Анализ свечей

High Performance Candlestick Patterns Colors//Candle Patterns Ranked by Performance THOMAS N. BULKOWSKI

//1. Bearish Three Line Strike +Up 67.38%

//2. Bullish Three Line Strike -Down 65.23%

//3. Bearish Three Black Crows -Down 59.83%

//4. Bearish Evening Star -Down 55.85%

//5. Bullish Upside Tasuki Gap +Up 54.44%

//6. Bullish Inverted Hammer -Down 51.73%

//7. Bullish Matching Low -Down 50.00%

//8. Bullish Abandone Baby +Up 49.73%

//9. Bearish Two Black Gapping -Down 49.64%

//10. Brearish Breakaway -Down 49.24%

//11. Bullish Morning Star +Up 49.05%

//12. Bullish Piercing Line +Up 48.37%

//13. Bullish Stick Sandwich +Up 48.20%

//14. Bearish Thrusting Line During Dowtrend +Up 48.10%

//15. Bearish Meeting Line +Up 48.07%

//Down=Yellow Bar Color and Black Text

//Up=Blue Bar Color and Blue Text

//High Performance Candlestick Patterns Colors Top 15

High Performance Candlestick Patterns//Candle Patterns Ranked by Performance THOMAS N. BULKOWSKI

//1. Bearish Three Line Strike +Up 67.38%

//2. Bullish Three Line Strike -Down 65.23%

//3. Bearish Three Black Crows -Down 59.83%

//4. Bearish Evening Star -Down 55.85%

//5. Bullish Upside Tasuki Gap +Up 54.44%

//6. Bullish Inverted Hammer -Down 51.73%

//7. Bullish Matching Low -Down 50.00%

//8. Bullish Abandone Baby +Up 49.73%

//9. Bearish Two Black Gapping -Down 49.64%

//10. Brearish Breakaway -Down 49.24%

//11. Bullish Morning Star +Up 49.05%

//12. Bullish Piercing Line +Up 48.37%

//13. Bullish Stick Sandwich +Up 48.20%

//14. Bearish Thrusting Line During Dowtrend +Up 48.10%

//15. Bearish Meeting Line +Up 48.07%

//Down=Yellow Bar Color and Black Text

//Up=Blue Bar Color and Blue Text

//High Performance Candlestick Patterns Top 15

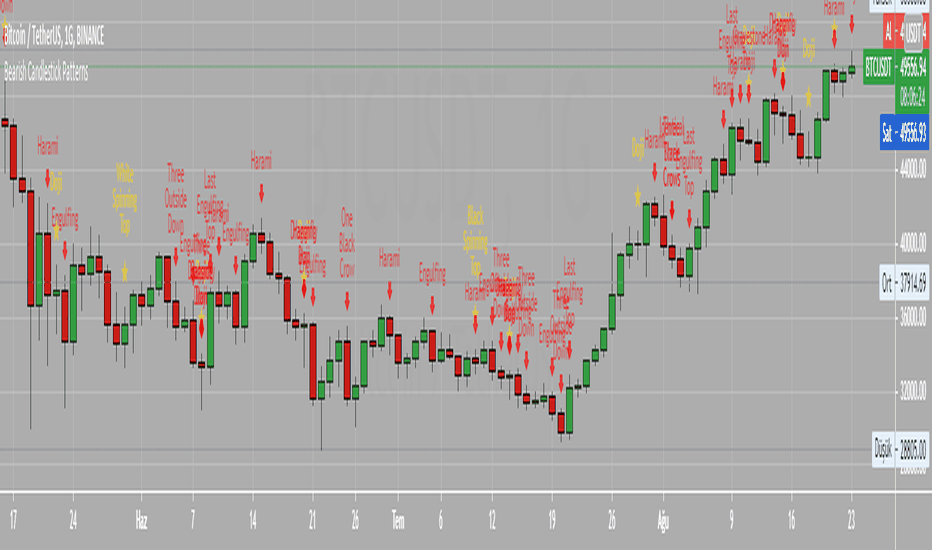

Bearish Candlestick PatternsDoji

Black Spinning Top

White Spinning Top

Bearish Abandoned Baby

Bearish Advance Block

Bearish Below The Stomach

Bearish Belt Hold

Bearish Breakaway

Bearish Counter Attack Lines

Bearish Dark Cloud Cover

Bearish Deliberation Blok

Bearish Descending Hawk

Bearish Doji Star

Bearish Downside Gap Three Methods

Bearish Downside Tasuki Gap

Bearish Dragonfly Doji

Bearish Engulfing

Bearish Evening Doji Star

Bearish Evening Star

Bearish Falling Three Methods

Bearish Falling Window

Bearish Gravestone Doji

Bearish Hanging Man

Bearish Harami

Bearish Harami Cross

Bearish Hook Reversal

Bearish Identical Three Crows

Bearish In Neck

Bearish Island Reversal

Bearish Kicking

Bearish Ladder Top

Bearish Last Engulfing Top

Bearish Low Price Gapping Play

Bearish Mat Hold

Bearish Matching High

Bearish Meeting Line

Bearish On Neck

Bearish One Black Crow

Bearish Separating Lines

Bearish Shooting Star

Bearish Side by side White Lines

Bearish Three Black Crows

Bearish Three Gap Up

Bearish Three Inside Down

Bearish Three Line Strike

Bearish Three Outside Down

Bearish Three Stars in the North

Bearish Thrusting Line During Dowtrend

Bearish Tower Top

Bearish Tristar

Bearish Tweezers Top

Bearish Two Black Gapping

Bearish Two Crows

Bearish Upside Gap Two Crows

Bullish Candlestick PatternsBullish Abandone Baby

Bullish Above The Stomach

