Candle counterI've created a simple red/green candle counting script with a custom number of candles to look back on.

Let me know if any bugs, issues, or suggestions.

Candle

GRAB or TrendStrength Bars with Highlights[Salty]GRAB or TrendStrength Bars with Propulsion Dots and Highlights for Squeeze Pro, CCI-Arrows, and SlowStoch

This indicator shows GRAB or TrendStrength candles and allows several moving averages to be displayed at the same time.

It has arrows and diamonds above or below the candles to show CCI values above 100 or below -100 with the arrow pointing in the direction of the momentum.

Diamonds indicate slightly weaker momentum than arrows, but still consider strong.

It has background coloring that is light green to show bullish trends and light red to show bearish trends that are derived from slow stochastics.

In general Darker colors are used for down moves and lighter colors are use to show up moves. Also, red indicates bearish, and green indicates bullish throughout.

It has yellow background to show squeezes with additional Squeeze Pro information shown at the bottom of the chart in the form of letters and momentum arrows.

L = Low compression squeeze, S = Normal Squeeze, and H = High Compression Squeeze.

It has a set of propulsion dots for each Moving Average. The trend is consider bullish when green colored dots print, and bearish when red dots print.

3 ATR Keltner channels are printed. The first two show the values used by the squeeze by default

2 Bolinger Bands are displayed based on the values used by the Squeeze by default.

1 VWAP line may be displayed.

TIP: overlaying the TICK symbol is great for confirming a bias where positive values are bullish and negative values are bearish.

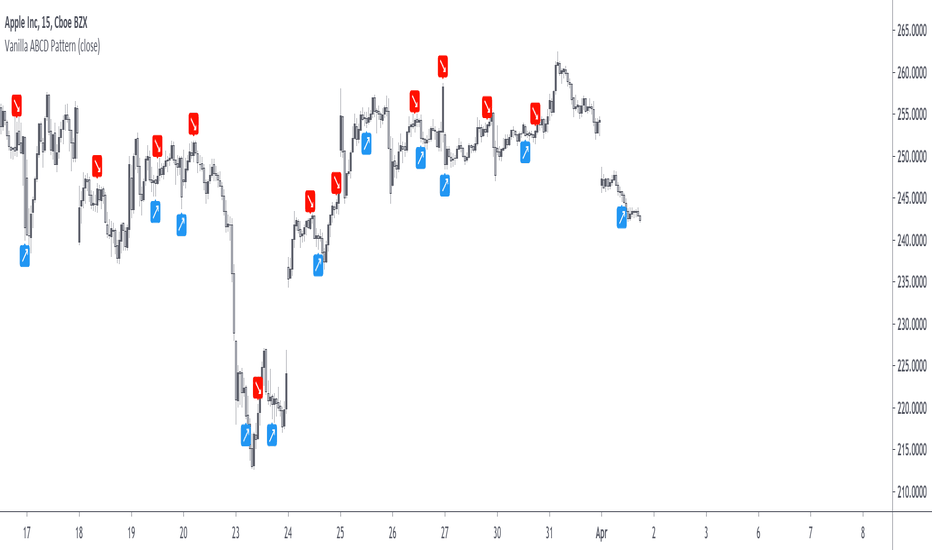

Vanilla ABCD PatternPatterns makes parts of the many predictive tools available to technical analysts, the most simples ones can be easily detected by using scripts. The proposed tool detect the simple (vanilla) form of the ABCD pattern, a pattern aiming to detect potential price swings. The script can use an additional confirmation condition that aim to filter potential false signals.

ABCD PATTERN

The ABCD pattern is not meant to be detected by analyzing individuals closing price observations but by analyzing longer term movements, this is done by using tools such as zig-zag. Like any pattern the ABCD one comes in different flavors, the simplest being based on the following structures:

Once price reach D we can expect a reversal. The classical pattern has the following conditions : BC = 0.618*AB and CD = 1.618*AB , as you can see this condition is based on 0.618 which is a ratio in the Fibonacci sequence. Other conditions are for AB to equal to CD or for CD to be 161.8% longer than AB. Why these conditions ? Cause Fibonacci of course .

The ABCD pattern that the proposed tool aim to detect is not based on the zig-zag but only on individual price observations and don't make use of any of the previously described conditions, thus becoming more like a candle pattern.

When the label is blue it means that the tool has detected a bullish ABCD pattern, while a red label means that the tool has detected a bearish ABCD pattern.

