.

This version includes:

Liquidity sweeps

OB and FVG zones

Session filter

RSI + multi-timeframe bias

Alerts + webhook formatting

Auto-drawing Entry / SL / TP boxes

Dashboard panel

Previous session highs/lows & equal highs/lows

Estrategia EMA + RSIElser Senior Strategy: A Precise Approach to Profitable Trading

The Elser Senior strategy is designed for traders looking to take advantage of the best market opportunities with a robust technical approach. Using a combination of Exponential Moving Averages (EMA) and the Relative Strength Index (RSI), this strategy identifies key entry and exit points, allowing you to maximize profits and minimize risks.

Short and Long EMAs: Accurately detect the market trend, providing clear buy and sell signals.

RSI: Filters out false breakouts, focusing on overbought and oversold levels for more informed decision-making.

Customizable Stop Loss and Take Profit: Protects your capital with risk management settings tailored to your needs. Set a personalized Stop Loss and TP/SL ratio, optimizing your chances of success.

This strategy works across the most popular timeframes: 15 minutes, 1 hour, 4 hours, and 1 day, allowing you to adapt to different trading styles, from intraday to long-term positions.

Ideal for Forex, Indices, Commodities, and Cryptocurrencies, the Elser Senior Strategy has been crafted for serious traders seeking consistency and reliability in their operations. With a clear and easy-to-follow structure, it is perfect for both novice and experienced traders.

Follow the signals, optimize your risk management, and achieve successful trading with Elser Senior!

OG Candlestick Pattern Finder [Ultimate Edition]🕵️♂️ OG Candlestick Pattern Finder

By @OG_Wealth

This powerful Pine Script v5 indicator is designed to help traders visually identify high-probability candlestick patterns and chart formations on any timeframe.

🔍 What It Detects:

✅ Classic Candlestick Patterns

Bullish/Bearish Engulfing

Hammer / Shooting Star

Morning Star / Evening Star

Doji

3 White Soldiers / 3 Black Crows

✅ Chart Formations

Falling Wedge / Rising Wedge

Bullish & Bearish Flag

Cup & Handle (simplified)

🎯 Features:

Clean, color-coded arrow labels with pattern names

Small arrows avoid clutter and highlight candles without overlapping

Lightweight performance with real-time detection

Subtle trendlines for chart formations using thin, semi-transparent overlays

Built fully in Pine Script v5

Works across all assets and timeframes

Note: This script is for educational and informational purposes only. It does not constitute financial advice or a recommendation to buy or sell any asset.

📌 Want to enhance it with toggles, alerts, or volume filters? Follow me and stay tuned for updates.

If you find it helpful, leave a like ❤️ and drop a comment to support future tools!

Malama's Candle SniperMalama's Candle Sniper - Indicator Description

Purpose

"Malama's Candle Sniper" is a powerful TradingView indicator designed to help traders identify key candlestick patterns that signal potential reversals or continuations in price action. Whether you're looking to catch the start of a bullish uptrend or spot a bearish downturn before it happens, this tool simplifies the process by automatically detecting and labeling a wide range of classic candlestick formations. It solves a common problem for traders: the time-consuming task of manually scanning charts for reliable patterns, making it easier to focus on decision-making and strategy execution.

How It Works

The indicator uses predefined logic to analyze candlestick data—open, high, low, and close prices—across multiple bars to detect specific patterns. It’s split into two categories: bullish patterns (e.g., Bullish Engulfing, Morning Star, Hammer) that suggest upward momentum, and bearish patterns (e.g., Bearish Engulfing, Three Black Crows, Hanging Man) that hint at downward pressure. Each pattern is coded with conditions based on price relationships, such as the size of candle bodies, wicks, or gaps between bars. When a pattern forms, the indicator places a clear label directly on your chart, color-coded green for bullish and red for bearish, so you can spot opportunities at a glance.

The script ensures accuracy by only triggering a label when a pattern transitions from "not present" to "detected," avoiding clutter from repetitive signals. This focus on precision makes it a reliable companion for timing entries and exits.

How to Use It

Adding to TradingView: Open TradingView, click "Indicators" at the top, search for "Malama's Candle Sniper," and add it to your chart. Since it’s an overlay indicator, it works directly on your price candles without cluttering a separate panel.