Bullish Belt Hold

Bullish Breakaway

Bullish Concealing Baby Swallow

Bullish Counterattack Lines

Bullish Deliberation Block

Bullish Descent Block

Bullish Doji Star

Bullish Downside Gap Two Rabbits

Bullish Dragonfly Doji

Bullish Engulfing

Bullish Hammer

Bullish Harami

Bullish Harami Cross

Bullish High Price Gapping Play

Bullish Homing Pigeon

Bullish Hook Reversal

Bullish Inverted Hammer

Bullish Island Reversal

Bullish Kicking

Bullish Ladder Bottom

Bullish Last Engulfing Bottom

Bullish Mat Hold

Bullish Matching Low

Bullish Meeting Line

Bullish Morning Doji Star

Bullish Morning Star

Bullish On Neck

Bullish One White Soldier

Bullish Piercing Line

Bullish Rising Three Methods

Bullish Rising Window

Bullish Separating Lines

Bullish Side by Side White Lines

Bullish Stick Sandwich

Bullish Takuri Line

Bullish Three Gap Downs

Bullish Three Inside Up

Bullish Three Line Strike

Bullish Three Outside Up

Bullish Three Stars in the South

Bullish Three White Soldiers

Bullish Thrusting Line During Uptrend

Bullish Tower Bottom

Bullish Tristar

Bullish Tweezers Bottom

Bullish Two Rabbits

Bullish Unique Three River Bottom

Bullish Upside Gap Three Methods

Bullish Upside Tasuki Gap

Wick Delta Buy/Sell PressureIf you think of a perfect doji candle, where the wicks on top and bottom are exactly the same, that's a candle with a delta of 0. What this indicator does is show the delta/difference between wicks, if the top wick is longer than the bottom wick it show's sell pressure/bear interest, which is displayed as a red bar and vice versa for buy/bull pressure, which is shown as green bars. I added arrows for clarity.

It's a different way of visualising wicks, which can clarify sentiment and be a useful way to understand wicks better in general. One way to use it is to look for clusters of 3/4 larger bars in a row, which generally helps to determine future direction especially when seen at important levels.

Sort pseudo-array v3Based on Sort pseudo-array v2 by apozdnyakov

- fixed issue where if the same number is repeated in the list it gets skipped

- replaced hardcoded 10000 and -10000 values with na in case those values are in the list

- added sort_all to demonstrate how to sort a list if the length is fixed

Range: OHLC vs Previous OHLC - Version 2Version 1 here -

This is essentially the same as version 1 with one update. You have the freedom to independently choose OHLC for current candle and prior candle.

To elaborate further, Version 1 had 1 choice. For example, Close; you could only compare the close of prior candle to the current candle.

Version 2; you can compare close of the current candle to the low of the prior candle.

Instabot Heikin Ashi Market CloseThis simple script adds a small marker on the last bar of a Heikin Ashi chart to indicate where the current market close price is, which can be hard to see on this style of candle.

FREE TRADINGVIEW FOR TIMEFRAMESWhen doing i.e the 3 minute timeframe turn on the closest timeframe available for you or the candles and wicks will be fucked up.

So if you're doing the 5 hour timeframe candles turn on the 4hr chart on your main chart.