We can't expect patterns based on the analysis of 1,2,3 or 4 closing price observations to predict the reversal of mid/long term movements, this can be seen on the above chart, but we can see some signals predicting short term movements.

Since the pattern is based on a noisy variation, using smoother input can result in less signals.

Above the tool on BTCUSD using closing price as input. Below the tool using ohlc4 as input:

TOOL OPTIONS

Being to early can be as devastating as being to late, therefore a confirmation point can be beneficial, the tool allow you to wait for confirmation thus having a potentially better timing. Below is a chart of AMD with no confirmation:

As we can see there are many signals with some of them occurring to early, we can fix this by checking the confirmation option:

The confirmation is simply based on the candle color, for example if a bearish ABCD pattern has been detected in the past and the closing price is greater than the opening price then the tool return a buy signal. The same apply with a bearish ABCD pattern.

The "last bar repaint" option is true by default, this in order to show the bar where the D point of the pattern has been detected, since the closing price of the last bar is constantly changing the signals on the last bar can be constantly appearing/disappearing, unchecking the option will fix this but will no longer the bar where the D point of the pattern has been detected.

SUMMARY

The pattern is simple and can sometimes be accurate when predicting the direction of future short terms movements. The tool was a request, as it seems i don't post many pattern detectors, well thats true, and the reason is that for me patterns are not super significant, and their detection can be extremely subjective, this is why simple patterns are certainly the only ones worth a look.

Don't expect me to post many pattern related indicators in the future ^^'

Candle Range - Monthly - Open/High/Low/Close/Wicks (Oldinvestor)This candle range comparison is similar to my original script Candle Range Compare .

This script is to compares the size of open/close high/low and wick size side by side. This version of the script allows you to only show a chosen month of each year to compare. I hadn't even thought to try and vanish the part of the chart I'm not looking at. I'll consider that later (may never happen, I am limited on time).

I have also included check boxes to turn on/off certain candles. This part is pretty self explanatory. For example: if you wish to not see wicks in front of the open/close, go to the settings for the study and uncheck the box for "Show Wicks".

Warning: The script does not work so well on monthly candles? Some of the candles are missing...

Good luck

Oldinvestor

Sequential Filter - An Original Filtering ApproachRemoving irregular variations in the closing price remain a major task in technical analysis, indicators used to this end mostly include moving averages and other kind of low-pass filters. Understanding what kind of variations we want to remove is important, irregular (noisy) variations have mostly a short term period, fully removing them can be complicated if the filter is not properly selected, for example we might want to fully remove variations with a period of 2 bars and lower, if we select an arithmetic moving average the filter output might still contain such variations because of the ripples in the frequency response passband, all it would take is a variation of high amplitude for that variation to be clearly visible.

Although all it would take for better filtering is a filter with better performance in the frequency domain (gaussian, Butterworth, Bessel...) we can design innovative approaches that does not rely on the model of classical moving averages, today a new technical indicator is proposed, the technical indicator fully remove variations lower than the selected period.

The Indicator Approach

In order for the indicator output to change the closing price need to produce length consecutive up's/down's, length control the variation threshold of the indicator, variations lower than length are fully removed. Lets see a visual example :

Here length = 3, the closing price need to make 3 consecutive up's/down's, when the sequence happen the indicator output is equal to src , here the closing price, else the indicator is equal to its precedent value, hence removing other variations. The value of 3 is the value by default, this is because i have seen in the past that the average smallest variations period where in general of 3 bars.

Because the indicator focus only on the variation sign, it totally ignore the amplitude of the movement, this provide an effective way to filter short term retracement in a fluctuation as show'n below :

The candle option of the indicator allow the indicator to only focus on the body color of a candle, thus ignoring potential gaps, below is an example with the candle option off :

If we activate the "candle" option we end up with :

Note that the candle option is based on the closing and opening price, if you use the indicator on another indicator output make sure to have the candle option off.

Length and Indicator Color

The closing price is infected by noise, and will rarely make a large sequence of consecutive up's/down's, the indicator can therefore be useful to detect consecutive sequence of length period, here 6 is selected on BTCUSD :

A consecutive up's/down's of period 6 can be considered a relatively rare event.

It is important to note that the color of the indicator used by default has nothing to do with the consecutive sequence detected, that is the indicator turning red doesn't necessarily mean that a consecutive down's sequence has occurred, but only that this sequence has occurred at a lower value than the precedent detected sequence. This is show'n below :

In order to make the indicator color based on the detected sequence check the "Color Based On Detected Sequence" option.