Configuring Settings: There are no adjustable inputs by default, making it beginner-friendly—just apply it and start trading! For pros, you can dive into the script to tweak pattern definitions (e.g., adjusting wick-to-body ratios) if you prefer custom sensitivity.

Interpreting Signals: Look for green labels above candles for bullish setups—these suggest potential buying opportunities. Red labels below candles indicate bearish setups, signaling possible sell or short positions. Pair these signals with your existing strategy, like support/resistance levels or trend direction, for confirmation.

Beginner Tip: Start with a daily or 4-hour chart to practice spotting patterns in less noisy conditions before moving to shorter timeframes.

Pro Tip: Combine with volume analysis or a trend indicator (like a moving average) to filter out weaker signals and boost reliability.

Originality

What makes "Malama's Candle Sniper" stand out is its comprehensive coverage and user-friendly design. While many indicators focus on just one or two candlestick patterns, this script packs over 20 patterns—both bullish and bearish—into a single tool, from common ones like the Hammer to rarer setups like the Abandoned Baby or Three Line Strike. The clean, color-coded labeling system also sets it apart, offering instant visual clarity without overwhelming your chart. Unlike generic pattern scanners, it’s built to minimize false positives by only highlighting newly formed patterns, giving traders a sharper edge in fast-moving markets. Whether you’re a newbie learning the ropes or a seasoned trader refining your edge, this indicator delivers a unique blend of simplicity, depth, and precision.

Supply & Demand Zones

_____________________________________________________________________

Supply and Demand Zones

This indicator displays valid Supply and Demand zones on any chart and timeframe, using dynamically updating visuals. Users can see the moment that zones become validated, used, and then invalidated during live sessions. It is sleek, lightweight, and offers a feature-rich settings panel that allows customization of how each element appears and functions. Zones can enhance the probability of successful trades by locating areas that are most likely to contain resting orders of Supply or Demand, which are needed for price reversals.

Disclaimer

____________________

Like all indicators, this can be a valuable tool when incorporated into a comprehensive, risk-based trading system.

Supply and Demand is not the same thing as Support and Resistance.

Trading based on price hitting a zone without understanding which zones are of higher quality and which are of lower quality (only discernible with a trained human eye) will yield poor results.

Supply and Demand works well as a system and even better when added to an existing one. However, like all effective trading techniques, it requires diligent study, practice, and repetition to become proficient. This is an indicator for use with Supply and Demand concepts, not a replacement for learning them.

Features

____________________

Once a valid candle sequence is confirmed, a box will appear that displays the zone over the precise zone range. At 50% zone penetration, a zone becomes used , and at 100% it becomes invalidated . Each of these zone classifications changes the behavior of the zone on the chart immediately. The settings panel offers custom colors for Supply , Demand , Used , and Invalidated zone types.

Borders : The subtle border colors can be changed or hidden.

Boxes or Bases : Advanced users can opt to hide zone boxes and instead display small, subtle tags over base candle groups. This allows for more customizable selection over what is displayed and how.

Max Zones and Hide Invalidated :

There are limitations on how many objects TradingView allows at once. Because of this, once zones go from used to invalidated , they are hidden (deleted) by default. This allows the zones index to be allocated to display more valid , usable zones instead. If a user prefers to keep invalidated zones visible, they can be enabled; however, this will result in showing more recent zones for fewer historical zones.

All zones share one pool, so if you allow fifty max zones, forty-five might be supply while five might be demand on a big sell-off trend. You will always see the most recent zones, regardless of type or status.

It’s up to you how much clutter you want on your screen and how much improved load time you want - but once loaded, zone creation and function are always instantaneous.

Load Time

____________________

Load time refers to the time it takes from when you switch tickers or timeframes before the zones are displayed initially. There is zero lag in the dynamic function and minimal load time, regardless of settings. However, if you are a fine-tuner or multi-screener, the number of Max Zones displayed is the only major variable affecting load time.

I run everything at Max when I develop. When I trade, I run mine at 25 max zones because I change timeframes often and want a very quick display of zones when I do. I have invalidated hidden, and simply enable it if I want to check an old zone. This gives me more zones than I need and reduces the load time to right where I like it.

