Today's Daily LevelsTrack daily price action like a pro with instant visibility of key levels, percentages, and P&L values - all in one clean view.

• Shows Daily Open, High, Low & Median levels

• Dynamic color-coding: green above open, red below

• Real-time price labels with:

Exact price levels

% distance between levels

Point values

Dollar values per contract

• Auto-repaints on timeframe changes

• 30min alerts for median crosses

Candlestick analysis

Vertical Line at Specified HoursThis script helps you easily separate time.

This indicator can be used for many different purposes. For example, I use it to separate different days and sessions.

Features :

1- Ability to use 10 vertical lines simultaneously

2- The Possibility to change the color of lines

3- The Possibility to change the line type

Tip : The times you enter in the input section must be in the New York time zone.

Piorun-ZEUS Setup AutoDetects market structure and generates LONG or SHORT signals

The script analyzes market structure based on predefined conditions (e.g., trendline break, BOS, CHOCH, OB, FVG, candlestick patterns).

When all conditions of your strategy are met (trend, structure, candle pattern, FVG, OB) — the script automatically displays an Entry signal for LONG (buy) or SHORT (sell).

It does not react to random moves — the signal will only appear when all the key criteria are fulfilled.

Automatically draws Entry, SL, TP1, TP2, TP3 levels on the chart

After detecting a valid setup, the script plots the exact levels:

Entry – suggested entry price

SL (Stop Loss) – level to protect against loss

TP1, TP2, TP3 (Take Profit) – target levels to secure profits (minimum RRR 1:3)

✅ Once a trade is opened, these levels are marked on the chart so you can clearly see your targets and risk.

Creates alerts in TradingView for both directions (LONG & SHORT)

The script generates alert signals in TradingView, so you will be notified when a valid trading setup appears — whether it's a buy (LONG) or sell (SHORT) opportunity.

Fancy as Fuck Moving Averages [PQ_MOD] [v0.1.4]This advanced multi-timeframe indicator provides a comprehensive suite of moving average calculations and visual tools for trend analysis and trade signal generation. It supports a wide range of moving average types—from classic SMA, EMA, and WMA to more sophisticated variants like ALMA, JMA, and FRAMA—allowing users to customize parameters such as periods, offsets, and smoothing factors. The script plots these moving averages across intraday, daily, weekly, and monthly timeframes, with options to overlay dynamic cloud fills that visually highlight the relationship between faster and slower averages for an immediate trend confirmation. Additionally, it integrates an ATR-based mechanism to define upper and lower trend boundaries and automatically generate buy and sell signals when trends reverse, complete with customizable alert conditions. This flexible design ensures traders have both the detailed analytical tools and clear visual cues needed for effective market analysis.

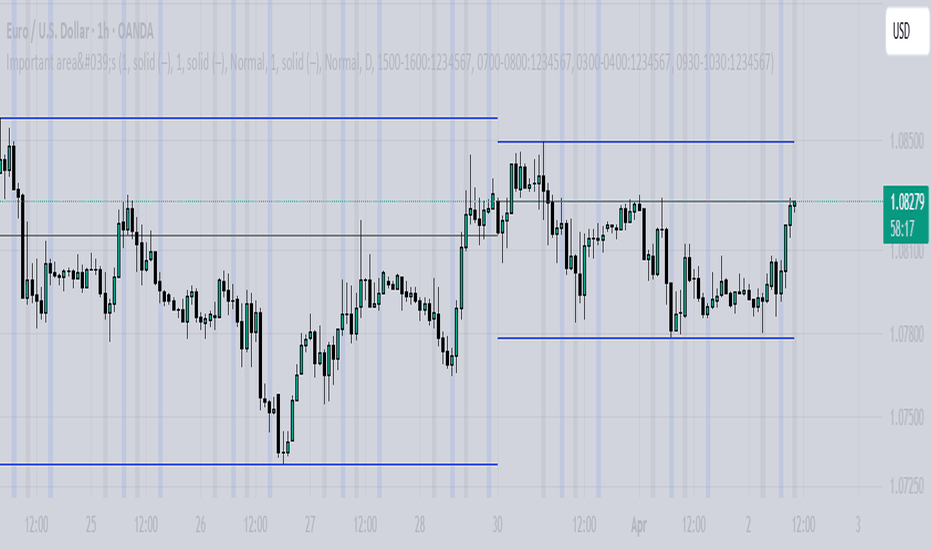

Important area'sI have tried to mark levels and zones I look for trades in, and kept the styling in way it doesn't messes up the chart, you can add it and look how these levels and zones have performed on previous data.

