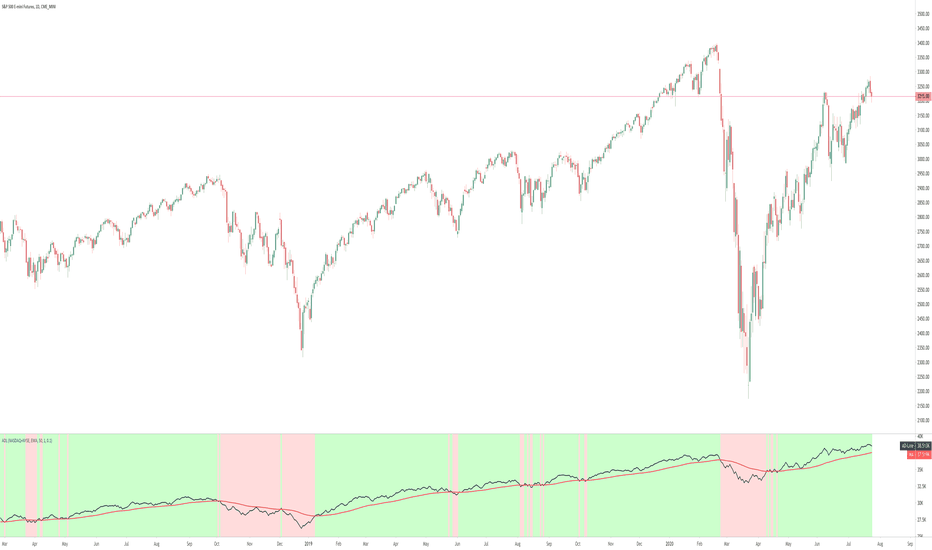

BankNifty Modified McClellan OscillatorThe McClellan Oscillator developed by Marian McClellan is a useful breadth indicator because it describes the acceleration that takes place in the breadth numbers.

How to read McClellan Oscillator

A positive or negative value gives a simplistic bullish or bearish statement about the short-term trend of the market

Very low readings show oversold conditions

Very high readings show overbought conditions

Divergences are also important to look for as a sign that the strength of a trend is waning

Here same oscillator is rebuilded for BANKNIFTY using the difference between Capital weighted Up Volume and Down Volume instead of Advance - Decline.

Индикаторы ширины рынка

[KY]Cumulative Advance Decline Line(1) What is Cumulative A/D Line?

Cumulative A/D Line is a total of advancing issues - declining issues of all time.

This can be used to know long-term trend.(weeks, months long)

(2) How to use this?

- Add this script to your chart.

- Select the market from "Nasdaq", "NYSE", "Nasdaq+NYSE"

- You could change the moving average.

[KY]New High New Low Ratio(1) What is New High/New Low ratio?

New High/New Low ratio is a ratio based on new 52-week high issues and new 52-week low issues.

This indicator is best for identifying a bottom if you use this with other breadth indicators.

However, this is not so useful to know the timing for short because bull momentum tends to continue.

(Market top period is long, market bottom period is short.)

Reference: Stochcharts.com

school.stockcharts.com

(2) How to use?

- Add this indicator to your chart.

- Overbought >85 tends to continue, so don't short too early. You rather want to hold long until bull momentum deteriorates.

Dark green = bullish momentum zone.

- Oversold < 30 and if rolls over at the bottom, you can pile up long position.

[KY]McClellan Summation Index RSIThis script contains McClellan Summation Index(MSI) and McClellan Oscillator(MO)

(1) What is McClellan Summation Index(MSI)

McClellan Summation Index(MSI) is a breadth indicator derived the McClellan Oscillator(MO),

which is a breadth indicator based on Net Advances (advancing issues less declining issues).

The Summation Index is simply a running total of the McClellan Oscillator values.

To identify the market direction, I prefer to use the relative strength(RSI) of MSI rather than MSI itself

because MSI is a summation so it's difficult to compare with previous market patterns. So I use RSI applied MSI.