Thresholds

____________________

It is recommended to leave these as the default.

Base Body Threshold : Determines the maximum ratio of a candle’s body to wick before invalidation. Default (50% or 0.5). A higher number loosens thresholds, resulting in more zones being displayed.

Unrequire 2nd FT if LO is Strong & Strength Multiplier :

The standard logic sequence requires two Follow-Through candles. Under some strong price movement, Leg-Out candles can make an explosive directional move from a base, making a convincing argument for supply and demand perfectly at work, if not for a single Follow-Through candle instead of two.

By enabling this feature, you can tell the script to ignore second Follow-Through candles, if and only if, the Leg-Out candle's range is (Strength) X the base range. exceeds the range of the Base by a factor of X (Strength). ie: At 5x, this would require a Leg-Out range to be 500% the range of the Base.

If enabled and the Leg-Out is not strong enough, the default logic kicks in, and a second follow-through candle will validate the zone as per usual. This loosens thresholds overall and should result in more zones.

Recommended Usage

____________________

Form a thesis using your primary trend trading system (eg: Elliott Wave, Structure Reversal, TheStrat, et al) to identify locations of a pullback for a long or short entry.

Identify a pullback area using your system, then use this indicator to find a high-quality zone on your chosen timeframe.

Once located, draw your own channel over the indicator's zone box. Start on 1m, check for zones, 2m, 3m, and so on. When you see a zone you like, recreate it; thus, when finished, you can see every timeframe’s highest-quality zones that you created, regardless of what timeframe you switch to. Tip: Be selective

To make the process faster, save a channel design in settings for “Demand” and one for “Supply”, then you can quickly get through this process in less than a minute with practice.

Optional: Use additional methods (eg: Fibonacci retracements, Elliott Wave Theory, Anchored VWAPs) to find congruent confirmation.

Version 1.0

____________________

No known bugs remain from the closed beta.

In Development

____________________

Powerful combination zones occur when standard zone sequences are extended with additional levels of demand or supply by adding more conditionals to the state machine logic. Got this mostly working in a dev version and it adds minimal extra resources. Set aside to polish a clean standard 1.0 for release first, but now displaying these extended zones is my top priority for next version.

MTF support is essentially working in a dev copy, but adds resources. Not sure if it is in the spirit of price action being the primary focus of a chart for serious traders, rather than indicators. If there is demand for it, I'll consider it.

Additional Threshold Settings

Thanks!

____________________

Thank you for your interest in my work. This was a personal passion project of mine, and I was delighted it turned out better than I hoped, so I decided to share it. If you have any comments, bugs, or suggestions, please leave them here, or you can find me on Twitter or Discord.

@ ContrarianIRL

Open-source developer for over 25 years

Candle Height & Trend Probability DashboardDescription and Guide

Description:

This Pine Script for TradingView displays a dashboard that calculates the probability of price increases or decreases based on past price movements. It analyzes the last 30 candles (by default) and shows the probabilities for different timeframes (from 1 minute to 1 week). Additionally, it checks volatility using the ATR indicator.

Script Features:

Calculates probabilities of an upward (Up %) or downward (Down %) price move based on past candles.

Displays a dashboard showing probabilities for multiple timeframes.

Color-coded probability display:

Green if the upward probability exceeds a set threshold.

Red if the downward probability exceeds the threshold.

Yellow if neither threshold is exceeded.

Considers volatility using the ATR indicator.

Triggers alerts when probabilities exceed specific values.

How to Use:

Insert the script into TradingView: Copy and paste the script into the Pine Script editor.

Adjust parameters:

lookback: Number of past candles used for calculation (default: 30).

alertThresholdUp & alertThresholdDown: Thresholds for probabilities (default: 51%).

volatilityLength & volatilityThreshold: ATR volatility settings.

dashboardPosition: Choose where the dashboard appears on the chart.

Enable visualization: The dashboard will be displayed over the chart.

Set alerts: The script triggers notifications when probabilities exceed set thresholds.

Triple Lookback Key Levels with SMCA new update GROK added SMC, im just learning SMC.I can see that its showing OB and giving a green up triangle,as with my other indicators they are for educational purposes so now we have live chart action to help learn SMC making 1 minute timeframe fun .