Conclusion

An original approach on filtering price variations has been proposed, i believe the indicator code is elegant as well as relatively efficient, and since high values of length can't really be used the indicator execution speed will remain relatively fast.

Thanks for reading !

$0 Monthly Weekly & Daily OHLC Viewer

Visualizer of current or previous month(s), week(s) & days ranges

Purpose: View last Monthly, Weekly, Daily, and/or a custom time interval OHLC, i.e. previously closed/confirmed or the ongoing higher time interval ranges

Main configurations available:

- 2 main reporting modes: View the current/ongoing M/W/D candles' OHLC (live, repaints) or report OHLC of last closed ones, i.e. previous Montly, Weekly and/or Daily

- View only latest Monthly, Weekly and/or Daily OHLC (lines) or all past ones (~channel)

- Set your own time interval for its price range(s) to be reported, e.g. last quarter '3M', 12H '720', or hide it

- View one specific day of the week OHLC reported all over the week

Graphic/visual configuration:

- Show the High & Low levels or not

- Show the Open & close levels or not

- Display a background color between top & down or lines only

- Change the background color depending if is/was rising or falling price

- Highlight the top & down breaches of higher timeframe resolution candles: Daily breaching last Weekly range, and/or the Weekly the Monthly one

- Colors & styling can be edited from the indicator's styling configuration panel

Depending on its expected usage, those configurations enable to:

- Consider previously closed candles OLHC as reference top & down ranges (support & resistance, breaches)

- Review chart's current candles evolution within their higher time interval / candle (M/W/D)

- Consider specific week days' range as a reference for the week trend

- Have a general overview of the market evolution trends

Default config is to view current candles evolving within their higher time interval / candle, while reporting last previously closed M+W is a preferred usage. Play with the config settings to find your setup.

View ongoing M+W+D OHLC with dynamic background color:

View previously closed M+W+D OHLC:

View closed H&L for M+W+D, latest only:

View Mondays' OHLC:

Feedback & support welcome.

Consecutive Candle Count Momentum StrategyVery simple strategy based on consecutive candle count. Simple but can be very profitable if you know how to execute.

Example:

- Buy when consecutive up closes exceeds 3

- Sell when consecutive down closes exceeds 3

For a buy signal, if price closes higher within 5 candles, it is defined as a win.

For a sell signal, if price closes lower within 5 candles, it is defined as a win.

Win rates for buy/sell signals are calculated over history of security.

Volume Candle 4 typesThis is not my indicator, I just added one more pattern for my personal use.Credits goes to andreholanda73 .

Candle TheoryDescription: The theory behind this script is that if within the last 10 candles, if the majority of them are green and the average length (wick to wick) of those majority green candles is greater than the average length of the minority red candles then it will signal that this is a bullish move within the market and signal you to buy. The opposite is true for bearish moves.

Inputs:

Length - this allows you to decide how many candles to look back, default/recommended is 10

Show First Signal In Series Only - using this indicator without this checked will show many more signals in a row. This allows you to just get a signal for the first candle that is the predicted bullish or bearish move

Candles (acronyms)Same script as "Candles" by TraderMentality but with acronyms for candle shape names.

Heiken-Ashi CandlesSimple script to view Heiken-Ashi candles below a normal candles chart.

Could also be useful for using HA calcs in strategy scripts on normal candles chart for proper backtesting.

I adapted this to v4 from original v2 script by @samtsui. If you like please remember to give him a Thumbs Up for his original version! ->

High and lows round vs full numbersLiterally the name, just checks if a high or low is a full number or decimal (i.e 100.5) then shows the percentage of full number highs vs percentage of full number lows.

I couldn't really find anything useful with it but maybe someone else can

Candle Based RSI w/ EMA 9 CrossoverThis is my first published script. I hope you find it as useful as I have.

This is a modified version of olegnator's RSI script. Enjoy!

HTF Candle [Custom Time Period] by JustUncleL [SOMMI 1.0 edit]This is a custom High Time Frame indicator, originally created by JustUncleL. 💚

I have edited the Pine Script to allow a custom Time Period input. 💛

In the original version, you could only select from a few time periods as your High Time Frame. 💙

In this version you can put any time frame as your reference. 🧡

Example: 6-hour HTF or 2-Day HTF

SOMMI'S SPECIAL NOTES:

-This indicator works with Heikin-Ashi candles.

-Please change your candles to Heikin-Ashi and apply the indicator.

-Advised to disable "Body Wicks"

-Advised to also refresh your page a few times a day as it doesn't update properly due to limitations of TradingView / Pinescript currently.

