Close Price PercentileClose Price Percentile with Range Distribution

This indicator helps traders identify where the current price stands relative to its historical context using percentile ranking. It calculates and displays the current price's percentile position within a customizable lookback window (default: 365 periods).

Key Features:

• Percentile Ranking: Shows where the current price falls within its historical range (0-100%)

• Customizable Thresholds: Set your own high/low percentile boundaries for analysis

• Statistical Distribution: Tracks and displays the number and percentage of data points falling in each range (below threshold, between thresholds, above threshold)

• Visual References: Includes dashed lines at threshold levels for easy visual reference

• Clean Data Presentation: Organized table display in the top-right corner

Perfect for:

• Understanding price extremes

• Identifying potential overbought/oversold conditions

• Statistical analysis of price movements

• Mean reversion strategies

Fully customizable with adjustable window length, thresholds, and visual settings.

Полосы и каналы

SessionRangeLevels_v0.1SessionRangeLevels_v0.1

Overview:

SessionRangeLevels_v0.1 is a customizable Pine Script (v6) indicator designed to plot key price levels based on a user-defined trading session. It identifies the high and low of the session and calculates intermediate levels (75%, 50% "EQ", and 25%) within that range. These levels are projected forward as horizontal lines with accompanying labels, providing traders with dynamic support and resistance zones. The indicator supports extensive customization for session timing, time zones, line styles, colors, and more.

Key Features:

Session-Based Range Detection: Tracks the high and low prices during a specified session (e.g., 0600-0900) and updates them dynamically as the session progresses.

Customizable Levels: Displays High, 75%, EQ (50%), 25%, and Low levels, each with independent toggle options, styles (Solid, Dashed, Dotted), colors, and widths.

Session Anchor: Optional vertical line marking the session start, with customizable style, color, and width.

Projection Offset: Extends level lines forward by a user-defined number of bars (default: 24) for future price reference.

Labels: Toggleable labels for each level (e.g., "High," "75%," "EQ") with adjustable size (Tiny, Small, Normal, Large).

Time Zone Support: Aligns session timing to a selected time zone (e.g., America/New_York, UTC, Asia/Tokyo, etc.).

Alert Conditions: Triggers alerts when the price crosses any of the plotted levels (High, 75%, EQ, 25%, Low).

Inputs:

Session Time (HHMM-HHMM): Define the session range (e.g., "0600-0900" for 6:00 AM to 9:00 AM).

Time Zone: Choose from options like UTC, America/New_York, Europe/London, etc.

Anchor Settings: Toggle the session start line, adjust its style (default: Dotted), color (default: Black), and width (default: 1).

Level Settings:

High (Solid, Black, Width 2)

75% (Dotted, Blue, Width 1)

EQ/50% (Dotted, Orange, Width 1)

25% (Dotted, Blue, Width 1)

Low (Solid, Black, Width 2)

Each level includes options to show/hide, set style, color, width, and label visibility.

Projection Offset: Number of bars to extend lines (default: 24).

Label Size: Set label size (default: Small).

How It Works:

The indicator detects the start and end of the user-defined session based on the specified time and time zone.

During the session, it tracks the highest high and lowest low, updating the levels in real-time.

At the session start, it plots the High, Low, and intermediate levels (75%, 50%, 25%), projecting them forward.

Lines and labels dynamically adjust as new highs or lows occur within the session.

Alerts notify users when the price crosses any active level.

Usage:

Ideal for traders who focus on session-based strategies (e.g., London or New York open). Use it to identify key price zones, monitor breakouts, or set targets. Customize the appearance to suit your chart preferences and enable alerts for real-time trading signals.

Notes:

Ensure your chart’s timeframe aligns with your session duration for optimal results (e.g., 1-minute or 5-minute charts for short sessions).

The indicator overlays directly on the price chart for easy integration with other tools.

Dynamic Momentum Bands | AlphaAlgosDynamic Momentum Bands | AlphaAlgos

Overview

The Dynamic Momentum Bands indicator is an advanced technical analysis tool that combines multiple analytical techniques to provide a comprehensive view of market momentum and trend dynamics. By integrating RSI (Relative Strength Index), volatility analysis, and adaptive moving averages, this indicator offers traders a nuanced perspective on market conditions.