Heikin Ashi + Supertrend SSR SMART-BNFOREXThis indicator combines HEIKIN ASHI candles with a SUPER TREND calculated from HEIKIN ASHI data (BNFOREX version), specifically created for SSR SMART strategy backtesting.

iFVG StrategySimple iFVG strategy that tracks inversion fair value gaps and enters anticipating a reversal.

GQT GPT - Volume-based Support & Resistance Zones V2搞钱兔,搞钱是为了更好的生活。

Title: GQT GPT - Volume-based Support & Resistance Zones V2

Overview:

This strategy is implemented in PineScript v5 and is designed to identify key support and resistance zones based on volume-driven fractal analysis on a 1-hour timeframe. It computes fractal high points (for resistance) and fractal low points (for support) using volume moving averages and specific price action criteria. These zones are visually represented on the chart with customizable lines and zone fills.

Trading Logic:

• Entry: The strategy initiates a long position when the price crosses into the support zone (i.e., when the price drops into a predetermined support area).

• Exit: The long position is closed when the price enters the resistance zone (i.e., when the price rises into a predetermined resistance area).

• Time Frame: Trading signals are generated solely from the 1-hour chart. The strategy is only active within a specified start and end date.

• Note: Only long trades are executed; short selling is not part of the strategy.

Visualization and Parameters:

• Support/Resistance Zones: The zones are drawn based on calculated fractal values, with options to extend the lines to the right for easier tracking.

• Customization: Users can configure the appearance, such as line style (solid, dotted, dashed), line width, colors, and label positions.

• Volume Filtering: A volume moving average threshold is used to confirm the fractal signals, enhancing the reliability of the support and resistance levels.

• Alerts: The strategy includes alert conditions for when the price enters the support or resistance zones, allowing for timely notifications.

⸻

搞钱兔,搞钱是为了更好的生活。

标题: GQT GPT - 基于成交量的支撑与阻力区间 V2

概述:

本策略使用 PineScript v5 实现,旨在基于成交量驱动的分形分析,在1小时级别的图表上识别关键支撑与阻力区间。策略通过成交量移动平均线和特定的价格行为标准计算分形高点(阻力)和分形低点(支撑),并以自定义的线条和区间填充形式直观地显示在图表上。

交易逻辑:

• 进场条件: 当价格进入支撑区间(即价格跌入预设支撑区域)时,策略在没有持仓的情况下发出做多信号。

• 离场条件: 当价格进入阻力区间(即价格上升至预设阻力区域)时,持有多头头寸则会被平仓。

• 时间范围: 策略的信号仅基于1小时级别的图表,并且仅在指定的开始日期与结束日期之间生效。

• 备注: 本策略仅执行多头交易,不进行空头操作。

可视化与参数设置:

• 支撑/阻力区间: 根据计算得出的分形值绘制支撑与阻力线,可选择将线条延伸至右侧,便于后续观察。

• 自定义选项: 用户可以调整线条样式(实线、点线、虚线)、线宽、颜色及标签位置,以满足个性化需求。

• 成交量过滤: 策略使用成交量移动平均阈值来确认分形信号,提高支撑和阻力区间的有效性。

• 警报功能: 当价格进入支撑或阻力区间时,策略会触发警报条件,方便用户及时关注市场变化。

⸻

Imbalance(FVG) DetectorImbalance (FVG) Detector

Overview

The Imbalance (FVG) Detector is a technical analysis tool designed to highlight price inefficiencies by identifying Fair Value Gaps (FVGs). These gaps occur when rapid price movement leaves an area with little to no traded volume, which may later act as a zone of interest. The indicator automatically detects and marks these imbalances on the chart, allowing users to observe historical price behavior more effectively.

Key Features

- Automatic Imbalance Detection: Identifies bullish and bearish imbalances based on a structured three-bar price action model.

