Wick Bodies [vnhilton]I noticed that changing the colour of the wicks through TradingView settings changes the colours of both the top and bottom wicks. I also noticed that the thickness of wicks couldn't be changed either so they remained very hard to see when zoomed out of charts. Wicks have the potential to show zones where price rejects from - this is useful for identifying potential support and resistance zones.

I created an alternative solution to this problem by creating bodies for the wicks. It's recommended that you hide the wicks so it shows candles as bars split into 3 segments (top segment representing top wick; middle segment representing candle; bottom segment representing bottom wick). Colours are customizable. Also includes borders for the wick bodies.

Анализ свечей

Reversal zone finderThis script would find potential reversal price zones according to RSI over bought or sell condition and big reversal candle.

It works better in range markets and lower time frames like 5M and especially in Support/Resistance zones.

Suit for scalping in forex or crypto markets.

* Use it as a trade assistant not a trade signal!

Higher Time Frame Chart OverlayHello All,

This script gets OHLC values from any security and Higher/Same time frame you set, then creates the chart including last 10 candles. it shows Symbol name, Time Frame, Highest/Lowest level of last 10 candles and Close Price at the right side of the chart as well. Closing price text color changes by the real-time candle of the related symbol and time frame. The all this was made using the Tables in Pine and the chart location doesn't change even if you change the size of main chart window.

Almost everything can be change as you want. You can change/set:

- Colors of Body and Top/Bottom Wicks separately

- The Height of each Cell

- The Width of Body and Wicks

- The Background and Frame color

- Enable/disable Status Panel (if you disable Status Panel then only candle chart is shown)

- Location of Status Panel

- Text color and Text size

- The Background color of Status Panel

Some examples:

The info shown in Status Panel:

You can change The Height of each Cell and The Width of Body and Wicks

You can change colors:

You can change location of the chart:

If you add the script more than once then you can see the charts for different symbols and time frames: (This may slow down your chart)

If you right-click on the script and choose "Visual Order" => "Bring to front" then it will be better visually:

P.S. Using this script may slow down your chart, especially if you add it more than once

Enjoy!

VCC Impulse 101Title = VCC Impulse 101

Version = v1.2.0

Author = Vic Cebedo

A cryptocurrency Buy and Sell signal indicator.

BUY SIGNAL (green background) is triggered if Buy Score (black line) reaches (4) Points.

1 Point is added to Buy Score if:

- The Closing Price is above all Moving Averages (7, 21, 50, 100, and 200), and

- If the 200MA is above the other Moving Averages (7, 21, 50, 100).

1 Point is added to Buy Score if:

- MACD is greater than MACD Signal, and

- MACD is greater than zero, and

- MACD Signal is greater than zero, and

- MACD is greater than previous value.

1 Point is added to Buy Score if:

- SMI is greater than zero, and

- SMI is greater than previous value.

1 Point is added to Buy Score if:

- RSI is greater than 50.

The SELL SIGNAL (red background) is triggered if EITHER Ethereum Sell Score (purple line) OR Bitcoin Sell Score (red line), reaches (-3) Points.

2 Points is deducted from the Ethereum Sell Score if:

- The number of Ethereum Short positions is greater than the Longs.

1 Point is deducted from the Ethereum Sell Score if:

- The Ethereum RSI is greater than 75.

2 Points is deducted from the Bitcoin Sell Score if:

- The number of Bitcoin Short positions is greater than the Longs.

1 Point is deducted from the Bitcoin Sell Score if:

- The Bitcoin RSI is greater than 75.

CandleEvaluationLibrary "CandleEvaluation"

Contains functions to evaluate bullish and bearish, engulfing, and outsized candles. They are different from the built-in indicators from TradingView in that these functions don't evaluate classical patterns composed of multiple candles, and they reflect my own understanding of what is "bullish" and bearish", "engulfing", and "outsized".

isBullishBearishCandle()

Determines if the current candle is bullish or bearish according to the length of the wicks and the open and close.

int _barsBack How many bars back is the candle you want to evaluate. By default this is 0, i.e., the current bar.

returns Two values, true or false, for whether it's a bullish or bearish candle respectively.

isTripleBull()

Tells you whether a candle is a "Triple Bull" - that is, one which is bullish in three ways:

It closes higher than it opens

It closes higher than the body of the previous candle

The High is above the High of the previous candle.

int _barsBack How many bars back is the candle you want to evaluate. By default this is 0, i.e., the current bar.

returns True or false.

isTripleBear()

Tells you whether a candle is a "Triple Bear" - that is, one which is bearish in three ways:

It closes lower than it opens

It closes lower than the body of the previous candle

The Low is below the Low of the previous candle.

int _barsBack How many bars back is the candle you want to evaluate. By default this is 0, i.e., the current bar.

returns True or false.

isBigBody()

Tells you if the current candle has a larger than average body size.

int _length - The length of the sma to calculate the average

float _percent - The percentage of the average that the candle body has to be to count as "big". E.g. 100 means it has to be just larger than the average, 200 means it has to be twice as large.

returns True or false

isBullishEngulfing()

Tells you if the current candle is a bullish engulfing candle.

int _barsBack How many bars back is the candle you want to evaluate. By default this is 0, i.e., the current bar.

int _atrFraction The denominator for the ATR fraction, which is the small amount by which the open can be different from the previous close.

returns True or false

isBearishEngulfing()

Tells you if the current candle is a bearish engulfing candle.

int _barsBack How many bars back is the candle you want to evaluate. By default this is 0, i.e., the current bar.

int _atrFraction The denominator for the ATR fraction, which is the small amount by which the open can be different from the previous close.

returns True or false

CH-I: Trend - Higher Timeframe BodyI took the script for the built-in indicator for candle bodies of a higher timeframe (www.tradingview.com) which has a fixed border width and style and added the possibility to customize both the border width and the border style or to even disable the display of any border at all, which makes the presentation of those boxes more flexible.

GSI (Gap Size Indicator)The purpose of this indicator is to give a quick view of a gap size between two candles, and to detect any gap bigger than the trigger setting.

Options

Mode: Select the display mode (% or Value)

Variation Trigger: Defines the minimum gap size to give a signal, for both positive and negative sides. This option depends on the Mode setting

Show trigger lines: Enable/Disable the display of the Variation Trigger setting lines

Color signals only: When enabled, bars crossing the trigger value are still colored, but other are gray

Show signals only: When enabled, will only show bars corresponding to gaps crossing the trigger value

Notes

Basic alerts on Bullish , Bearish and All gaps are available.

Feel free to suggest any improvement.

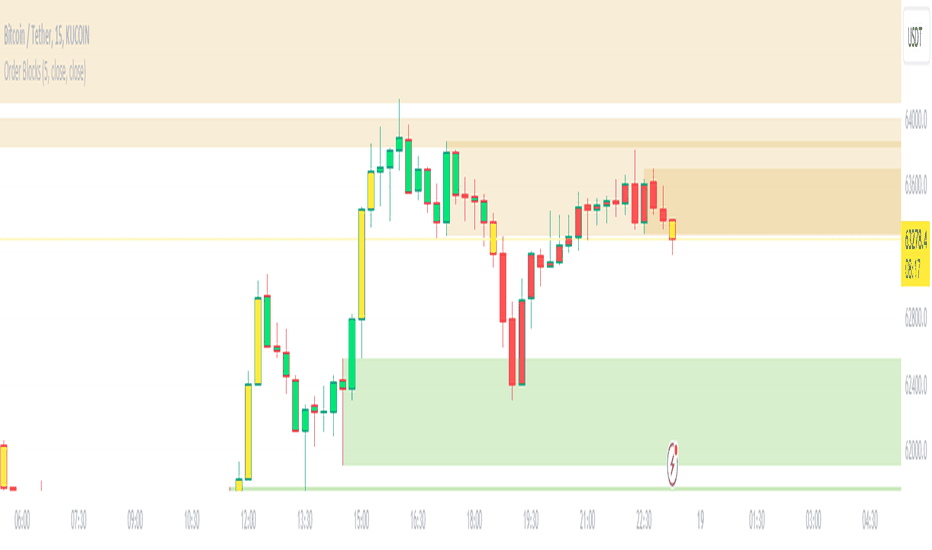

Order BlocksThis is experimental Indicator is to help identifying Order Blocks.

It uses not confirmed higher order pivots as Higher Highs (HH) and Lower Lows (LL), finds high/lows that created most recent LL/HH and in case if this high/low are broken it notes candle that broke structure, market structure broke line (MSB) and demand box (candle that created liquidity for the move that broke structure).

Concepts and parts of code used in this study:

1) @rumpypumpydumpy - Higher Order Pivots

2) @MarkMiddleton2020 - Order Blocks

Compression support&resistance [LM]Hello traders,

I would like to present you Compression support&resistance script. The idea behind is to look for areas of price compression(inside bar candles). Basically the S/R lines are created after three candles that are formed in certain pattern and volume conditions. First candle of pattern is usually the most volatile and fist inside bar after volatile candle high and low creates S/R lines in order to look for breakouts or for future bounces of the S/R line. Also by default volume has to be decreasing from candle to candle, although this condition can be controlled by setting.

