ASFX ADR ToolUsers cannot seem to find the original. This is a new publish at the request of Austin Silver, please enjoy!

Индикаторы ширины рынка

Dr_Pivots High & Low Trend Line- I'd like to find a pattern more easily on the chart.

- This script might give you a better view of the support and resistance lines.

Buying and Selling Smoothed with HistogramBuying and Selling Smoothed with Histogram

Smoothed version with version with a red line representing the selling pressure and a green line which represents the Buying pressure.

If the green line is above the red line it would mean that the Buying pressure is more and vice versa.

The difference between the two is plotted as a Histogram. This is a cumulative value of the buying and selling pressure and provides a easy visual presentation of the dominating pressure.

Buying and Selling Pressure RawBuying and Selling Pressure Raw

Raw Buying and selling pressure Indicator. The Raw buying and selling indication is provided in terms of a Columns.

Green bars above zero show the buying pressure and the red bars below the zero line show the selling pressure.

This presents a good visual representation of the dominating pressure.

TRI - The Range Indicator by Jack Weinberg TRI - The Range Indicator by Jack Weinberg

Developed by Jack Weinberg, Range indicator compares intraday range with inter-day range

Intraday range is bar’s (high – low) and inter-day range is (Close – Close-1)

Author had a strong belief that crossing of intraday range outside the inter-day range is an indication of end of current trend

It oscillates between 0 to 100 levels

Interpretation

RI crossing above level 80 is a signal to exit

RI below 20 is indication that a new trend is about to take charge

RI is useful to filter signal given by other studies

HXRO WalletThis script show your HXRO current wallet value (you don't need to stay on particular ticker, data is available everywhere)

Currency:

BTC From Bittrex

USD From Bitfinex

EUR From Bitfinex

GBP From Bitfinex

JPY From Bitfinex

More customization available in the options

check my other hxro indicator: HXRO Contest that highlights the side, start and end of contest and allows you to set alarms 1 minute before the end to remember to bet

For Tradingview Pro+ user (better performance):

For Other:

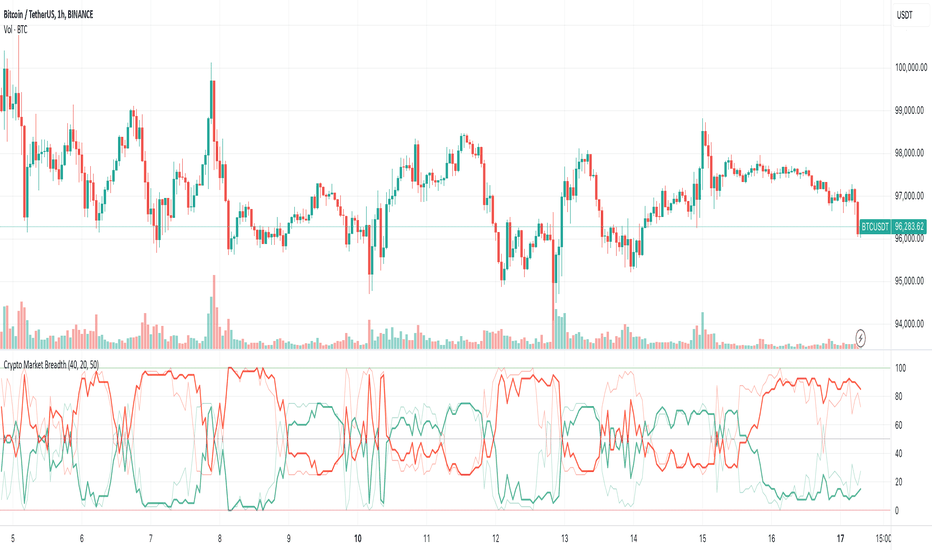

Crypto Market BreadthThis is the "Crypto Market Breadth" indicator from

I updated it to latest symbol so that it resolves again:

removed: BINANCE:NPXSUSD

added: BITFINEX:LEOUSD

Also helpful for automatic trading with WolfBot.org and TradingView Integration

Crypto - Candle Price Info PanelInfo Panel that displays difference in percentages between current candle open value and highest/lowest wick values in past "X" number of candles

Quickly glance at a simple and recent price action range. Due to displayed difference in percentages more useful on Crypto, stocks etc. than Forex

Put together as a learning project with help, code and advice from @jhanson107, @Zekis.

Forex - Candle Price Info PanelInfo Panel that displays difference in ticks between current candle open value and highest/lowest wick values in past "X" number of candles

Quickly glance at a simple and recent price action range.

Put together as a learning project with help, code and advice from @jhanson107, @Zekis.

Multi XXL Indikator v2Ma s (50,100,200)

Keltner

Bollinger 2 und 3

Future Pivot

Multi Timeframe MA

Ema s 55=>20

Multi XXL IdicatorMulti XXL Indicator

Ma s (50,100,200)

Keltner

Bollinger 2 und 3

Future Pivot

Multi Timeframe MA

Ema s 55=>20

Multi XXL IdicatorMulti XXL Indicator

Ma s (50,100,200)

Keltner

Bollinger 2 und 3

Future Pivot

Multi Timeframe MA

MTF Bollinger Bands - ModifiedModified version of tansancrypto's MTF Bollinger to Pinescript 4 and removed limiters on BB1/BB2 max Sigma values.

Original Script:

Weis Wave Volume (Pinescript 4)Port of LazyBear's Weis Wave Volume indicator to pinescript v4 from v2.

TA-Money Flow-Version5This is the MACD of a stochastic OBV movement indicator, Squeeze Momentum Indicator, and addition coloring for Market Direction Indicator . It is good (right) to work with both price and volume.

In this version we've moved the divergence highlighting to symbols at the ends of the histograms. Same coloring scheme as previous, yellow is divergence of either OBV or SQZ , red is both divergence. In the previous version we added in the "squeeze on - blue" highlighting to show follow through of divergence (or just squeeze/stall). We also added in another old script, but colors so well, Lazybears (Market Direction Indicator, linked below). Also incorporated a 3 color or 5 color scheme from the MDI script as a bool. It works great on any time frame, but you need to have volume data. Not sure where I originally got this (stoch-OBV, somewhere off Tradingview several years ago, thanks to the person who shared), Squeeze/MDI is Lazybear, links below.

Enjoy.

Version 5:

Moved divergence highlighting to symbols on histogram

Added coloring based on MDI

TA-Money-Flow-Version4

TA-Money-Flow-Version3

TA-Money-Flow-Version2

Squeeze-Momentum-Indicator-LazyBear

Market-Direction-Indicator-LazyBear

How to Collapse, hide, fold blocks of your codeThis script contains no trading value. This is no indicator.

It is only showing how to use a powerful editor feature:

To collapse (hide, fold) and expand (unhide, unfold) some blocks of your code.

Don't tell me you never wished it was there ;)

Well - it is!

How to enable it?

Look at line 4 of this script. It starts with //, but then there is this "opening curly bracket"

- it marks where block of code starts.

It produces that small arrow near number "4" of the code line, which you can click.

You close the block with "closing curly bracket" in line 18.

Thanks @ricardosantos for showing me this!

Next breakthrough editor feature like that will be Search&Replace. Stay tuned!

*********

Forex / Indices / Commodities traders who want to start AUTO-TRADING might want to take a look at http://www.tradingconnector.com, which allows no-latency trades execution from TradingView to MT4.