Reference: Stockcharts.com has a nice set of detailed explanation about MSI.

school.stockcharts.com

(2) How to use this script

- Add this script to your chart.

- You can choose one of two options ("MSI RSI" or "MO").

- You can also choose the market from three options ("Nasdaq", "NYSE", "Nasdaq+NYSE")

(3) "MSI RSI" or "MO"

a) "MSI RSI"

For swing trade(sevelal weeks), MSI RSI is much better to identify the broad market direction.

I backtested last several years of S&P500. The result was not symmetrical between MT bear/bull market.

For bull side, when MSI RSI curls up from the bottom(e.g. RSI 30 level), 90% of times out of them the market rallied.

For bear side, when MSI RSI rolles over to downside from the top(e.g. RSI 70 level), only 60% of times out of them the market declined.

So the market tends to hit negatively diverrgent high from advancing/declining issues perspective. Be careful to use MSI oscilator.

b) "MO"

For short term trade(intraday, 2-3 days of holding), MO is better because MSI is a summation so lags several days. MO is quick.

MO is sometimes very noisy, so you need to draw trendlines or horizontal levels to compare with the previous cases.

For beginners, I recommend to use "MSI RSI".

Trend Lines ProHello Traders!

We need to make things better & better to solve the puzzle and I try to do my best on this way. now I am here with my new Trend Lines Pro script.

As you know, Trend Lines is very subjective and many people (even professionals) draw different Trend Lines on the same chart. This is confusing and there must be an automation to make the life easer. with this tool I tried to automate it.

The idea in this script is different from my previous trend lines scripts. In this, I use channel idea so it can check number of pivot points it contains, it checks H/L/C in the channels as well. it also checks the angle while choosing trend lines. then we get stronger and useful Trend Lines automatically.

There are some option in the script, let see one by one:

Pivot Period: The Length to calculate Pivot Highs/Lows

Source : Option to use "High/Low" or "Close" as the source for Pivot Points

Threshold Rate : This rate is used for channel width. it you give bigger numbers then you get bigger channels. it's 4 by default

Minimum Angle Rate for new Trendline: if there are different trend lines, there must be an angle between them to choose best trend lines. you can set the angle with this option.

Minimum Strength: there can be many trend lines but we need to choose/use stronger ones. with this option you can set the number of pivot points a trend channel have to contains.

Maximum Loopback Length: by default the script can check 40 pivot highs and 40 pivot lows but to make the script faster and useful I needed to add a limitation for the number of bars that the script can go back.

Show Trendlines as: you can see trend lines as "Trendline", "Channel", "Trend Channel". you can see examples below.

Enable Weak Trend Lines: if there is no trend lines strong enough (as defined in "Minimum Strength" option) you have option to see a weak trend line. that is useful sometimes. if you enable this option weak lines are shown as dotted lines.

Show Price Labels on Trendlines: the script can show the price levels to break trend lines. the examples are below

Line Style: trend lines can be Solid or Dashed as you wish

Color theme: colors of the Up/Down Trend lines can be set. 'Red', Lime, Blue, White, Black, Olive, Gray

you can see the Trend Lines as channels:

you can see Trend Channels to see the big picture.also there is dotted trend line as weak trend line defined above.

you can set color/width of trend lines as you wish.

the script is fast enough to run on 1sec chart:

you can use this script on any chart, fx pairs, stocks, indices etc

I made a short video to explain how to use it and some options:

Please PM for access.

Enjoy!

DISCLAIMER: No sharing, copying, reselling, modifying, or any other forms of use are authorized for our documents, script / strategy, and the information published with them. This informational planning script / strategy is strictly for individual use and educational purposes only. This is not financial or investment advice. Investments are always made at your own risk and are based on your personal judgement. I am not responsible for any losses you may incur. Please invest wisely.

MinichartsA further improvement of the Sparklines indicator, which shows the last 6 candles of 4 different instruments (can be customized on the user's choice).