It has various settings as my other S/R scripts for multi timeframe analysis. The current timeframe uses line API but for multi timeframe I use plot lines. There are two filters. Volume filter for declining volume of the pattern candles and volatility filter which renders line only in case that pattern occurs after some % change has happened within some lookback period.

Credit also for this indicator goes to @berkek as he took time to explain it to me.

Hope you will enjoy it,

Lukas

Order BlocksThis script analyses candle stick patterns and draws order blocks in real time, it is designed to be very easy to use and works on all markets.

With a simple sensitivity configuration to control the range of candles in scope for analysis, the order blocks are automatically drawn and removed in real time if price action closes through an order block.

M.Right Candlestick Patterns & Bulkowski Percentages 1.0Hello Traders!

As a fan of Bulkowski, I figured I'd release this for everyone's benefit as well.

The legendary candlestick pattern expert, Thomas Bulkowski, has over 35 years of trading and analysis experience and is the absolute go-to expert when it comes to candlestick pattern identification.

Bulkowski Candlestick Percentages from his site and books.

Source: Built in "All Candlestick Patterns"

In this version,

--> Added 8 Candles and removed some that are statistically insignificant and others that Bulkowski doesn't use (can add back if requested).

--> Added 2 Colors for Bullish and Bearish Continuations.

----> Assigned Colors Tested performance to Continuations.

--> Built-in Variables and Candles adjusted slightly to conform to Bulkowski pattern principles.

--> Moved inputs back to ABC order.

--> Decided to leave the theoretical performance positioning for the signal (i.e. Top for theoretically bearish ). However..

----> I adjusted the signal color to match Bulkowski's tested performance.

--> Removed Plot Close (obsolete)

--> Hover over signal to see both Theoretical and Tested Performance.

Figured I'd help give an edge to the @TradingView Community like so many before me have been able to.

Please feel free to add comments, share insight, and of course, like!

Cheers,

Mike

Classic Candlestick on Range ChartHello traders!

This is my first script to share with everyone! As of right now the range candles on Tradingview are lacking the option to see range charts using the classic candlesticks. This script allows you to overlay a regular candlestick or heikin-ashi candlestick on a range chart!! Unfortunately, the only bar that cannot be a candlestick is the current bar. Once that bar has completed its range then it will update to a regular candlestick.

Install / Use instructions!

-For the best visual appearance it is important to set the transparency of up bars and down bars to 0. This setting is found in the main chart settings under SYMBOL. However, if you want to see the current unfinished range bar you need to set the "projection up bars" and "projection down bars" to the color you prefer.

-To change the colors of the candlesticks is found under the indicator settings like any other script!

20% up with all continuously green candle: Lovevanshi It can be used to get the indication for 20% up movement among all continuously green candles formed in past. It is suitable for Indian company stock for short term trading plans.

TSLA $4 Red CandleThose who trade TSLA often have come to know that a $4ish red candle on the 15min chart is normally a sign of a trend reversal to the downside by the market makers. To help identify these with ease this script will label any candles that close red with a $4.00 -> $4.99 price gap.

4 SMAs & Inside Bar (Colored)SMAs and Inside Bar strategy is very common as far as Technical analysis is concern. This script is a combination of 10-20-50-200 SMA and Inside Bar Candle Identification.

SMA Crossover:

4 SMAs (10, 20, 50 & 200) are combined here in one single indicator.

Crossover signal for Buy as "B" will be shown in the chart if SMA 10 is above 20 & 50 and SMA 20 is above 50.

Crossover signal for Sell as "S" will be shown in the chart if SMA 10 is below 20 & 50 and SMA 20 is below 50.

Inside Bar Identification:

This is to simply identify if there is a inside bar candle. The logic is very simple - High of the previous candle should be higher than current candle and low of the previous candle should be lower than the current candle.

If the previous candle is red, the following candle would be Yellow - which may give some bullish view in most of the cases but not always

If the previous candle is green, the following candle would be Black - which may give some bearish view in most of the cases but not always

Be Cautious when you see alternate yellow and black candle, it may give move on the both side

Please comment if you have any interesting ideas to improve this indicator.

Price Action: Inside Bar BoxesThis script automatically draws rectangles around bars inside IB pattern.

Note :: because Pinescript does not allow changes to already drawn charts on historical bars, checkbox "show only last box" doesn't work for arrows

3 Candle EngulfingThree Line Strike Candlestick Pattern (3 candle Engulfing pattern) to help you detect sniper entry point mostly for (forex)

You can use this as an indicator to detect an entry point for your trade.

