CME & XBT - BTC Futures Settlement DatesHi everyone

This in an indicator inspired by Scarrff

I added the XBT quarterly and yearly settlement dates

Enjoy

David

BTCUSD

MVA collector cryptoHello Traders

This indicator draw multiple Simple Moving Averages multi-timeframes at once

I use it to define take profit zones for my crypto trading

Hope you'll like it

Enjoy

Dave

Dividing 2 symbolsHello Traders

This indicator is used to divide two assets between them. Why you would ask ?

For instance, in crypto trading, traders often look at the ratio Longs/Shorts or Shorts/Longs to figure out which side is leading the market and use this information as a powerful hedge for their next trade

Enjoy

Dave

OBV Z-ScoresThis study calculates the On-Balance Volume (OBV) and displays it in terms of its Z-Score.

OBV is a great momentum indicator . As the name suggests, OBV predicts changes in price based on the security's volume flow.

Formula:

if (Current Price > Previous Price)

then Current OBV = Previous OBV + Current Volume

if (Current Price < Previous Price)

then Current OBV = Previous OBV - Current Volume

if (Current Price == Previous Price)

then Current OBV = Previous OBV

As the formula shows, the OBV goes a step beyond just looking at the pure volume of a security. Instead, it factors in relative price action from period to period to reflect investor sentiment. As a result, we often look to the OBV to spot bullish or bearish trends while they are in the early stages of development or simply predict impending uptrends or downtrends.

To make the OBV easier to visualize, we converted the value to a Z-Score. The Z-Score is a simple statistical measurement and represents the current OBV value's distance from the mean OBV value in terms of # of standard deviations.

Users can adjust the values for the 2 upper bounds for Z Scores and 2 lower bounds. Additionally, the n value for z score calculation can be adjusted in the input menu. A higher n value means the z score will be based on a longer lookback period. A lower value will result in more sensitive readings.

Overall, I think this is an interesting way to represent OBV values and will be a valuable leading indicator.

~Happy Trading~

Modiied Elder Ray Index(Bull or Bear)Here's a modified version of the Elder Ray Index created by the famed Dr.Alexander Elder. This indicator has proven to be especially helpful lately given the crazy state of crypto.

Slow Moving Average :

The top chart shows the moving average used to filter trends. I recommend using a higher window length(can be adjusted with the 'lenSlowMA' input option). I wanted this to be a very smooth moving average, so I used the following formula:

slow MA = ema(vwma(close, 64), 64)

This resulted in a pretty smooth line that still detects major price movements very well.

-The background and bar colors both change in response to the Slow MA's value. The background and bars change to green when a bullish trend is detected and red when bearish.

Bear and Bull Power :

To balance things out a little, I included two histogram's based on Elder's Ray. Here, a more responsive EMA with a shorter window length is used to calculate the bull and bear power values and track short-term price fluctuations.

NOTE: The length of the EMA used here can be adjusted in the input menu.

Bull Power = current high - EMA(close, 13)

Bear Power = current low - EMA(close, 13)

Momentum TraderThis study combines two versatile momentum indicators :

Chande Momentum Oscillator:

-Measures trend strength, with higher absolute values meaning greater strength.

-Also tracks divergence. When price increases, but is not accompanied by an increase in Chande Momentum Oscillator values, it signifies bearish divergence and a reversal is likely to follow.

-Shown as the teal and pink histogram.

Percentage Price Oscillator:

-Similar to the MACD, except that it expresses the difference between the two moving averages in terms of a percentage. This makes it a little easier to visualize.

-PPO values greater than zero indicate an uptrend, as that means the fast EMA is greater than the slow (and vice versa).

Entry and Exit Conditions:

Enter When:

1) Chande Momentum crosses over zero from negative to positive territory. AND

2) It has been less than 3 bars since Chande Momentum was less than the lower green line. AND

3) Chande Momentum is rising(positive slope).

Exit When:

1) Chande Momentum is greater than the upper line. AND

2) It has been less than 6 bars since the PPO value was greater than the upper bound. AND

3) PPO is less than 5 (meaning the difference between the two EMA's is less than 5%). AND

4)PPO has a negative slope.

This study comes with alert conditions for long entries and exits.

~Happy Trading~

Mayer MultiplerThe ‘Mayer Multiple’ is one of the most popular metrics and derives from the current price divided by the 200-day moving average (200-MA). The average value is 1.39, and historically, when it becomes equal to or greater than 2.4 it will retrace to under 1.5.