Use cases are remain the same as for the Sparklines :

Merge of two instances

A screener

* on the preview

If you have any questions you can contact me either via private messages here or via Telegram

Support Resistance HH HL LH LLThis is a very powerful indicator and I'm really happy to show you how it works.

It shows Higher Highs(HH),Higher Lows(HL),Lower Highs(LH),and Lower Lows (LL), the supports and the resistance.

Lets start with the HH, HL, LH and LL.

This points helps a lot who can not identify them yet. They help to identify up trends having HH and HL in sequence, and when the trend is not strong anymore creating LH after.

For down trends, the indicator show LH and LL in sequence and when the trend is not strong anymore showing HL after.

As well this indicator helps to draw trend lines when it shows. For example the LL drawing the line from the low of the first candle (LL) to the low of the second candle showing HL for an uptrend.

It can be done for the down trend, drawing the trend line from the high of the candle showing the HH, to the high of the candle showing LH.

Another use of the HH, HL, LH, LL can be the stop loss this will be explained later in the support and resistance part.

Now let me explain the support and resistance.

The support and resistance can be used as entry when the price break true using the previous HH, HL, LH and LL as stop loss.

For a safer entry I advise to use the retest of the line.

In the settings of the indicator there is the possibility to make the indicators invisible, to change the color, and as well to change how many candles before and after the main candle showing the HH, HL, LH and LL, but I advise to leave it as it is.

Thank you and lets take some pips!

OBV - ADX and DI+/-This is the ADX and DI+/- indicator applied to OBV!

This really clearly shows up and down, but using VOLUME! Don't ignore it, there is too much information captured in the OBV.

If you just love the ADX/DI format, it is included in a checkbox.

Want some excellent background highlighting, turn in on in a checkbox.

Shout out to some inspirations

csw-dmi

unRekt-KISS-Addie

MCDX PlusINTRODUCTION

Upgraded version of MCDX (Add Moving Average) PROTECTED VERSION

This indicator is similar to original MCDX to detect Buyer and Seller momentum based on Price and Volume to detect Buyer and Seller momentum

This indicator helps to detect “Strong Buyer Activities a.k.a Bankers” based on volume and price movement.

HOW TO USE THE INDICATOR?

There are 2 parts . BARs & Moving Average Lines

BARs

RED BAR = POSSIBILITY of BANKER VOLUME

YELLOW BAR = POSSIBILITY of HOT MONEY VOLUME

GREEN BAR = POSSIBILITY of RETAILER VOLUME

Red Bar Increase means Buyer's momentum increases.

Green Increase means Seller's momentum increases.

We focus on RED Bar to buy. i.e PREFERABLY we buy when RED bar increase.

Example:-

If Banker’s Bar (Red Bar) crosses above 5 (25%) = Banker begins to build position

If Banker’s Bar > 10 (50%) = Banker already built positions. Price will start accelerate

If Banker’s Bar > 15 (75%) = Banker in control. Price will rocket

If Green colour is Retailer (Avoid)..

MCDX Plus comes with Moving Average

DEAD CROSS (shares down)

Banker’s MA cross below Retail’s MA

Banker’s MA cross below Hot Money’s MA

Hot Money’s MA cross below Retail’s MA

GOLDEN CROSS (shares up)

Banker’s MA cross above Retail’s MA

Banker’s MA cross above Hot Money’s MA

Hot Money’s MA cross above Retail’s MA

Contact me to find out more about Turtle Trading System and indicators

Alpha Performance of PeriodAlpha Performance of Period (PoP) produces a visualization of returns (gains and losses) over a quarterly, monthly, or annual period. It also displays the total % gain and loss over any length of days, months, and years as defined by the user.

Performance of Period (PoP) can be used to understand the performance of an asset over multiple periods using a single chart layout, and to compare the performance of different assets by using a multi-chart layout.

This can, for example, be used to compare the NASDAQ, S&P, and DJI over the past 20 years to create a dow vs. nasdaq vs. s&p performance chart. This can help you understand a comparison of historical returns by showing which performs the best month-over-month, quarter-to-quarter, year-to-year, throughout any custom period of days/months/years.