Key Features

Adaptive band calculation based on price momentum

Integrated RSI-driven volatility scaling

Multiple moving average type options (EMA, SMA, VWMA)

Smooth, gradient-based band visualization

Optional price bar coloring for trend identification

Technical Methodology

The indicator employs a sophisticated approach to market analysis:

1. Momentum Calculation

Calculates RSI using a customizable length

Uses RSI to dynamically adjust band volatility

Scales band width based on distance from the 50 RSI level

2. Band Construction

Applies a selected moving average type to the price source

Calculates deviation using ATR (Average True Range)

Smooths band edges for improved visual clarity

Configuration Options

Core Settings:

Price Source: Choose the price data used for calculations

RSI Length: Customize the RSI calculation period (1-50)

Band Length: Adjust the moving average period (5-100)

Volatility Multiplier: Fine-tune band width

Band Type: Select between EMA, SMA, and VWMA

Visual Settings:

Bar Coloring: Toggle color-coded price bars

Gradient-based band visualization

Smooth color transitions for trend representation

Trend Identification

The indicator provides trend insights through:

Color-coded bands (blue for bullish, pink for bearish)

Smooth gradient visualization

Optional price bar coloring

Trading Applications

Trend Following:

- Use band position relative to price as trend indicator

- Identify momentum shifts through color changes

- Utilize gradient zones for trend strength assessment

Volatility Analysis:

Observe band width changes

Detect potential breakout or consolidation periods

Use RSI-driven volatility scaling for market context

Best Practices

Adjust RSI length to match trading timeframe

Experiment with different moving average types

Use in conjunction with other technical indicators

Consider volatility multiplier for different market conditions

This indicator is provided for informational purposes only. Always use proper risk management when trading. Past performance is not indicative of future results. Not financial Advise

Multi-Anchored Linear Regression Channels [TANHEF]█ Overview:

The 'Multi-Anchored Linear Regression Channels ' plots multiple dynamic regression channels (or bands) with unique selectable calculation types for both regression and deviation. It leverages a variety of techniques, customizable anchor sources to determine regression lengths, and user-defined criteria to highlight potential opportunities.

Before getting started, it's worth exploring all sections, but make sure to review the Setup & Configuration section in particular. It covers key parameters like anchor type, regression length, bias, and signal criteria—essential for aligning the tool with your trading strategy.

█ Key Features:

⯁ Multi-Regression Capability:

Plot up to three distinct regression channels and/or bands simultaneously, each with customizable anchor types to define their length.

⯁ Regression & Deviation Methods:

Regressions Types:

Standard: Uses ordinary least squares to compute a simple linear trend by averaging the data and deriving a slope and endpoints over the lookback period.

Ridge: Introduces L2 regularization to stabilize the slope by penalizing large coefficients, which helps mitigate multicollinearity in the data.

Lasso: Uses L1 regularization through soft-thresholding to shrink less important coefficients, yielding a simpler model that highlights key trends.

Elastic Net: Combines L1 and L2 penalties to balance coefficient shrinkage and selection, producing a robust weighted slope that handles redundant predictors.

Huber: Implements the Huber loss with iteratively reweighted least squares (IRLS) and EMA-style weights to reduce the impact of outliers while estimating the slope.

Least Absolute Deviations (LAD): Reduces absolute errors using iteratively reweighted least squares (IRLS), yielding a slope less sensitive to outliers than squared-error methods.

Bayesian Linear: Merges prior beliefs with weighted data through Bayesian updating, balancing the prior slope with data evidence to derive a probabilistic trend.

Deviation Types:

Regressive Linear (Reverse): In reverse order (recent to oldest), compute weighted squared differences between the data and a line defined by a starting value and slope.

Progressive Linear (Forward): In forward order (oldest to recent), compute weighted squared differences between the data and a line defined by a starting value and slope.

Balanced Linear: In forward order (oldest to newest), compute regression, then pair to source data in reverse order (newest to oldest) to compute weighted squared differences.

Mean Absolute: Compute weighted absolute differences between each data point and its regression line value, then aggregate them to yield an average deviation.

Median Absolute: Determine the weighted median of the absolute differences between each data point and its regression line value to capture the central tendency of deviations.

Percent: Compute deviation as a percentage of a base value by multiplying that base by the specified percentage, yielding symmetric positive and negative deviations.