- Customizable Sensitivity: Users can adjust the minimum imbalance percentage threshold to tailor detection settings to different assets and market conditions.

- Real-time Visualization: Marked imbalances are displayed as colored boxes directly on the chart.

- Dynamic Box Updates: Imbalance zones extend forward in time until price interacts with them.

- Alert System: Users can set alerts for when new imbalances appear or when price tests an existing imbalance.

How It Works

The indicator identifies market imbalances using a three-bar price structure:

- Bullish Imbalance: Occurs when the high of three bars ago is lower than the low of the previous bar, forming a price gap.

- Bearish Imbalance: Occurs when the low of three bars ago is higher than the high of the previous bar, creating a downward gap.

When an imbalance is detected:

- Green Boxes indicate bullish imbalances.

- Red Boxes indicate bearish imbalances.

- Once price interacts with an imbalance, the box fades to gray, marking it as tested.

! Designed for Crypto Markets

This indicator is particularly useful in crypto markets, where frequent volatility can create price inefficiencies. It provides a structured way to visualize gaps in price movement, helping users analyze historical liquidity areas.

Customization Options

- Min Imbalance Percentage Size: Adjusts the sensitivity of the imbalance detection.

- Alerts: Users can enable alerts to stay notified of new or tested imbalances.

Important Notes

- This indicator is a technical analysis tool and does not provide trading signals or financial advice.

- It does not predict future price movement but highlights historical price inefficiencies.

- Always use this tool alongside other market analysis methods and risk management strategies.

BuySell Strategy OD📘 Strategy Summary – Orkoin Trend Strategy v1

This strategy identifies strong trend-based buy/sell opportunities using:

ADX > 25 for trend confirmation

RSI < 30 / > 70 to detect oversold or overbought zones

Stochastic RSI < 20 / > 80 for momentum shifts

Price < VWAP / > VWAP for value filtering

🔹 A BUY signal triggers when at least 3 of the buy conditions are met.

🔹 A SELL signal triggers when at least 3 of the sell conditions are met.

Ideal for 15m charts. Backtest-ready.

[francrypto®] Heikin Ashi Supertrend + Multi-Indicator v6This indicator combines HEIKIN ASHI candles with a SUPER TREND calculated from HEIKIN ASHI data (BNFOREX version), specifically created for SSR SMART strategy backtesting.

Segnali C/V (Ibrido LinReg + ATR)“Discover the new LinReg + ATR Hybrid Bot: your compass in the markets!

Forget old static strategies: our system integrates the power of Linear Regression with the ATR indicator, detecting buying and selling opportunities in real time based on volatility and trends. Simple to use, quick to make decisions and designed to follow the market with intelligent trailing stops, the Hybrid Bot helps you maximize your entries and protect your profits. Try it now and take your trading to the next level!”

RSTrenderEMA based trend indicator with color candle logic.

Strategy: Enter one 1st white candle close coming off colored candles.

Target 1:1

www.youtube.com

Heikin Ashi + Supertrend + EMA + Bollinger Bands BN FOREX"This custom BN FOREX indicator combines Heikin Ashi price action with Supertrend (HA-based), moving averages and Bollinger Bands for enhanced market analysis."

The translation preserves:

All technical components (Heikin Ashi, Supertrend, EMA, Bollinger Bands)