The ability to get a visualization of the % gain/loss can help to better understand how markets have performed over time and which markets have historically performed the best.

Check out the up and coming Educational Idea we will be releasing soon after this is live to see an example of how we use this tool.

Current Period Label

-----

Current Period : This label shows the current period's performance only when you hover over it.

(This label is located to the left of the current period's open candle and at the current candles close price)

TICKER "Time Period" Performance Label

-----

Total Period Gain : The total of all % gain periods from the start to end date.

Largest Period Gain : The biggest % gain period from the start to end date.

Total Period Loss : The total of all % loss periods from the start to end date.

Largest Period Loss : The biggest % loss period from the start to end date.

Total period Performance : The total % performance, the difference between the total gain and total loss.

NOTE : The "Current Period" performance is excluded from ALL five of the above-mentioned figures. This was done to avoid giving inaccurate comparison figures due to the period not being finished yet.

Inputs

-----

Current Script Version + Info : A drop-down list of instructions for the user to refer to.

Dark Mode Labels : Toggle on for Dark Mode. This is done since Labels text and background color can not be adjusted separately within the visual inputs so this is the best fit solution.

Time Period of Returns : Pick the period of performance you would like to emulate monthly/quarterly/annual.

Start Date : The day to start tracking performance.

Start Month : The month to start tracking performance.

Start Year : The year to start tracking performance.

End Date : The day to stop tracking performance.

End Month : The month to stop tracking performance.

End Year : The year to stop tracking performance.

As always if you have any feedback let us know in the comments and leave a like if you enjoy this tool :)

On Balance Volume Flow (Expo)On Balance Volume Flow (Expo) identifies buying and selling pressure at extreme points. On Balance Volume Flow (Expo) is primarily used to identify potential turning points and areas of congestion.

Vwap can be enabled as an input source instead of using Volume.

The indicator can be used standalone or as a part of your current trading strategy.

HOW TO USE

1. Use the indicator to identify potential turning points and areas of congestion.

2. Use the indicator to get a feel of how price movements and volume are related.

INDICATOR IN ACTION

1-hour chart

Works on any market

I hope you find this indicator useful , and please comment or contact me if you like the script or have any questions/suggestions for future improvements. Thanks!

I will continually work on this indicator, so please share your experience and feedback as it will enable me to make even better improvements. Thanks to everyone that has already contacted me regarding my scripts. Your feedback is valuable for future developments!

ACCESS THE INDICATOR

• Contact me on TradingView or use the links below

-----------------

Disclaimer

Copyright by Zeiierman.

The information contained in my scripts/indicators/ideas does not constitute financial advice or a solicitation to buy or sell any securities of any type. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

My scripts/indicators/ideas are only for educational purposes!

MMP Indicator 4-step WeeklyFading levels using martingale (limit orders, rebate venue) with no stop-loss orders, long the wings at the end of Support and Resist levels from prior week Friday right before the close. Re-hedge the order book units when there is a breakout.

Steady Swift by Hashtag_binarySteady Swift is an indicator that shows the forex sessions and the highest and lowest points of each session of the day.

The sessions that appear on the indicator are Tokyo, London and New York.

The calculation of each session is per hour and goes from 0 to 24 hours, where point 0 begins in the Tokyo session.

In the settings part sessions can be selected or removed, just as you can choose if you want the high and low points to be measured from the wick or the body of the candle, and you can also place the colored background or remove it if you wish (as a preference it is better to leave the background color).

The lines (either current or past) of the high points and the low points of each session can be modified in thickness.

There is a variety to choose the color of the sessions. Even modify the term of each session.

SparklinesA sparkline is a very small line chart, typically drawn without axes or coordinates (the presented implementation has coordinates). It presents the general shape of the variation (typically over time) in some measurement, in our case - market price, in a simple and highly condensed way. The approach has a long history and is widespread nowadays.

