OS AlligatorOS Alligator includes Bill and Justine Williams´ indicators explained both in their "New Trading Dimensions" and "Trading Chaos: Second Edition" books. This script replicates the visual alerts shown on their graphs.

OS Alligator includes:

- Fractals (with labels for easy reading)

- Divergent Bars (signaled by top and bottom triangles)

- Zone bar colors (the bar is green when both AO and AC are green, red when both are red, and black when different)

- Zone buys and sells (subsequent AO of the same color), with letter Z

- Saucer buys and sells, with letter S

- Highest High and Lowest Low tracking (for traling stop setting)

- Balance line (Teeth) crossover alerts

and of course the Alligator's Mouth (Lips, Teeth, Jaw) with SMMA.

All these functions are customizable both in periods and in color. For example if you want to modify the Fractal or HiLo periods you can do so.

You can also add alerts based on any or all indicators.

Thank you for reading. Any comments for improvement are welcome.

-ownsov

Индикаторы Билла Вильямса

Ultimate Buy/Sell IndicatorAn Indicator based on the William Alligator, helping to find suitable entry and exit points.

The Bayesian Q OscillatorFirst of all the biggest thanks to @tista and @KivancOzbilgic for publishing their open source public indicators Bayesian BBSMA + nQQE Oscillator. And a mighty round of applause for @MarkBench for once again being my superhero pinescript guy that puts these awesome combination Ideas and ES stradegies in my head together. Now let me go ahead and explain what we have here.

I am gonna call it the Bayesian Q Oscillator I suppose. The goal of the script is to solve an issue both indicators on their own suffer from. QQE signals are not new and often the problem has always been false signals for them. They are good for scalping but the difference between a quality move and a small to nearly nonexistent move following a signal is not so clear. Kivanc made his normalized version to help reduce this problem by adding colors to his histogram type verision that would essentially represent if price was a trending move or in a ranging structure. As you can see I have kept this Idea but instead opted for lines as the oscillator. two yellow line (default color) is a ranging sideways area and when there is red or green it is trending up or down. I wanted to take this to the next level with combining the Bayesian probability oscillator that tista put together.

The Bayesian indicator is the opposite for its issue as it is a probability indicator that shows which candle or price movement is more likely to come next. Red rising means possibly down move soon and green means up soon. I will not go into the complex details of this indicator but will suggest others take a look at his and others to understand the idea behind them. The point I am driving at is that it show probabilities or likelyhood without the most effecient signal device to match it. This original was line form and now it is background filled colors.

The idea. is that you can potentially get some stronger and more accurate reversal signals with these two paired together. when you see a sell signal or cross with the towering or rising red... maybe it is a good jump potentially. The same for green. At the same time it is a double added filter effect from just having yellow represent it is ranging... but now if you get a buy signal (example) and have yellow lines (example) along wi5h a red rising or mountain color background... it not only is an indication of ranging, but also that there is potentially even a counter move coming based on the probabilities. Also if you get into a good trade and see dual yellow qqe crosses with no color represented by the bayesian background... it is possible it might only be noise.

I have found them to work decently in the 1 hour timframe. Let me know your experience.

I hope everyone takes a look at the originals to understand them. Full credit goes to those guys for this to be here. Let me know how it is working out for you.

Here are the original links.

bayesian

Normalized QQE

[blackcat] L1 Enhanced Awesome OscillatorLevel: 1

Background

The awesome oscillator is just that, an oscillator by Bill Williams. In contrast to the slow stochastics, which ranges from +100 to -100, the fantastic oscillator is limitless. On the surface, one might think that the fantastic oscillator is made up of a complicated algorithm developed by a Whiz Kid from M.I.T. You will be surprised to learn that the indicator is a basic calculation of two simple moving averages. I made some improvements on it by introducing some novel moving average functions and choppiness index as L1 Enhanced Awesome Oscillator.

Function

Yellow bars for bull and fuchsia bars for bear with candles. Buying and selling signal is provided. Divergence signal is provided. Choppiness index is used as a green background color, which indicates trends when it under green color. The choppiness index is used to filter out entry signals.

Key Signal

yellow candle --> bull

fuchsia candle --> bear

yellow DIV label --> bottom divergence

fuchsia DIV label --> top divergence

red SELL label --> short entry

green BUY label --> long entry

Remarks

Feedbacks are appreciated.

Readme

In real life, I am a prolific inventor. I have successfully applied for more than 60 international and regional patents in the past 12 years. But in the past two years or so, I have tried to transfer my creativity to the development of trading strategies. Tradingview is the ideal platform for me. I am selecting and contributing some of the hundreds of scripts to publish in Tradingview community. Welcome everyone to interact with me to discuss these interesting pine scripts.