Simulations performed by Trace Mayer determined that in the past, the best long-term results were achieved by accumulating Bitcoin whenever the Mayer Multiple was below 2.4.

Since the simulations were based on historical data, they are purely educational and should not be the basis of any financial decision.

Credit:

bitcoinist.com

mayermultiple.info

Double ALMAIncludes fast and slow Arnaud Legoux Moving Averages (ALMA). ALMA is a moving average based on a Gaussian(normal) distribution that reduces lag while still retaining smoothness.

Input Options:

-Offset : Value in range {0,1} that adjusts the curve of the Gaussian Distribution. A higher value will result in higher responsiveness but lower smoothness. A lower value will mean higher smoothness but less responsiveness.

-Lengths : The lookback for each ALMA calculation.

-Sigma : Defines the sharpe of the curve coefficients.

The slow ALMA is the thickest red and green alternating line that indicates bullish or bearish movement. When slow ALMA is bullish, the graph's background changes to green. When the slow ALMA is bearish, the background is red.

The fast ALMA uses a smaller lookback and is more responsive than the slow ALMA as a result of the shorter length and higher default offset parameter.

The two dotted lines represent (slowALMA +/- 1.25 * stdev(slowALMA, slowALMA period *2)).

The indicator bases its buy and sell signals based on the trend identified by the slow ALMA and the fast ALMA's crossings of the standard deviation bands.

Comes with pre-set buy and sell alerts.

VWMA/SMA Breakout and Divergence DetectorThis indicator compares four different values :

-Fast Simple Moving Average(SMA)

-Fast Volume Weighted Moving Average(VWMA)

-Slow SMA

-Slow VWMA

Comparing SMA's and VWMA's of the same length is a common trading tactic. Since volume is not taken into consideration when calculating Simple Moving Averages, we can gain valuable insights from the difference between the two lines.

Since volume should be increasing along with an upwards price movement, the VWMA should be greater than the SMA during a volume-supported uptrend. Thus, we can confirm an uptrend if the VWMA remains greater than the SMA. If the VWMA falls under the SMA in the midst of an upwards price movement, however, that indicates bearish divergence. The opposite is true for downtrends. If price is decreasing and volume is decreasing at the same time (as it should), then we can confirm the downtrend.

Interpreting the Graph:

If the slow SMA is greater than the slow VWMA, then the area representing the difference between the two lines is filled in red. If the slow VWMA is greater than the slow SMA, however, the area between the two is filled green.

If the fast SMA is greater than the fast VWMA, then the area between the two dotted lines is filled in red. On the other hand, the area will be filled green if the fast VWMA is greater than the slow SMA.

In addition to spotting divergences and confirming trends, the four lines can be used to spot breakouts. Typically, a VWMA crossover will precede the SMA crossover. When the fast VWMA crosses over the slow VWMA and then a SMA crossover follows shortly after, then it is a hint that a bullish trend is beginning to form.

Bitcoin Fat Volume IndicatorBitcoin Fat Volume Indicator

The script displays aggregate sums of Bitcoin dollar and Tether market volumes separately as follows:

USD markets (blue): gemini, coinbase, okcoin, kraken, bitfinex, bitstamp, btce, mtgox

Tether markets (orange): huobi, binance, bittrex, poloniex, hitbtc

The indicator should work on all time frames on any chart so long as volume data exists. Obviously for full history use Bitcoin Liquid Index.

The indicator is slow that's why I'm not including other stable coins or fiat markets at present.

Use settings to turn off Tether or USD bars as desired.

Coinbase Pro EMAsAn indicator to match the only overlays available on Coinbase Pro charts, the EMA12 and EMA26.

Golden Ratio Multiplier: Multiplied Moving AveragesThe script for plotting DMAs from the study made by @PositiveCrypto (twitter)

Golden Ratio Multiplier: Multiplied Moving AveragesMultiplied moving averages script visualizing the study made by @PositiveCrypto (twitter).

weekend rally bloody mondayTracks the gain-loss of the price on Mondays and the range gain-loss from Monday (configurable) to Sunday. Then, it identifies Sunday's pumps that end with a Monday dump.

Slices of Bitcoin

A very simple indicator that shows how many times a currency fits into Bitcoin. In other words, the higher the value, the weaker the currency against Bitcoin.

You can easily see that since the beginning of 2019 Stellar Lumen (XLM) lost half of its BTC-value while the USD-value was constant.