The BN FOREX branding

The combined/customized nature of the indicator

Proper technical terminology

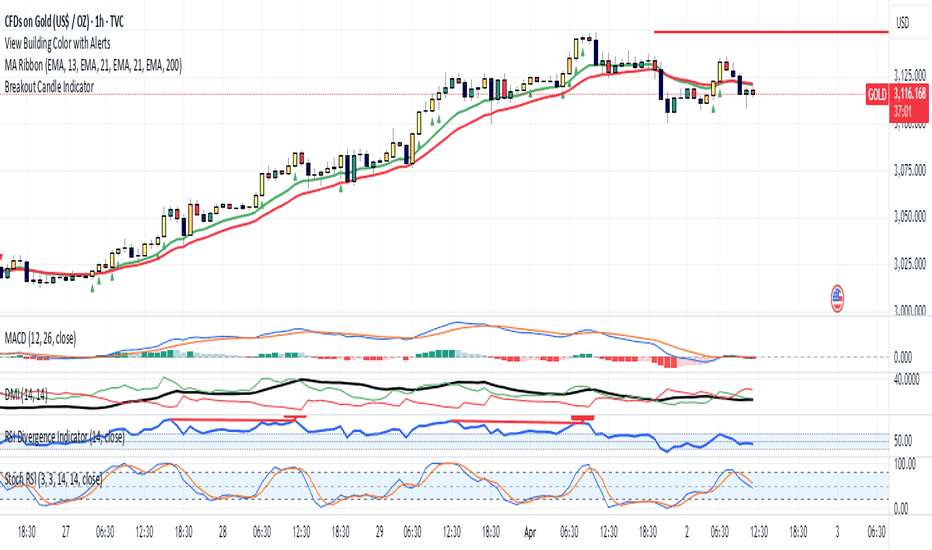

Breakout Candle Indicatorit decide breakout candles. if you higher time frame view fixed. you can use this indicator on lower time frame

Accumulation-Distribution CandlesThis enhanced price visualization tool interprets each candle through the lens of effort versus result, blending volume, range, and closing bias into a rich, color-coded display of Accumulation and Distribution pressure.

While compatible with any timeframe, this indicator is designed primarily for use on the 1D chart, where Wyckoff-style market phases are most clearly expressed. (Adjust visibility setting accordingly). After analyzing the high-timeframe phase, traders may switch to lower timeframes and apply faster execution tools more effectively.

Candle bodies are dynamically colored using a five-tier scale:

💙 Dark Blue — heavy accumulation

🩵 Pale Blue — mild accumulation

🌚 Gray — neutral / balanced behavior

💛 Pale Yellow — mild distribution

🧡 Deep Yellow — heavy distribution

Coloring is based on a normalized strength score, calculated using a blend of price movement and effort (with or without volume). This helps visually isolate Markup, Markdown, Re-accumulation, and Distribution at a glance.

The indicator also features optional microstructure overlays:

🟦 🟧 Zone highlighting — background shading for strong accumulation/distribution zones

📌 Pin bars — classic rejection wicks, optionally filtered by above-average volume

🔺 Fractals — 5-bar swing highs and lows, color-matched to the reference candle (not shown)

🟥 🟩 Engulfing candles — basic engulfing logic filtered by directional strength (not shown)

Every element is toggleable. The candle logic will auto-adjust for volume-less tickers such as DXY, and includes structural defaults for both traditional and crypto assets (5-day vs 7-day week logic).

🧐 Strategy tips: This tool is not meant to generate signals — it's meant to show the story. Start by identifying the market phase using the 1D chart, then move to lower timeframes with confluence tools such as SUPeR TReND 2.718 and/or the Granular MA Ribbon. This indicator is designed to slot cleanly into a multi-layered workflow of visual structure and informed execution.

BTCUSDT 70 Candles Average x3 NotificationNotification when generating candles 3 times the length of 70 candles (excluding progress candles)

Kyi price percentage This is an indicator that shows the percentage ratio of the highest and lowest prices within a specified range.

2:45 AM Candle High/Low Crossing Bars2:45 AM Candle High/Low Crossing Bars is an indicator that focuses on the trading view 2:45am NY TIME high and low indicating green for buy and red bars for sell, with the 2:45am new york time highlight/ If the next candle sweeps the low we buy while if it sweeps the high we sell, all time zoon must be the new York UTC time.

EMA Channel Key K-LinesEMA Channel Setup :

Three 32-period EMAs (high, low, close prices)

Visually distinct colors (red, blue, green)

Gray background between high and low EMAs

Key K-line Identification :

For buy signals: Close > highest EMA, K-line height ≥ channel height, body ≥ 2/3 of range

For sell signals: Close < lowest EMA, K-line height ≥ channel height, body ≥ 2/3 of range

Alternating signals only (no consecutive buy/sell signals)

Visual Markers :

Green "BUY" labels below key buy K-lines

Red "SELL" labels above key sell K-lines

Clear channel visualization

Logic Flow :

Tracks last signal direction to prevent consecutive same-type signals

Strict conditions ensure only significant breakouts are marked

All calculations based on your exact specifications