Fitted: Compare a regression line with high and low series values by computing weighted differences to determine the maximum upward and downward deviations.

Average True Range: Iteratively compute the weighted average of absolute differences between the data and its regression line to yield an ATR-style deviation measure.

Bias:

Bias: Applies EMA or inverse-EMA style weighting to both Regression and/or Deviation, emphasizing either recent or older data.

⯁ Customizable Regression Length via Anchors:

Anchor Types:

Fixed: Length.

Bar-Based: Bar Highest/Lowest, Volume Highest/Lowest, Spread Highest/Lowest.

Correlation: R Zero, R Highest, R Lowest, R Absolute.

Slope: Slope Zero, Slope Highest, Slope Lowest, Slope Absolute.

Indicator-Based: Indicators Highest/Lowest (ADX, ATR, BBW, CCI, MACD, RSI, Stoch).

Time-Based: Time (Day, Week, Month, Quarter, Year, Decade, Custom).

Session-Based: Session (Tokyo, London, New York, Sydney, Custom).

Event-Based: Earnings, Dividends, Splits.

External: Input Source Highest/Lowest.

Length Selection:

Maximum: The highest allowed regression length (also fixed value of “Length” anchor).

Minimum: The shortest allowed length, ensuring enough bars for a valid regression.

Step: The sampling interval (e.g., 1 checks every bar, 2 checks every other bar, etc.). Increasing the step reduces the loading time, most applicable to “Slope” and “R” anchors.

Adaptive lookback:

Adaptive Lookback: Enable to display regression regardless of too few historical bars.

⯁ Selecting Bias:

Bias applies separately to regression and deviation.

Positive values emphasize recent data (EMA-style), negative invert, and near-zero maintains balance. (e.g., a length 100, bias +1 gives the newest price ~7× more weight than the oldest).

It's best to apply bias to both (regression and deviation) or just the deviation. Biasing only regression may distort deviation visually, while biasing both keeps their relationship intuitive. Using bias only for deviation scales it without altering regression, offering unique analysis.

⯁ Scale Awareness:

Supports linear and logarithmic price scaling, the regression and deviations adjust accordingly.

⯁ Signal Generation & Alerts:

Customizable entry/exit signals and alerts, detailed in the dedicated section below.

⯁ Visual Enhancements & Real-World Examples:

Optional on-chart table display summarizing regression input criteria (display type, anchor type, source, regression type, regression bias, deviation type, deviation bias, deviation multiplier) and key calculated metrics (regression length, slope, Pearson’s R, percentage position within deviations, etc.) for quick reference.

█ Understanding R (Pearson Correlation Coefficient):

Pearson’s R gauges data alignment to a straight-line trend within the regression length:

Range: R varies between –1 and +1.

R = +1 → Perfect positive correlation (strong uptrend).

R = 0 → No linear relationship detected.

R = –1 → Perfect negative correlation (strong downtrend).

This script uses Pearson’s R as an anchor, adjusting regression length to target specific R traits. Strong R (±1) follows the regression channel, while weak R (0) shows inconsistency.

█ Understanding the Slope:

The slope is the direction and rate at which the regression line rises or falls per bar:

Positive Slope (>0): Uptrend – Steeper means faster increase.

Negative Slope (<0): Downtrend – Steeper means sharper drop.

Zero or Near-Zero Slope: Sideways – Indicating range-bound conditions.

This script uses highest and lowest slope as an anchor, where extremes highlight strong moves and trend lines, while values near zero indicate sideways action and possible support/resistance.

█ Setup & Configuration:

Whether you’re new to this script or want to quickly adjust all critical parameters, the panel below shows the main settings available. You can customize everything from the anchor type and maximum length to the bias, signal conditions, and more.

Scale (select Log Scale for logarithmic, otherwise linear scale).

Display (regression channel and/or bands).

Anchor (how regression length is determined).

Length (control bars analyzed):

• Max – Upper limit.

• Min – Prevents regression from becoming too short.

• Step – Controls scanning precision; increasing Step reduces load time.

Regression:

• Type – Calculation method.

• Bias – EMA-style emphasis (>0=new bars weighted more; <0=old bars weighted more).

Deviation:

• Type – Calculation method.