The scripts posted are categorized into 5 levels according to my efforts or manhours put into these works.

Level 1 : interesting script snippets or distinctive improvement from classic indicators or strategy. Level 1 scripts can usually appear in more complex indicators as a function module or element.

Level 2 : composite indicator/strategy. By selecting or combining several independent or dependent functions or sub indicators in proper way, the composite script exhibits a resonance phenomenon which can filter out noise or fake trading signal to enhance trading confidence level.

Level 3 : comprehensive indicator/strategy. They are simple trading systems based on my strategies. They are commonly containing several or all of entry signal, close signal, stop loss, take profit, re-entry, risk management, and position sizing techniques. Even some interesting fundamental and mass psychological aspects are incorporated.

Level 4 : script snippets or functions that do not disclose source code. Interesting element that can reveal market laws and work as raw material for indicators and strategies. If you find Level 1~2 scripts are helpful, Level 4 is a private version that took me far more efforts to develop.

Level 5 : indicator/strategy that do not disclose source code. private version of Level 3 script with my accumulated script processing skills or a large number of custom functions. I had a private function library built in past two years. Level 5 scripts use many of them to achieve private trading strategy.

Market Cap - simpleThis is a simple market cap indicator . it allows you to see the actual market cap of a stock, live, on the chart, right next to the stock price.

The indicator uses the data provided by Tradingview to calculate the market cap based on the simple calculation of outstanding shares times the price, at any given time.

The indicator can be used to compare the actual value of a stock at different times when sometimes you might discover that the market cap when the price is low is actually higher than the market cap when the price was high. That scenario might happen when the amount of outstanding shares has been changed as time goes by.

That conclusion is another nice benefit to having the indicator, on top of just having the Market Cap right in front of your eyes, always up-to-date, changing as the price is changing as well.

transparency= the higher the value, the more transparent the indicator will be. this feature allows you to see the indicator if you want to, but not letting it interrupting your chart.

Hope you enjoy it and good luck!

Awesome Oscillator & MACD Cross TacticOscillator for Tradingview based on MACD and Awesome Oscillator. This oscillator is designed to identify potential local growth or decline in prices as part of a trend movement.

For some ridiculous reason I am not allowed to attach screenshots of graphs and links on TradingView, so I hope that you will find my detailed instructions on my github page: github.com/samgozman/AO-MACD-cross-tradingview

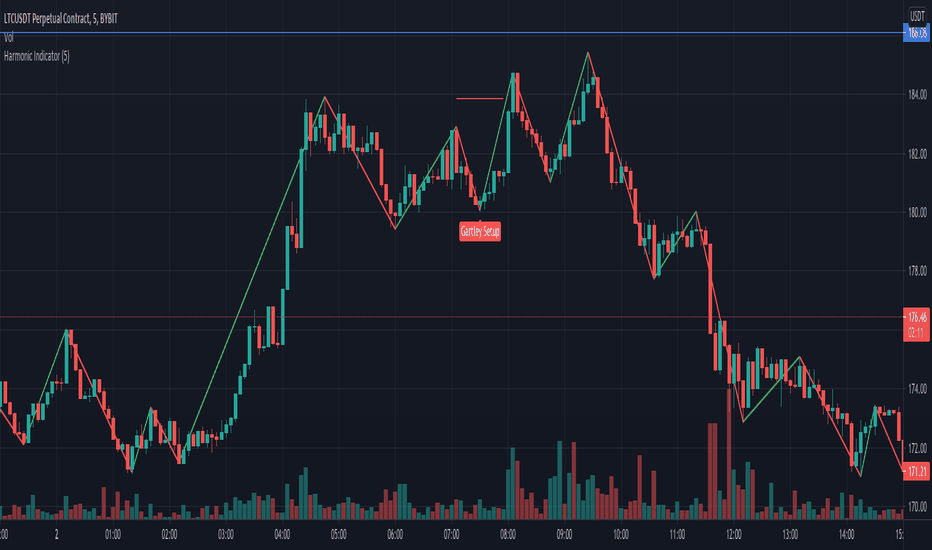

Harmonic IndicatorThis indicator finds all of the gartley and cypher patterns on anychart and personally I have been using them profitably with BTC, ETH, and LTC. It includes entry points for both patterns but not TP levels, that is up to you to do research on. In version 2 I am working on this, if any of you can help me with that, it would be appreciated. Goodluck!