💙💛💚🧡

Candles - Cheat SheetWhat is up y'all ? (french trying to sound American)

I found that in my script archives, way back in an old cave. I think this might be useful as a few really asked me how to define a green/red candle, how to capture the wick value, the body, etc..

This is not a fancy script as usual and I'm sure they're plenty of candles pattern scripts out there but I saw no one sharing a simple candle cheat sheet for pinescript coding

Being able to define candles using codes is an essential skill to have for any Pinescripter

Still on the train so won't write a roman as usual... Kidding... I actually did it here What-is-an-Hard-Exit-and-a-few-notes-on-trading-management/

It won't bring me as many likes as any magic p**p cannon accounts promising the moon at each trade but if I can help at least 1 trader a day not losing his/her money, I'll be happy and my daily goal will be fulfilled

All the best

Dave

____________________________________________________________

Be sure to hit the thumbs up

- I'm an officially approved PineEditor/LUA/MT4 approved mentor on codementor. You can request a coaching with me if you want and I'll teach you how to build kick-ass indicators and strategies

Jump on a 1 to 1 coaching with me

- You can also hire for a custom dev of your indicator/strategy/bot/chrome extension/python

MACD Profit CandlesThis tool is simple yet very effective. It creates new candles on the chart based on the MACD.

Candles are green when MACD is increasing and red when it is decreasing. All lengths can be adjusted in the input menu and there is an option to plot the signal line.

The rules for using it are pretty simple:

1.Buy on Green

2.Sell on red

~Happy Trading~

Engulfing Candles DetectorHello traders

Credit to HPotter for that script

I took his script and added alerts to it. 2 lines lol

But anyway, useful to detect reversals by coloring bullish/bearish engulfing candles :)

Enjoy

David

Directional filter VERSION 2The idea is to make it more visible if the moment is to seek buying or selling, based on moving averages, being SMA 21 and EMA 9.

best BUYBAR has the EMA9 and SMA21 rising and closing above them. "relevance A"

best SELLBAR has the EMA9 and SMA21 dropping and closing below them. "relevance A"

Conditions for all colors of the candlesticks:

BuyBar A = price closes above EMA9 and SMA21 with EMA9 and SMA21 rising.

BuyBar B = price closes above SMA21 with SMA21 rising OR price closes above EMA9 and SMA21.

BuyBar C = price closes above EMA9 with EMA9 rising and SMA21 falling.

BuyBar Neutral = close> open.

SellBar A = price closes below EMA9 and SMA21 with EMA9 and SMA21 falling.

SellBar B = price closes below SMA21 with SMA21 falling OR price closes below EMA9 and SMA21.

SellBar C = price closes below EMA9 with EMA9 falling and SMA21 rising.

SellBar Neutral = close abertura.

SellBar A = preço fecha abaixo de EMA9 e SMA21 com EMA9 e SMA21 caindo.

SellBar B = preço fecha abaixo de SMA21 com SMA21 caindo OU preço fecha abaixo de EMA9 e SMA21.

SellBar C = preço fecha abaixo de EMA9 com EMA9 caindo e SMA21 subindo.

SellBar Neutral = fechamento < abertura.

As medias moveis também alteram de acordo com a direção em que estão:

EMA 9 subindo = azul

EMA 9 caindo = laranja

SMA 21 subindo = verde

SMA21 caindo = vermelho

High Performance Candlestick Patterns Colors//Candle Patterns Ranked by Performance THOMAS N. BULKOWSKI

//1. Bearish Three Line Strike +Up 67.38%

//2. Bullish Three Line Strike -Down 65.23%

//3. Bearish Three Black Crows -Down 59.83%

//4. Bearish Evening Star -Down 55.85%

//5. Bullish Upside Tasuki Gap +Up 54.44%

//6. Bullish Inverted Hammer -Down 51.73%

//7. Bullish Matching Low -Down 50.00%

//8. Bullish Abandone Baby +Up 49.73%

//9. Bearish Two Black Gapping -Down 49.64%

//10. Brearish Breakaway -Down 49.24%

//11. Bullish Morning Star +Up 49.05%

//12. Bullish Piercing Line +Up 48.37%

//13. Bullish Stick Sandwich +Up 48.20%

//14. Bearish Thrusting Line During Dowtrend +Up 48.10%

//15. Bearish Meeting Line +Up 48.07%

//Down=Yellow Bar Color and Black Text

//Up=Blue Bar Color and Blue Text

//High Performance Candlestick Patterns Colors Top 15

High Performance Candlestick Patterns//Candle Patterns Ranked by Performance THOMAS N. BULKOWSKI