Crypto Indicators #u9tusA set of low timeframe (LTF), medium timeframe (MTF), and high timeframe (HTF) indicators for use in crypto currencies / bitcoin.

Traditionally the 10, 20, 50, 100, and 200 SMAs are used in TA. With cryptos, I've found that the 8 EMA, 21, 55, and 128 SMAs backtest better, while no change in length was necessary for the 200. I wanted to combine all these into one indicator to easily add them to a chart layout, hence this script.

You can customize the length of each MA to your liking in the settings, or accept the defaults.

LTF Indicators:

8 EMA in blue hues, medium line stroke.

MTF Indicators:

21, 55 SMA in purple hues, medium line stroke.

HTF Indicators:

128, 200 SMA in yellow hues, thick line stroke.

Defaults are for daily timeframes and lower; suggest changing up the intervals for weekly and monthly to:

21 -> 30

55 -> 50

128 -> 100

$BTC, $ETH, #ALTS

twitter.com

(c) @jhaurawachsman 20190515

Finex PremiumThis is a simple script for the Bitfinex premium against Bitstamp

Easy to modify values

BitMEX KairiBitMEX Kairi

# Abstract

This script shows the divergence between BTC futures price and BTC actuals price of bitFlyer FX and BitMEX in percentage.

Usually, when people bought it or sold it too much on futures , the divergence between actuals and futures are getting expanding.

I believe this is really useful to find when the conversion of the trend happens.

Also supports USDT divergence too. If you wish to enable USDT mode, please check "Show only USDT divergence (Poloniex)" on the settings menu.

Enjoy :)

# Supports:

- BitMEX BTC Futures 3mo (orange)

- BitMEX BTC Futures 6mo (red)

- bitFlyer FX (blue)

- USDTUSD (Poloniex)

# Disclaimer:

This is a free script. Feedbacks are welcome! But I don't have any responsibility when this script has broken or something went wrong.

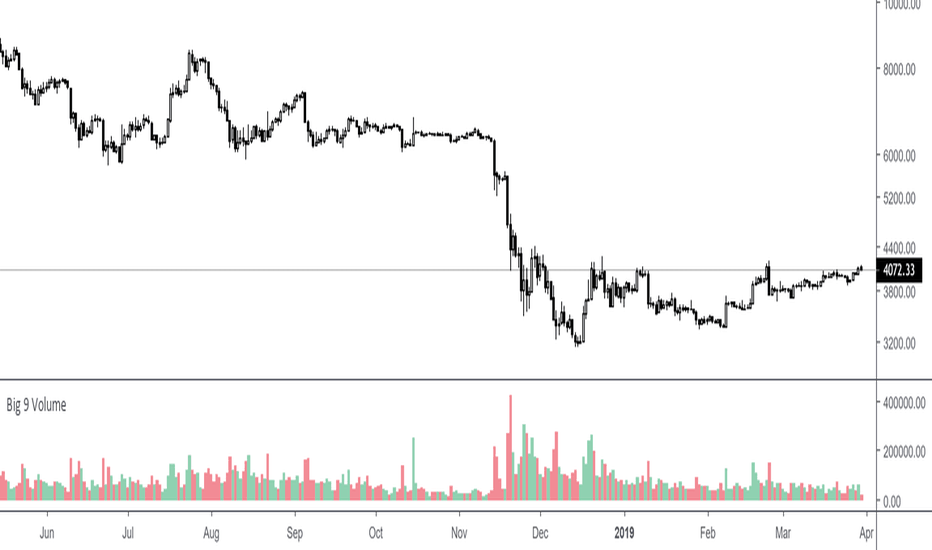

Big 9 Volume - Volume indicator from exchanges with real volumeHere is a very basic indicator combining the volumes of the 9 biggest exchanges trading BTC/USD or BTC/USDT. These 9 exchanges were chosen based on the report by Bitwise Invest stating that 95% of the volume on CoinMarketCap is fake. On these 9 exchanges, however, volume data appears to be reliable. Please note BitFlyer was not included because it does not trade in USD. Please note also that data on all 9 exchanges is only available from June 2018.

Anyone is welcome to modify this and make it more elegant, this was just a quick implementation.

Delta longs-shorts. BITFINEX:BTCUSDFor any timeframe. Use for the BTC/USD pair. It is calculated by the formula: longs - shorts. Used data from Bitfinex. To smooth the values, you can use the EMA embedded in the indicator.