IO_William's Variable Accumulation DistributionThis is an academic version of William's Variable Accumulation Distribution(WVAD) smoothed with a weighted moving average for measuring correlation of price with intraday volume

Индикаторы Билла Вильямса

Wisemen Bill Ali Williams v3Use 2 timeframe:

Current timeframe + configurable timeframe (default: 6hours)

Get resistance & support for both timeframe.

Entry when breakout both resistance or both support

For donations

BTC: 3E7rUPX7upS8iTj42JdLt7keJVbJLfvMoH

ETH: 0x094ed88e4c5a9b225e936586cbc2d61f4a027f68

Thank you & happy trading!

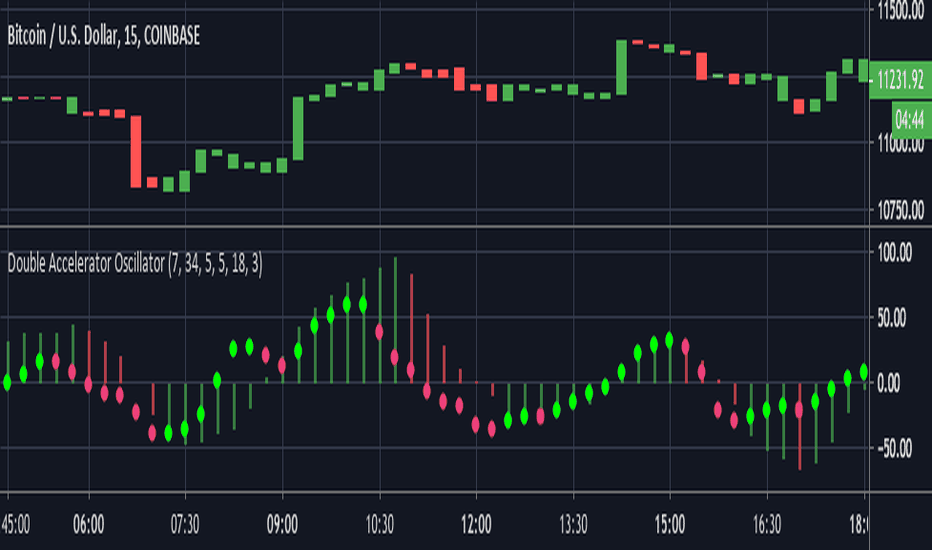

Double Accelerator OscillatorThis is a modified version of Bill Williams' Accelerator. The Accelerator measures the difference between the Awesome Oscillator(another Williams indicator) and its 5 day SMA.

This script plots 2 accelerators rather than 1. Users can define the lengths of the fast and slow SMA's used in the Awesome Oscillator calculation by adjusting the options in the input menu.

We set the default the lengths of the fast and slow SMA's used in the first Awesome Oscillator calculation as 34 and 7 periods. Then to find the Accelerator Oscillator, the difference between the Awesome Oscillator and its 7 period SMA is calculated. The second Accelerator uses shorter window lengths than the first. The fast SMA length is 5 by default and the slow SMA length is 18. Finally, the length of the Awesome Oscillator SMA used to calculate the second Accelerator Oscillator is 3.

By utilizing two Accelerator Oscillators with increasingly shorter window lengths, this indicator identifies changes in momentum very well.

The red and green histogram represents the first Accelerator Oscillator. It is green when the Accelerator is increasing and red when it is decreasing. I found this layout to be more practical than the standard, which plots the AC as green when it is greater than 0 and red when less than zero. The second Accelerator Oscillator is plotted as the bright green and pink circle line. It uses the same coloring conditions as above.

Bill Williams Chaos TheoryBill Williams Chaos Theory

- Alligator

- Fractals

- Accelerator Decelerator Oscillator

- Market Facilitation Index

Combining all of that to generate signal long or short.

Long entry when long signal appears.

Short entry when short signal appears.

For donations

BTC: 3E7rUPX7upS8iTj42JdLt7keJVbJLfvMoH

ETH: 0x094ed88e4c5a9b225e936586cbc2d61f4a027f68

Thank you & happy trading!

Williy CRIThis idea I got from rationalinvestor.com . SELL when you see overbought with MACD confirming bearish divergences and buywhen you see oversold with MACD confirming bullish divergences.

Sinyal GhoibLeading Signal!!!

Long entry while long signal appears.

Short entry while short signal appears.