• Bias – EMA-style emphasis (>0=new bars weighted more; <0=old bars weighted more).

• Multiplier - Adjusts Upper and Lower Deviation.

Signal Criteria:

• % (Price vs Deviation) – (0% = lower deviation, 50% = regression, 100% = upper deviation).

• R – (0 = no correlation, ±1 = perfect correlation; >0 = +slope, <0 = -slope).

Table (analyze table of input settings, calculated results, and signal criteria).

Adaptive Lookback (display regression while too few historical bars).

Multiple Regressions (steps 2 to 7 apply to #1, #2, and #3 regressions).

█ Signal Generation & Alerts:

The script offers customizable entry and exit signals with flexible criteria and visual cues (background color, dots, or triangles). Alerts can also be triggered for these opportunities.

Percent Direction Criteria:

(0% = lower deviation, 50% = regression line, 100% = upper deviation)

Above %: Triggers if price is above a specified percent of the deviation channel.

Below %: Triggers if price is below a specified percent of the deviation channel.

(Blank): Ignores the percent‐based condition.

Pearson's R (Correlation) Direction Criteria:

(0 = no correlation, ±1 = perfect correlation; >0 = positive slope, <0 = negative slope)

Above R / Below R: Compares the correlation to a threshold.

Above│R│ / Below│R│: Uses absolute correlation to focus on strength, ignoring direction.

Zero to R: Checks if R is in the 0-to-threshold range.

(Blank): Ignores correlation-based conditions.

█ User Tips & Best Practices:

Choose an anchor type that suits your strategy, “Bar Highest/Lowest” automatically spots commonly used regression zones, while “│R│ Highest” targets strong linear trends.

Consider enabling or disabling the Adaptive Lookback feature to ensure you always have a plotted regression if your chart doesn’t meet the maximum-length requirement.

Use a small Step size (1) unless relying on R-correlation or slope-based anchors as the are time-consuming to calculate. Larger steps speed up calculations but reduce precision.

Fine-tune settings such as lookback periods, regression bias, and deviation multipliers, or trend strength. Small adjustments can significantly affect how channels and signals behave.

To reduce loading time , show only channels (not bands) and disable signals, this limits calculations to the last bar and supports more extreme criteria.

Use the table display to monitor anchor type, calculated length, slope, R value, and percent location at a glance—especially if you have multiple regressions visible simultaneously.

█ Conclusion:

With its blend of advanced regression techniques, flexible deviation options, and a wide range of anchor types, this indicator offers a highly adaptable linear regression channeling system. Whether you're anchoring to time, price extremes, correlation, slope, or external events, the tool can be shaped to fit a variety of strategies. Combined with customizable signals and alerts, it may help highlight areas of confluence and support a more structured approach to identifying potential opportunities.

Find Untapped LevelsYou can find your daily, weekly and monthly levels with this indicator. You still need to go through each time frame and draw them yourself

Nasan Ultimate Health Index (NUHI)The Nasan Ultimate Health Index (NUHI) is a technical indicator designed to measure the relative health of a stock compared to a benchmark index or sector. By incorporating price action, volume dynamics, and volatility, NUHI provides traders with a clearer picture of a stock’s performance relative to the broader market.

The NUHI is based on the idea that a stock’s relative strength and momentum can be assessed more effectively when adjusted for volume behavior and benchmark comparison. Instead of looking at price movement alone, this indicator factors in:

The stock’s price trend (via EMA)

Volume participation (green vs. red volume) and volume ratio - SMA(volume, 21)/ SMA(volume, 252)

Volatility-adjusted performance (ATR-based scaling)

Comparison with a selected benchmark (e.g., SPX, NDX, sector ETFs)

This results in a normalized and comparative score that helps traders identify outperforming, neutral, and underperforming stocks within a specific market environment.

The NUHI is constructed using the following elements:

1️⃣ Stock Raw Score (Unadjusted Momentum)

The exponential moving average (EMA) of the hlc3 (average of high, low, close) is used to define the price trend.

The difference between the current EMA and the EMA from n bars ago shows whether the stock is gaining or losing momentum.

This difference is divided by the ATR (Average True Range) to adjust for volatility.

2️⃣ Volume Behavior Adjustment

Volume is split into green volume (up candles) and red volume (down candles).