YouKnowTheVibesThis is mainly used for trading binary options but can be used for regular forex trading as well. If price is above BOTH EMAs and PSAR then you're looking for BUY opportunities. If price is below then you're looking for sell opportunities. Wait for price to break the most recent fractal high/low and retest; wait for a confirmation candle then enter a call/put and the expiry time is THREE candles.

Vix SpikeThis script calculates spikes Vix tops and bottoms. The Vix Market Bottom is calculated using CM_Williams_Vix_Fix Finds Market Bottoms (Chris Moody). The Vix Market Top is calculated as the inverse of CM Williams’ formula.

The highest Vix Bottom and the highest Vix Top are averaged (over the Highest Vix Lookback period).

Buys are signaled when the Vix Bottom line crosses below the Highest Vix Average.

Sells are signaled when the Vix Top line crosses below Highest Vix Average.

BINANCE:ETHUSDT 5 min

BYBIT:XRPUSD 5 min

Technical checklistNo one indicator is perfect. People always have their favorite indicators and maintain a bias on weighing them purely on psychological reasons other than mathematical. This technical checklist indicator collected 20 common indicators and custom ones to address the issue of a bias weighted decision.

Here, I apply machine learning using a simple sigmoid neuron network with one hidden layer and a single node to avoid artifacts. For the ease of data collection, the indicator matrix is first shown as a heatmap. Once an uptrend signal window is selected manually, an indicator matrix can be recorded in a binary format (i.e., 1 0 0 1 1 0, etc.).

For example, the following indicator matrix was retrieved from the MRNA chart (deciscion: first 5 rows, buying; last 5 rows, no buying):

1 1 0 0 0 1 1 1 1 1 0 1 0 0 1 1 0 1 1 1

1 1 0 0 1 1 1 0 0 0 1 0 1 1 0 1 0 1 1 1

0 0 1 1 0 1 0 0 0 1 1 1 0 0 1 0 0 1 0 0

1 1 0 0 0 1 1 1 1 1 1 0 1 0 0 1 0 1 0 0

0 0 1 1 0 1 1 1 0 1 1 1 0 1 1 1 0 1 0 0

1 1 0 0 1 0 1 0 0 0 0 1 0 0 0 1 0 0 1 1

1 1 0 0 0 0 1 0 0 0 0 1 0 0 1 1 0 1 1 1

0 0 0 0 1 0 1 0 0 1 1 0 0 0 0 0 0 1 0 0

0 0 0 0 0 0 1 0 0 0 1 0 0 1 0 0 0 1 1 1

0 0 0 0 1 0 1 0 0 0 1 0 1 0 0 0 0 1 1 1

This matrix is then used as an input to train the machine learning network. With a correlated buying decision matrix as an output:

1

1

1

1

1

0

0

0

0

0

After training, the corrected weight matrix can be applied back to the indicator. And the display mode can be changed from a heatmap into a histogram to reveal buying signals visually.

Usage:

python stock_ml.py mrna_input.txt output.txt

Weight matrix output:

1.37639407

1.67969656

1.0162141

1.3184323

-1.88888442

8.32928588

-5.35777295

3.08739916

3.06464844

0.82986227

-0.53092333

-1.95045383

4.14441698

2.99179435

-0.08379438

1.70379704

0.4173048

-1.51870972

-2.14284707

-2.08513252

Corresponding indicators to the weight matrix:

1. Breakout

2. Reversal

3. Crossover of ema20 and ema60

4. Crossover of ema20 and ema120

5. MACD golden cross

6. Long cycle (MACD crossover 0)

7. RSI not overbought

8. KD not overbought and crossover

9. OBV uptrend

10. Bullish gap

11. High volume

12. Breakout up fractal

13. Rebounce of down fractal

14. Convergence

15. Turbulence reversal

16. Low resistance

17. Bullish trend (blue zone)

18. Bearish trend (red zone)

19. VIX close above ema20

20. SPY close below ema20

PS. It is recommended not to use default settings but to train your weight matrix based on underlying and timeframe.

Breach v3 BetaThis is a script that allows you to toggle multiple indicators related to support and resistance, CCI, and Breaches (Crossovers based on William's Fractals).