//1. Bearish Three Line Strike +Up 67.38%

//2. Bullish Three Line Strike -Down 65.23%

//3. Bearish Three Black Crows -Down 59.83%

//4. Bearish Evening Star -Down 55.85%

//5. Bullish Upside Tasuki Gap +Up 54.44%

//6. Bullish Inverted Hammer -Down 51.73%

//7. Bullish Matching Low -Down 50.00%

//8. Bullish Abandone Baby +Up 49.73%

//9. Bearish Two Black Gapping -Down 49.64%

//10. Brearish Breakaway -Down 49.24%

//11. Bullish Morning Star +Up 49.05%

//12. Bullish Piercing Line +Up 48.37%

//13. Bullish Stick Sandwich +Up 48.20%

//14. Bearish Thrusting Line During Dowtrend +Up 48.10%

//15. Bearish Meeting Line +Up 48.07%

//Down=Yellow Bar Color and Black Text

//Up=Blue Bar Color and Blue Text

//High Performance Candlestick Patterns Top 15

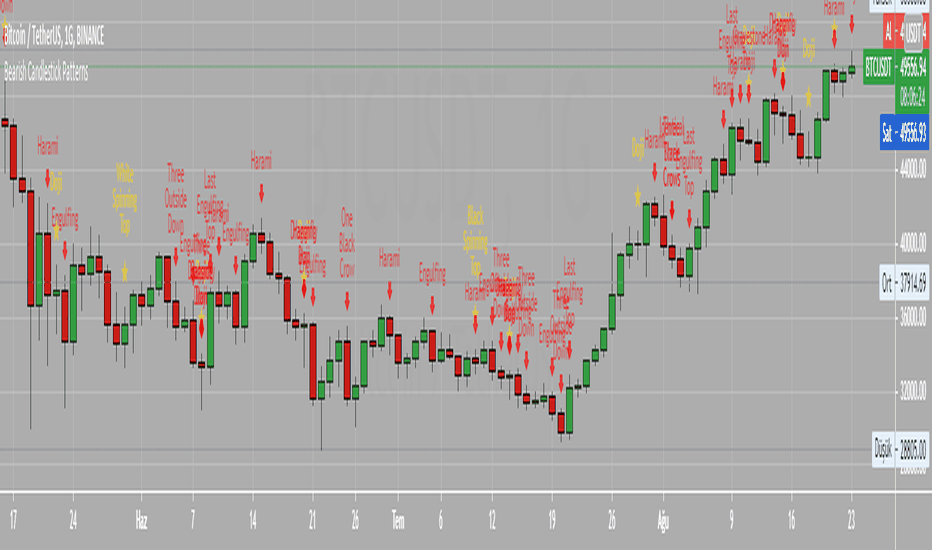

Bearish Candlestick PatternsDoji

Black Spinning Top

White Spinning Top

Bearish Abandoned Baby

Bearish Advance Block

Bearish Below The Stomach

Bearish Belt Hold

Bearish Breakaway

Bearish Counter Attack Lines

Bearish Dark Cloud Cover

Bearish Deliberation Blok

Bearish Descending Hawk

Bearish Doji Star

Bearish Downside Gap Three Methods

Bearish Downside Tasuki Gap

Bearish Dragonfly Doji

Bearish Engulfing

Bearish Evening Doji Star

Bearish Evening Star

Bearish Falling Three Methods

Bearish Falling Window

Bearish Gravestone Doji

Bearish Hanging Man

Bearish Harami

Bearish Harami Cross

Bearish Hook Reversal

Bearish Identical Three Crows

Bearish In Neck

Bearish Island Reversal

Bearish Kicking

Bearish Ladder Top

Bearish Last Engulfing Top

Bearish Low Price Gapping Play

Bearish Mat Hold

Bearish Matching High

Bearish Meeting Line

Bearish On Neck

Bearish One Black Crow

Bearish Separating Lines

Bearish Shooting Star

Bearish Side by side White Lines

Bearish Three Black Crows

Bearish Three Gap Up

Bearish Three Inside Down

Bearish Three Line Strike

Bearish Three Outside Down

Bearish Three Stars in the North

Bearish Thrusting Line During Dowtrend

Bearish Tower Top

Bearish Tristar

Bearish Tweezers Top

Bearish Two Black Gapping

Bearish Two Crows

Bearish Upside Gap Two Crows