The ratio of green to red volume determines whether buyers or sellers dominate over the selected period (n bars).

If the stock is in an uptrend, green volume is weighted higher; if in a downtrend, red volume is weighted higher.

The stock’s Volume Ratio (short-term SMA divided by long-term SMA) is adjusted based on this weight.

3️⃣ Benchmark Comparison

A similar Raw Score calculation is performed on the selected benchmark (SPX, NDX, or sector ETF).

Benchmark price movements, volume behavior, and ATR adjustments mirror the stock’s calculations.

This provides a reference point for evaluating the stock’s relative strength.

4️⃣ Normalization Process

Both the stock and benchmark raw scores are min-max normalized over the past 252 bars (1-year lookback).

This scales values between 0 and 1, ensuring fair comparisons regardless of absolute price differences.

5️⃣ NUHI Calculation

The final NUHI value is computed using a logarithmic ratio between the normalized stock score and the normalized benchmark score:

This transformation ensures a more symmetrical representation of overperformance and underperformance.

Performance Zones

Strong Outperforming (NUHI between >0.41 and 0.69)

Leading (NUHI between >0.10 and 0.41)

Transitioning Outperformance (NUHI between 0.10 and 0)

Equilibrium (NUHI 0)

Transitioning Underperformance (NUHI between -0.10 and 0)

Lagging (NUHI between < -0.1 and -0.41)

Strong Underperforming (NUHI between< -0.41 and -0.69 )

How to Use NUHI

✅ Identifying Strong Stocks

If NUHI > 0, the stock is outperforming its benchmark.

If NUHI < 0, the stock is underperforming the benchmark.

✅ Trend Confirmation

A steadily rising NUHI and raw score (colored green) suggests sustained strength bullish conditions.

A falling NUHI and raw score (colored orange) indicates weakness and possible rotation into other assets.

✅ Finding Reversals

Bullish Divergence: If NUHI is improving while the stock’s raw score is negative, it may signal a bottoming opportunity.

Bearish Signs: If NUHI is dropping despite price strength, it could hint at underlying weakness.

Why a Stock in a Downtrend Can Have NUHI > 0 (and Vice Versa )

NUHI measures performance relative to both its own history and the benchmark.

A stock’s recent movement is compared to how it usually behaves and how the benchmark is performing.

Example Scenarios:

Stock in a Downtrend but NUHI > 0

The stock may still be in a downtrend (negative raw score), but it’s performing better relative to its past downtrend behavior and better than the benchmark over the same period.

This could mean it’s showing relative strength compared to the broader market or sector.

Stock in an Uptrend but NUHI < 0

Even in a uptrend (positive raw score), the stock might be underperforming relative to its past uptrend behavior and underperforming the benchmark.

What This Means:

NUHI > 0 in a downtrend → The stock is falling less aggressively than usual and/or holding up better than the benchmark.

NUHI < 0 in an uptrend → The stock is gaining less than expected based on its history and/or lagging behind the benchmark.

NUHI helps identify relative strength or weakness .

Dynamic Heat Levels [BigBeluga]This indicator visualizes dynamic support and resistance levels with an adaptive heatmap effect. It helps traders identify key price interaction zones and potential mean reversion opportunities by displaying multiple levels that react to price movement.

🔵Key Features:

Multi-Level Heatmap Channel:

- The indicator plots multiple dynamic levels forming a structured channel.

- Each level represents a historical price interaction zone, helping traders identify critical areas.

- The channel expands or contracts based on market conditions, adapting dynamically to price movements.

Heatmap-Based Strength Indication:

- Levels change in transparency and color intensity based on price interactions for the length period .

- The more frequently price interacts with a level, the more visible and intense the color becomes.

- When a level reaches a threshold (count > 10), it starts to turn red, signaling a high-heat zone with significant price activity.

🔵Usage:

Support & Resistance Analysis: Identify price levels where the market frequently interacts, making them strong areas for trade decisions.

Heatmap Strength Assessment: More intense red levels indicate areas with heavy price activity, useful for detecting key liquidity zones.

Dynamic Heat Levels is a powerful tool for traders looking to analyze price interaction zones with a heatmap effect. It offers a structured visualization of market dynamics, allowing traders to gauge the significance of key levels and detect mean reversion setups effectively.