How to use:

Custom Timeframe (Minutes) - To compare to current candles

Crossovers on custom - Crossovers and breaches on custom timeframe (Blue Triangle up)

Crossunders on custom - Crossunders and breaches on custom timeframe (Blue Triangle down)

Crossovers on current candles - Crossovers and breaches on current timeframe/Candlestick (Purple Triangle up)

Crossunder on current candles - Crossunders and breaches on current timeframe/Candlestick (Purple Triangle down)

CCI - CCI Trend indicator (red/green dots)

CCI - window - Input CCI window size in candlesticks (Integer)

Resistance on current candles - Resistance on current candles (Green Line)

Support on current candles - Support on current candles (Red Line)

Resistance - Custom - Resistance line based on Custom Timeframe (Blue Line)

Support - Custom - Support line based on Custom Timeframe (Purple Line)

Price on current support/resistance - Label displaying the price of current (candlestick) support/resistance

Price on custom support/resistance - Label displaying the price of custom (Custom Timeframe) support/resistance

FractalThis fractal indicator provides fractal support and resistance together with other integrated features, such as short-, mid-, and long-term SMA and EMA lines, color code for bullish and bearish candles, and showing closing price to length for planning future trend scenarios.

Using fractal support and resistance and a triple moving average trading system helps traders identify better trade signals.

Click on Settings to select indicators for those features. The default setting is showing all.

GBP/JPY Daily time FX Strategy ATR W% BaselineThis is a preety good strategy suited for long term trading.

It has been adapted and optimized in this case for GBP/JPY 1D time frame.

Its made of Kiojun baseline, together with ATR for stop loss and size calculation and Williams % R

For the purpose of this example we simulate that we have a leverage of 100x in order to be able to buy the ammount of lots required for our stop loss to be in same page with the risk % of our capital.

For entry we have for long, ascending R in the last 2 candles and crossover of close with KIOJUN baseline. For short the same but in reverse.

We exit if we reach the TP -100 points in this example, or SL , which is based on ATR of the last x days.

If you have any questions feel free to write me in private !

2B detector betaIdentifying a trend reversal is practically tricky, given that price movement is somewhat unpredictable and mostly obeys a power law. In which the price difference is primarily out of normal distribution. According to Benoit Mandelbrot, the price distribution follows an alpha-stable distribution with α equal to 1.7.

Real data observation suggests that stock prices do not follow the Random Walk Hypothesis or Brownian motion. Instead, they follow a fractal pattern. Fractals exhibit similar patterns at different scales called self-similarity. Using this character, one can develop fractal patterns to identify local highs and local lows.

This indicator identifies the reversal signal so-called 2B base on the following logic:

1. Identify local highs and local lows with fractals

2. Define relative positions of those local highs and lows (ABC and 2B)

3. Define the local range of ABC and B

Disclaimer: This indicator is only for research purposes. Please do not take it as investing or trading advice.

RSI of Ultimate Oscillator [SHORT Selling] StrategyThis is SHORT selling strategy with Ultimate Oscillator. Instead of drectly using the UO oscillator , I have used RSI on UO (as I did in my previous strategies )

Ultimator Oscillator settings are 5, 10 and 15

RSI of UO setting is 5

Short Sell

==========

I have used moving averages from WilliamAlligator indicator --- settings are 10(Lips), 20(teeth) and 50 (Jaw)

when Lips , Teeth and Jaw are aligned to downtrend (that means Lips < Teeth < Jaw )

Look for RSIofUO dropping below 60 ( setting parameter is Sell Line )

Partial Exit

==========

When RSIofUO crossing up Oversold line i.e 30

Cover Short / Exit

=================

When RSIofUO crosisng above overbought line i.e 70

StopLoss

========

StopLoss defaulted to 3 % , Though it is mentioned in settings , it has not been not used to calcuate and StopLoss Exit... Reason is, when RSIofUO already crossed 60 line (for SHORTING) , then it would take more efforts go up beynd 60. There is saying price takes stairs to climb up but it takes elevator to go down. I have not purely depend on this to exit stop loss, however noticed the trades in this stratgey did not get out with loss higher than when RSIofUO reaching 70 level.