To View the candles in full screen double click the windows with the candlesticks

If you don't have TradingView premium and want to look at custom timeframes you can use this.

For the ticker/coin/pair you want to show enter it like this:

For stocks, only the ticker i.e: MSFT, APPL

For Crypto, "Exchange:ticker" i.e: BITFINEX:BTCUSD, BINANCE:AGIBTC, BITMEX:ADAM19

When setting up the timeframe write i.e:

For minutes/hourly: 5, 240 (4 hour), 360 (6 hour)

For daily/weekly/monthly: 1D, 2W, 3M

When doing i.e the 3 minute timeframe turn on the closest timeframe available for you or the candles and wicks will be fucked up.

So if you're doing the 5 hour timeframe candles turn on the 4hr chart on your main chart.

Fake-Out IndicatorThe signal comes from the "RailRoad" candlestick pattern breaking a support/resistance level, which typically indicates price will respect that level.

How consistent is the pattern? Hard to say considering candlestick patterns vary wildly by % change between different securities.

I didn't implement any kind of "fuzzy logic" for this strategy, though it would benefit greatly from it.

There are many instances where a fixed% simply doesn't catch a winning trade from a "bounce" off a S/R level.

Highs and Lows (Previous Days Projected + Current Week & Month)Credit to Lachlan Smith created original on 31/03/15 - Edited by Elisa 30/3/19

Historical highs and lows

Includes three previous days projected onto today, plus current week and month.

Settings allow for data to be hidden after weekends for use in traditional markets. (i.e. prior 2 days not useful on a Monday)

PivotBoss TriggersI have collected the four PivotBoss indicators into one big indicator. Eventually I will delete the individual ones, since you can just turn off the ones you don't need in the style controller. Cheers.

Wick Reversal

When the market has been trending lower then suddenly forms a reversal wick candlestick , the likelihood of

a reversal increases since buyers have finally begun to overwhelm the sellers. Selling pressure rules the decline,

but responsive buyers entered the market due to perceived undervaluation. For the reversal wick to open near the

high of the candle, sell off sharply intra-bar, and then rally back toward the open of the candle is bullish , as it

signifies that the bears no longer have control since they were not able to extend the decline of the candle, or the

trend. Instead, the bulls were able to rally price from the lows of the candle and close the bar near the top of its

range, which is bullish - at least for one bar, which hadn't been the case during the bearish trend.

Essentially, when a reversal wick forms at the extreme of a trend, the market is telling you that the trend

either has stalled or is on the verge of a reversal. Remember, the market auctions higher in search of sellers, and

lower in search of buyers. When the market over-extends itself in search of market participants, it will find itself

out of value, which means responsive market participants will look to enter the market to push price back toward

an area of perceived value. This will help price find a value area for two-sided trade to take place. When the

market finds itself too far out of value, responsive market participants will sometimes enter the market with

force, which aggressively pushes price in the opposite direction, essentially forming reversal wick candlesticks .

This pattern is perhaps the most telling and common reversal setup, but requires steadfast confirmation in order

to capitalize on its power. Understanding the psychology behind these formations and learning to identify them

quickly will allow you to enter positions well ahead of the crowd, especially if you've spotted these patterns at

potentially overvalued or undervalued areas.

Fade (Extreme) Reversal

The extreme reversal setup is a clever pattern that capitalizes on the ongoing psychological patterns of

investors, traders, and institutions. Basically, the setup looks for an extreme pattern of selling pressure and then

looks to fade this behavior to capture a bullish move higher (reverse for shorts). In essence, this setup is visually

pointing out oversold and overbought scenarios that forces responsive buyers and sellers to come out of the dark

and put their money to work-price has been over-extended and must be pushed back toward a fair area of value

so two-sided trade can take place.

This setup works because many normal investors, or casual traders, head for the exits once their trade

begins to move sharply against them. When this happens, price becomes extremely overbought or oversold,

creating value for responsive buyers and sellers. Therefore, savvy professionals will see that price is above or

below value and will seize the opportunity. When the scared money is selling, the smart money begins to buy, and

Vice versa.

Look at it this way, when the market sells off sharply in one giant candlestick , traders that were short

during the drop begin to cover their profitable positions by buying. Likewise, the traders that were on the

sidelines during the sell-off now see value in lower prices and begin to buy, thus doubling up on the buying

pressure. This helps to spark a sharp v-bottom reversal that pushes price in the opposite direction back toward

fair value.