RSI-Colored Price Candles with BackgroundThis Pine Script indicator visually enhances price candles based on **RSI (Relative Strength Index)** behavior, helping traders quickly assess momentum directly on the price chart.

**RSI Calculation:**

The RSI is computed using a traditional 14-period lookback. It uses `ta.rma()` to smooth average gains and losses, and then transforms the result into an RSI value between 0 and 100. This value is used to determine both **candle color** and optional **background shading**.

**Candle Coloring:**

Each price candle is recolored based on the current RSI value:

- If RSI is **greater than or equal to 50**, the candle is **bright green**, indicating bullish momentum.

- If RSI is **less than 50**, the candle is **bright red**, indicating bearish momentum.

The actual OHLC values of the candles remain unchanged. Only their color is modified to reflect RSI strength.

**Optional Background Highlighting:**

A user setting called `Show Overbought/Oversold Background` lets traders toggle background shading on or off. When enabled:

- If RSI is **above 70**, a soft **green** background appears, signaling overbought conditions.

- If RSI is **below 30**, a soft **red** background appears, signaling oversold conditions.

This provides an intuitive visual cue that highlights potential reversal or exhaustion zones based on RSI extremes.

**Custom Settings:**

- The RSI length and source are customizable.

- Background highlighting is turned **off by default**, giving users a clean chart unless they choose to enable it.

**Purpose and Use:**

This script is designed for traders who want to visually integrate RSI momentum directly into their chart candles, reducing the need to look away from price action. It's clean, responsive, and adjustable — perfect for intraday or swing traders who value simplicity backed by momentum data.

Dual Keltner Channels Strategy [Eastgate3194]This strategy utilised 2 Keltner Channels to perform counter trade.

The strategy have 2 steps:

Long Position:

Step 1. Close price must cross under Outer Lower band of Keltner Channel.

Step 2. Close price cross over Inner Lower band of Keltner Channel.

Short Position:

Step 1. Close price must cross over Outer Upper band of Keltner Channel.

Step 2. Close price cross under Inner Upper band of Keltner Channel.

Suppot and resistance & BUY SELL SIGNALSThis indicator is highly customizable and suitable for traders of all experience levels. By adjusting the input settings, traders can tailor the indicator to their specific needs and trading strategies.

All Forex Sessions (SAST Accurate) + LabelsFor traders in South Africa

Uses timestamp("Africa/Johannesburg", ...) — this locks the session window to true SAST time

The session now perfectly aligns from 14:00 to 18:00 local time no matter what time zone your TradingView chart is in

Also shows start and end vertical lines only when the session opens and closes

Fib BB on VWMA*ATRThis TradingView Pine Script is designed to plot Fibonacci Bollinger Bands on a Volume Weighted Moving Average (VWMA) using the Average True Range (ATR). The script takes a higher timeframe (HTF) approach, allowing traders to analyze price action and volatility from a broader market perspective.

🔹 How It Works

Higher Timeframe Data Integration

Users can select a specific timeframe to calculate the VWMA and ATR.

This allows for a more macro perspective, avoiding the noise of lower timeframes.

Volume Weighted Moving Average (VWMA)

Unlike the Simple Moving Average (SMA), VWMA gives higher weight to price movements with larger volume.

Calculation Formula:

𝑉𝑊𝑀𝐴=∑(𝐶𝑙𝑜𝑠𝑒×𝑉𝑜𝑙𝑢𝑚𝑒) / ∑𝑉𝑜𝑙𝑢𝑚𝑒

Since VWMA accounts for volume, it is more reactive to price zones with high buying or selling activity, making it useful for identifying liquidity zones.

ATR-Based Fibonacci Bollinger Bands

The Average True Range (ATR) is used to measure market volatility.

Instead of standard deviation-based Bollinger Bands, Fibonacci multipliers (2.618, 3.0, 3.414) are applied to ATR.

These bands adjust dynamically with market volatility.

🔹 Key Findings from Exploration

Through testing and analysis, this indicator seems to effectively detect supply and demand zones, particularly at the Fibonacci levels of 2.618 to 3.414.

Price frequently reacts at these bands, indicating that they capture key liquidity zones.