The main purpose is to be aware of the moves on specific instruments using only one lead chart as well as to save as much of a free working place on chart as possible.

Use cases:

Standalone

Merge of two instances

Merge with another indicator

A screener

* on the preview

If you have any questions you can contact me either via private messages here or via Telegram

Japan RT Ratio(TSE: J-Reit & TOPIX Ratio)

English:

This script, RT Ratio shows the ratio between J-REIT(TSE:REIT) and TOPIX(TSE:TOPIX).

J-REIT tends to be higher than TOPIX, over 1.0.

When J-REIT is lower than TOPIX, below 1.0, J-REIT may be over sold.

RT Ratio < 1.0 : J-REIT over sold, a good chance to buy J-REIT.

RT Ratio > 1.4-1.5 : Over bought, J-REIT may be too high.

Notice: RT Ratio is for a long term trading of J-REIT, not for a short term trading.

Japanese:

RT倍率(RTレシオ)は、JリートとTOPIXの値を割った指標です。

RT倍率 < 1.0: Jリートが売られすぎ

RT倍率 > 1.4~1.5: Jリートが買われすぎ

長期投資目線のシグナルとして、Jリートの売買タイミングの大きな流れを掴むのに良いかもしれません。

ファイナンシャルスターさんの記事(『RT倍率(REIT/TOPIX倍率)を開発しました / 1倍割れは投資のチャンス』)を参考にして、Tradingview用のインジケーターを作ってみました。

[RS]Detrended Percent Price Over Average on RangeExperimental:

Detrended Price oscillator from price against the average inside the range.

Entrate, take profit e stop loss, target 1

Questo script vuole essere un aiuto nell'impostare le operazioni a mercato giorno per giorno.

A seconda della posizione che si vuole scegliere (long o short) guardando il grafico si può essere aiutati dall'indicatore Entrare.

Le linee trasparenti verdi e arancioni sono entrate:

long: la mia entrata a mercato sarà al prezzo della riga arancione trasparente, il mio stop loss alla riga rossa, il mio tp 1 alla riga bianca superiore e il tp 2 alla riga verde.

short: la mia entrata a mercato sarà al prezzo della riga verde trasparente, il mio stop loss alla riga verde, il mio tp 1 alla riga bianca inferiore e il tp 2 alla riga rossa.

Questa semplice strategia è basata su altri due script di mia creazione che trovate a questi indirizzi:

This script is made for help people with their entry day per dar.

Depending on the position yuo decided (long or short) and whatcing the chart you can be helped by this script "Entrate".

Transparent Green and Orange line are entry points:

long: the entry point will be the transparent orange line, stop loss at red line, tp1 at upper white line and tp 2 at green line.

short: the entry point will be the transparent green line, stop loss at green line, tp1 at lower white line and tp2 at red line.

This simple strategy is based on other 2 script made by me, and you can find at these links:

Buona fortuna e Good Luck!

IndianPivotBoss_ADMIN_NIFTYThis is the Advance Decline Momentum Index for Top 18 stocks of Nifty 50 index.

This is similar to the ADMIN index for Bank Nifty Stocks that is already available for public use.

Top 18 stocks of Nifty contributes more than 70% of Nifty's movement.

The index has the following options :

1) Admin line (shorter momentum ) : By default this is enabled. If it crosses above 50, it indicates upward momentum with stock participation. If it crosses below 50 it indicates downward momentum. Divergence of this indicator Vs price is an excellent advance clue for a possible reversal.

2) Admin line (longer momentum) : This is to be used with respect to S.No. 1. If shorter momentum crosses longer momentum upside, it is an indication of stronger momentum and vice versa.

3) Admin MACD : Upward sloping indicates stronger momentum and downward sloping of histogram lines indicate weaker momentum. Divergence Vs price is an excellent advance clue for a possible reversal.

4) Advance decline line : This is the actual cumulative advance decline line.

5) Advance decline line 200 ema : This is the 200 ema of the advance decline line.