Engulfing (Outside) Reversal

The power behind this pattern lies in the psychology behind the traders involved in this setup. If you have

ever participated in a breakout at support or resistance only to have the market reverse sharply against you, then

you are familiar with the market dynamics of this setup. What exactly is going on at these levels? To understand

this concept is to understand the outside reversal pattern. Basically, market participants are testing the waters

above resistance or below support to make sure there is no new business to be done at these levels. When no

initiative buyers or sellers participate in range extension, responsive participants have all the information they

need to reverse price back toward a new area of perceived value.

As you look at a bullish outside reversal pattern, you will notice that the current bar's low is lower than the

prior bar's low. Essentially, the market is testing the waters below recently established lows to see if a downside

follow-through will occur. When no additional selling pressure enters the market, the result is a flood of buying

pressure that causes a springboard effect, thereby shooting price above the prior bar's highs and creating the

beginning of a bullish advance.

If you recall the child on the trampoline for a moment, you'll realize that the child had to force the bounce

mat down before he could spring into the air. Also, remember Jennifer the cake baker? She initially pushed price

to $20 per cake, which sent a flood of orders into her shop. The flood of buying pressure eventually sent the price

of her cakes to $35 apiece. Basically, price had to test the $20 level before it could rise to $35.

Let's analyze the outside reversal setup in a different light for a moment. One of the reasons I like this setup

is because the two-bar pattern reduces into the wick reversal setup, which we covered earlier in the chapter. If

you are not familiar with candlestick reduction, the idea is simple. You are taking the price data over two or more

candlesticks and combining them to create a single candlestick . Therefore, you will be taking the open, high, low,

and close prices of the bars in question to create a single composite candlestick .

Doji Reversal

The doji candlestick is the epitome of indecision. The pattern illustrates a virtual stalemate between buyers

and sellers, which means the existing trend may be on the verge of a reversal. If buyers have been controlling a

bullish advance over a period of time, you will typically see full-bodied candlesticks that personify the bullish

nature of the move. However, if a doji candlestick suddenly appears, the indication is that buyers are suddenly

not as confident in upside price potential as they once were. This is clearly a point of indecision, as buyers are no

longer pushing price to higher valuation, and have allowed sellers to battle them to a draw-at least for this one

candlestick . This leads to profit taking, as buyers begin to sell their profitable long positions, which is heightened

by responsive sellers entering the market due to perceived overvaluation. This "double whammy" of selling

pressure essentially pushes price lower, as responsive sellers take control of the market and push price back

toward fair value.

Basic candle patternsBasic candle patterns marker marks:

- Doji stars

- Doji graves

- Doji dragonflies

- Hammers

- Reversed hammers

- Hanging mans

- Falling stars

- Absorption up/down

- Tweezers up/down

- Three inside ups/downs

Doji & hammers markerDoji & hammers marker marks:

- long/ short doji star ( marks as doji star )

- doji grave

- doji dragonfly

- hammer

- falling star

- hanging man

- reversed hammer

Doji detectorDoji detector marks doji candles.

Can find:

- short / long Doji star ( marks as Doji star )

- Doji grave

- Doji dragonfly

Combined MTF Camarilla Pivots (HA + Candles)This is a fairly basic (but hopefully useful) indicator that combines three time-frames of Camarilla pivots into one.

Default time-frames are:

Weekly

Monthly

Yearly

Time-frames can be modified as you wish, they are just set to these as I generally only trade higher intervals (just note that formatting labels will not change - but you can update these as needed).

The Camarilla pivots displayed are as follows:

R3, R4, R5, R6

Pivot line (Middle/Base)

S3, S4, S5, S6

R1/S1 & R2/S2 are excluded to make way for R5/S5 & R6/S6 - as these are more useful for the majority of traders. The formula for levels 5/6 are always up for debate, as no official formula has ever been released. I've used what I consider a mid, or consensus calculation.

By default all historical pivot levels are displayed, as there can be some benefit to mapping these forward once the relevant period has ended. If people find it's too cluttered I'll look into having an option to display the current period only.

Unfortunately, TradingView doesn't allow labels on plots (seems like such a basic feature to be missing, but there you go), so you'll have to learn the colours/linewidths.

Oh, and there's a checkbox to enable pivots to be calculated on Heiken-Ashi prices/candles rather than default prices/candles. This heavily modifies the location of the Camarilla Pivots, but I've found that in certain situations you can get some great results.

Let me know your thoughts/comments/suggestions.

Cheers

DD