Note

======

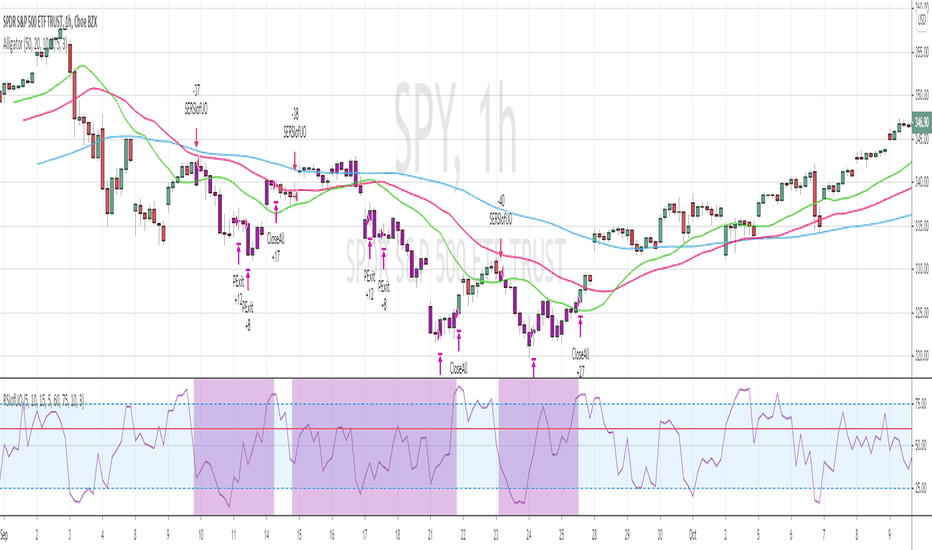

Williams Alligator is not drawn from the script. It is manually added to chart for illustration purpose. Please add it when you are using this strategy , whch woould give an idea how the strategy is taking Short Trades.

This is tested on Hourly chart for SPY

Bar color changes to purple when the strategy is in SHORT trade

Warning

========

For the eductional purposes only

Divergent Bars[Salty]Updated an existing Divergent Bar script to be able to show all divergent bars. There are 2 set of divergent bars that can be turned on. The original one based on price and alligator lines, and a new second one that shows ALL divergent bars. The second set has lighter lines and colors to differentiate them from the filtered alligator divergent bars.

William %R Scalper for GoldWilliam %R Scalper or WPR Scalper tool is used with small time frame : 5 , 3 or 1 minute, it uses two different William %R indicators : one for fast move with 9 period WPR9 and one slow with 54 period WPR54. You can find buy zone when WPR9 < -90 and WPR54 < -80 and sell zone when WPR9 > -10 AND WPR54 > -20. For experience user only you can adapt the two periods and threshold levels to your need. You can use only WPR9 to place trade and validate trend with WPR54.

Zalligator - Zero-Lag Alligator IndicatorI applied the zero-lag moving average theory to the Alligator Indicator. It seems like some different rules would would be required versus the traditional Alligator. Let me know what you think!

Multi StrategyDuring the course of a trade, we can find ourselves changing strategies depending on the market. Instead of using many different templates, I have a simple indicator that clearly says "Buy", "Sell" or "Stay Out". The great thing about this approach, is we instantly observe the majority are in agreement and that decides which way to place our trade.

This indicator includes the following strategies:

- QQE

- Ichimoku using much faster settings.

- Parabolic SAR

- Supertrend

- TTM Oscillator

- The Squeeze strategy

- The Alligator Strategy

Using this indicator is simple, if the lines are mainly green then buy, if mainly red then sell OR don't trade. So...

Green Line - This strategy is in a buy position

Orange or Black Line - This strategy is undecided

Red Line - This strategy is in a sell position

There are also some green and red circles for reference that appear showing when that bar has broken through the Ichimoku cloud.

The trader's approach is simple, when all indicators are green or red, then take the trade. As soon as one indicator changes, then re-evaluate using your normal process, such as price action, to determine whether to close the trade or continue.

I can customise this further or add other strategies, please message me.

[SCL] Bitcoin Hashrate Dips (Miner Capitulation)Gives long-term buy signals for Bitcoin from dips and recoveries in the hashrate (the "miner capitulation" theory). It has an overlay and a standalone mode and is fully configurable. It uses Williams Lows and ATR instead of moving averages.

Features that might be interesting for Pinescripters:

+ Automatic (as far as is possible currently) adjustment of plots for overlay and standalone display modes.

+ A neat label function for debugging floats

+ Fully commented

+ The debug that I used to overcome problems in developing it is left in

+ Ideas for how to deal with a wildly oscillating and exponentially increasing data source

You need to run this indicator on the Bitcoin daily chart for it to make any sense. The best is a BTC/USD chart with a long history, such as BNC:BLX.

Trend LineBasic Trend Line base on fractals (v0.1)

Can not draw a line on the future X axis, So just a line segment but not a ray.

I don't have a better idea to upgrade...

Williams Fractals with Alerts by MrTuanDoanCustom William Fractals for alerts and educational purpose.

Added custom alerts for Williams Fractals.

Also added filter to show less fractals on chart.

The simple idea how I use fractals in Binary Option is to determine temporary resistance and support.

Simple strategy:

- Mark Resistance/Support on higher time frame (e.g. 5M)

- Set an alert for new fractal

- Whenever a new fractal that appears close to your marked Resistance/Support, go to lower time frame (e.g. 1M)

- Wait for rejection at the level that lower than new down fractal (or higher than new up fractal).

- Enter with the same expiry of lower time frame.

Good luck and happy trading. :-)