Potential Order Block Detection:

The ends of the Fibonacci Bollinger Bands (especially at 2.618, 3.0, and 3.414) tend to align with order blocks—areas where institutional traders previously accumulated or distributed positions.

This is particularly useful for order flow traders who focus on unfilled institutional orders.

🔹 How to Use This Indicator?

Identifying Order Blocks

When price reaches the upper or lower bands, check if there was a strong reaction (rejection or consolidation).

If price rapidly moves away from a band, that level might be an order block.

Spotting Liquidity Pools

VWMA’s nature enhances liquidity detection since it emphasizes high-volume price action.

If a price level repeatedly touches the band without breaking through, it suggests institutional orders may be absorbing liquidity there.

Trend Confirmation

If VWMA is trending upwards and price keeps rejecting the lower bands, it confirms a strong bullish trend.

Conversely, constant rejection from the upper bands suggests a bearish market.

This script is designed for open-source publication and offers traders a refined approach to detecting order blocks and liquidity zones using Fibonacci-based volatility bands.

📌 한글 설명 (상세 설명)

이 트레이딩뷰 파인스크립트는 거래량 가중 이동평균(VWMA)과 평균 실제 범위(ATR)를 활용하여 피보나치 볼린저 밴드를 표시하는 지표입니다.

또한, 고차 타임프레임(HTF) 데이터를 활용하여 시장의 큰 흐름을 분석할 수 있도록 설계되었습니다.

🔹 지표 작동 방식

고차 타임프레임(HTF) 데이터 적용

사용자가 원하는 타임프레임을 선택하여 VWMA와 ATR을 계산할 수 있습니다.

이를 통해 더 큰 시장 흐름을 분석할 수 있으며, 저타임프레임의 노이즈를 줄일 수 있습니다.

거래량 가중 이동평균(VWMA) 적용

VWMA는 단순 이동평균(SMA)보다 거래량이 많은 가격 움직임에 더 큰 가중치를 부여합니다.

계산 공식:

𝑉𝑊𝑀𝐴=∑(𝐶𝑙𝑜𝑠𝑒×𝑉𝑜𝑙𝑢𝑚𝑒) / ∑𝑉𝑜𝑙𝑢𝑚𝑒

거래량이 많이 발생한 가격 구간을 강조하는 특성이 있어, 시장의 유동성 구간을 더 정확히 포착할 수 있습니다.

ATR 기반 피보나치 볼린저 밴드 생성

ATR(Average True Range)를 활용하여 변동성을 측정합니다.

기존의 표준편차 기반 볼린저 밴드 대신, 피보나치 계수(2.618, 3.0, 3.414)를 ATR에 곱하여 밴드를 생성합니다.

이 밴드는 시장 변동성에 따라 유동적으로 조정됩니다.

🔹 탐구 결과: 매물대 및 오더블록 감지

테스트를 통해 Fibonacci 2.618 ~ 3.414 구간에서 매물대 및 오더블록을 포착하는 경향이 있음을 확인했습니다.

가격이 피보나치 밴드(특히 2.618, 3.0, 3.414)에 닿을 때 반응하는 경우가 많음

VWMA의 특성을 통해 오더블록을 감지할 가능성이 높음

🔹 오더블록(Order Block) 감지 원리

Fibonacci 밴드 끄트머리(2.618 ~ 3.414)에서 가격이 강하게 반응

이 영역에서 가격이 강하게 튀어 오르거나(매수 압력) 급락하는(매도 압력) 경우,

→ 기관들이 포지션을 청산하거나 추가 매집하는 구간일 가능성이 큼.

과거에 대량 주문이 체결된 가격 구간(= 오더블록)일 수 있음.

VWMA를 통한 유동성 감지

VWMA는 거래량이 집중된 가격을 기준으로 이동하기 때문에, 기관 주문이 많이 들어온 가격대를 강조하는 특징이 있음.

따라서 VWMA와 피보나치 밴드가 만나는 지점은 유동성이 높은 핵심 구간이 될 가능성이 큼.