This signal only effective on BitMex | 5m | XBTUSD.

Take profit: 0,6% from entry price

Stop loss: 0,6% from entry price

Leverage: 10x - 50x

For donation

BTC: 3E7rUPX7upS8iTj42JdLt7keJVbJLfvMoH

ETH: 0x094ed88e4c5a9b225e936586cbc2d61f4a027f68

BitMex Referral: P81ZCO

Thank you & happy trading!

Support/Resistance x3Support and Resistance Levels for 3 time frames, based on volume at fractal levels

Original script is thanks to synapticex I have just migrated to version 3 and heavily modified it

Fractal Regression Channel V0.1Port of @RicardoSantos' Fractal Regression Channel V0 from pinescript 2 to pinescript 3.

// Source:

// Original Author: @RicardoSantos

Willams %R with 13 EMA and 13 SMAThis is standard Williams %R originally written by another user that I modified. Credit to him whose name escapes me at the moment. The green line is 13EMA and red line is 13SMA (offset by 2 for timing trades). Great for very quick trades/day trades. Green over red = long. Red over Green = short.

Beware: this is still a choppy indicator. You'll need to use it with the Ichimoku lagging span, chop indiicator, adx, or some other method of avoiding getting chopped to death trying to take every signal.

Awesome Oscillator and MACD Histogram by SierraPilot (Lemrin)This is an indicator I stole from Lemrin. I added the plots for the MACD line and the Signal line and also changed the AO and MACD histo to an area plot. MACD = red and green. AO = blue and yellow. Green over top of Blue = possible reversal. Green overlaid over blue = uptrend. Yellow over top of Red = downside reversal possible. Yellow overlaid over Red = downtrend in progress. MACD and Signal line behave normally. Thanks to Lemrin for the majority of the code.

STPatterns fractalsModified fractals using 1 candle on both side as mentioned by the strategies from stpatterns.com

Market Type IdentifierHelps to evaluate if a market is crypto, forex or stocks. Useful if you want to use specific Ichimoku settings or certain moving averages without having to manually change the settings. This is mostly provided for other Pinescript coders, so will not be useful as a standalone indicator

Williams_proGO_PRICEVersione rivisitata del Williams ProGo che risulta essere direttamente sul grafico principale con aggiunta

delle medie classiche per controllo golden cross ed anche una serie di calcoli visibili nella finestra dati per il posizionamento

dei livelli stop loss e take profit calcolati con un atr

Market Facilitation Index - MFIUsing Market Facilitation Index - MFI you will be able to recognise two important metrics:

Whether the current trend is strong enough to trade it.

When a new trend may start.

MFI combines changes in price (range) and volume. Here is the formula:

MFI = (High – Low) * Volume

The indicator has bars of four colours. Each colour has a specific meaning and shows how the market responds to a change in volume.

Green. A green bar forms in the situation that both MFI and the volume are up. It means that more and more traders join the market in the current direction. In other words, it points to a strong trend, so you can open trades in line with this trend.

Brown. A brown bar appears when both MFI and the volume decline. It is also called “fade”. It signals that traders are hesitating and don’t want to continue the trend anymore. As a result, it’s not recommended to join the trend. Several brown bars are a sign of the potential reversal of the trend.

Blue. A blue bar forms when MFI increases, but the volume declines. A spike in price may be short-lived a precede a change in the trend. Blue bars appear at the times when newbies enter the trend, but professional traders know that it’s already too dangerous.

Pink. A pink bar, also known as squat, appears when MFI is diminishing, but the volume is growing. It reflects an increase of trading interest and an active fight between buyers and sellers. After one of the sides wins, the price will likely make a big move breaking support or resistance levels. The MFI, however, can’t be used to determine the direction of the breakout.

Momentum & Williams %R This strategy join 2 power study indicators on the same plot: Willian %R and Momentum.

Willian %R can indicate the good time for you buy or sale. Less than -80 indicate good buying opportunity . Greater than -20 good sale opportunity.

Momentum can indicate the good price for buy or sale, in other words, can indicate the speed the price goes down or goes up.

By Baldasso, March 2019.

FRACHTALS"FRACHTALS" - A practical example of taking a joke entirely way, way too far

Speaking of which - Moon when?

#REKT

Credits/Acknowledgements/References:

Fractal detection + other functions (@RicardoSantos)

Laguerre RSI w/ self-Adjusting Alpha (@everget)