Please cross-check the Macro and Micro trend and don't go against the trend. Also use other indicators to confirm your entry.

You can set the engulfing minimum pips value (Default is set to 10 pips)

How it works:

Yellow candle with an up green triangle means a long entry

White candle with a down green triangle means a short entry

Special Time PeriodWith this indicator, you can choose candles in the period you want on your chart.

How ?

• If your chart is 5 minutes, the duration should be greater than 5 on this indicator.

If you do not do it this way, there will be gaps in the price, it will not give the right result.

• If you want to see it in minutes, you must enter a direct numerical value. For example, to see 2 hours, you must enter the number 120. Because 2 hours is 120 minutes.

Like the warning above, if you want to plot a 2-hour chart with this indicator, a maximum of 1 hour should be selected on your main chart.

• Resolution, eg. '60' - 60 minutes, 'D' - daily, 'W' - weekly, 'M' - monthly, '5D' - 5 days, '12M' - one year, '3M' - one quarter

• For example, if you want to see the 2-day chart, you should have a maximum of 1 day chart open on your home screen and write "2D" to the indicator value.

• You will get much better results if the period on your main chart and the period on this indicator are multiples of each other.

• In the image below, the period on the main chart is 30 minutes, but the period on the indicator is 90

• Click on the facing brackets at the top right of the legend and your chart will enlarge.

ROS [Range of Swag]Creates any multitimeframe level and marks opens, highs lows and midpoints

Comes with labels (hidable)

Works on Bar-by-bar replay

Customizable color!

The default 3 ranges are weekly, monthly, and quarterly in that order.

If you want to change the labels change it in the code... or just hide them.

Big thanks to @spacemanbtc @Kriswaters for the code (levels and session breaks) respectively.

Will be looking to improve it

Elephant - Shooting Star CandlesThis script aims to show elephant and shootingstar candles. Body for elephant are at least 70% of the whole candle. Shootingstar have a body of 35% times the lenht of the full candle. Both are searched with 1.3 Standard Deviations as noise within 100 bars. Colors are ploted if closes above/below 200 SMA

15m Candle ToolShows historical 15min candles for the 1m, 3m , and 5m time frames.

Counts down the time until the current 5m, 15m, and 1H candles close.

Recommended use on the 1m, 3m , and 5m TimeFrames!!!

Legend:

Vertical Lines (Left to Right)

-15m Candle wick (solid line) *

-Close of current 5m candle (red dotted)

-Close of current 15m candle (blue dashed)

- Close of current 1H candle (green solid)

Horizontal Lines (Top to Bottom)

- Previous 15m high (top of wick) *

- Subdivisions of the low to high of the previous 15m candle (.25, .50, .75) (WHITE LINES, .50 is extended)

- inter candle average of the highs within the previous 15m candle (solid green)

- average of the inter candle highs and lows (grey dashed)

- inter candle average of the lows within the previous 15m candle (solid red)

- Previous 15m low (bottom of wick) *

Previous Candle Body *

* = Changes color based on the bar color.

small channel in 5minThis indicator designed for 5min time-frame.

it detects a candlestick pattern in one hour time-frame and draw a channel based on the detected pattern, where two candles and are covered by the third one , in 5 min time-frame.

the bottom, middle and top of the channel are colored by green, gray and red respectively. this channel may help user to use it as a possible support and resistance region.

(the pattern is defined in line 11 to 13.)

enjoy it

Bar StatisticsThis script calculates and displays some bar statistics.

For the bar length statistics, it takes every length of upper or lower movements and calculates their average (with SD), median, and max. That way, you can see whether there is a bias in the market or not.

Eg.: If for 10 bars, the market moved 2 up, then 1 down, then 3 up, then 2 down, and 2 up, the average up bars length would be at 2.33, while the average for the down length would be at 1.5, showing that upper movements last longer than down movements.

For the range statistics, it takes the true range of each bar and calculates where the close of the bar is in relation to the true low of it. So if the closing of the bar is at 10.0, the low is at 9.0, and the high is at 10.2, the candle closed in the upper third of the bar. This process is calculated for every bar and for both closing prices and open prices. It is very useful to locate biasses, and they can you a better view of the market, since for most of the time a bar will open on an extreme and close on another extreme.

Eg.: Here on the DJI, we can see that for most of the time, a month opens at the lower third (near the low) and closes at the upper third (near the high). We can also see that it is very difficult for a month to open or close on the middle of the candle, showing how important the first and the last day are for determining the trend of the rest of the month.