매물대 및 청산 구간 분석

가격이 밴드에 도달했을 때 강한 반등이 나오는지를 확인 → 오더블록 가능성

가격이 밴드를 여러 번 테스트하면서 돌파하지 못한다면, 해당 지점은 강한 매물대일 가능성

🔹 활용 방법

✅ 오더블록 감지:

가격이 밴드(2.618~3.414)에 닿고 강하게 튕긴다면, 오더블록 가능성

해당 지점에서 거래량 증가 및 강한 반등 발생 시 매수 고려

✅ 유동성 풀 확인:

VWMA와 피보나치 밴드가 만나는 구간에서 반복적으로 거래량이 터진다면, 해당 지점은 기관 유동성 구간일 가능성

✅ 추세 확인:

VWMA가 상승하고 가격이 밴드 하단(지지선)에서 튕긴다면 강한 상승 추세

VWMA가 하락하고 가격이 밴드 상단(저항선)에서 거부당하면 하락 추세 지속

[NLR] - SweetSpot ZonesThe Sweet Spot Zone helps you find the best spots to enter a trade, inspired by the " Follow Line Indicator " by Dreadblitz (big thanks to him!). It draws a colored zone on your chart to show ideal entry points, with a Base Point to keep you on track.

What It Does

Blue Zone: Uptrend—buy when the price dips into the zone.

Red Zone: Downtrend—sell or short when the price climbs into the zone.

Base Point: A gray line showing the key level the zone is built on.

How to Use It

Look for the colored zone:

- Blue: Buy if the price dips into the zone but stays above the Base Point.

- Red: Sell/short if the price climbs into the zone but stays below the Base Point.

Important: Avoid entering trade beyond base point - you might see low returns and face big drawdowns.

Confirm with other signals (like RSI/MACD) before entering.

Settings

ATR Length (10): How far back it looks to calculate price movement.

ATR Multiplier (2.5): How wide the zone is.

Error Margin (5.0): Keeps the zone steady during small price wiggles.

Uptrend/Downtrend Colors: Change the zone colors if you’d like!

Credits

Inspired by the "Follow Line Indicator" by Dreadblitz—check out his work for more great ideas!

Dynamic Volume Profile Oscillator | AlphaAlgosDynamic Volume Profile Oscillator | AlphaAlgos

Overview

The Dynamic Volume Profile Oscillator is an advanced technical analysis tool that transforms traditional volume analysis into a responsive oscillator. By creating a dynamic volume profile and measuring price deviation from volume-weighted equilibrium levels, this indicator provides traders with powerful insights into market momentum and potential reversals.

Key Features

• Volume-weighted price deviation analysis

• Adaptive midline that adjusts to changing market conditions

• Beautiful gradient visualization with 10-level intensity zones

• Fast and slow signal lines for trend confirmation

• Mean reversion mode that identifies price extremes relative to volume

• Fully customizable sensitivity and smoothing parameters

Technical Components

1. Volume Profile Analysis

The indicator builds a dynamic volume profile by:

• Collecting recent price and volume data within a specified lookback period

• Calculating a volume-weighted mean price (similar to VWAP)

• Measuring how far current price has deviated from this weighted average

• Adjusting this deviation based on historical volatility

2. Oscillator Calculation

The oscillator offers two calculation methods:

• Mean Reversion Mode (default): Measures deviation from volume-weighted mean price, normalized to reflect potential overbought/oversold conditions

• Standard Mode : Normalizes volume activity to identify unusual volume patterns

3. Adaptive Zones

The indicator features dynamic zones that:

• Center around an adaptive midline that reflects the average oscillator value

• Expand and contract based on recent volatility (standard deviation)

• Visually represent intensity through multi-level gradient coloring

• Provide clear visualization of bullish/bearish extremes

4. Signal Generation

Trading signals are generated through:

• Main oscillator line position relative to the adaptive midline

• Crossovers between fast (5-period) and slow (15-period) signal lines

• Color changes that instantly identify trend direction

• Distance from the midline indicating trend strength

Configuration Options

Volume Analysis Settings:

• Price Source - Select which price data to analyze

• Volume Source - Define volume data source

• Lookback Period - Number of bars for main calculations

• Profile Calculation Periods - Frequency of profile recalculation

Oscillator Settings:

• Smoothing Length - Controls oscillator smoothness

• Sensitivity - Adjusts responsiveness to price/volume changes

• Mean Reversion Mode - Toggles calculation methodology

Threshold Settings:

• Adaptive Midline - Uses dynamic midline based on historical values

• Midline Period - Lookback period for midline calculation

• Zone Width Multiplier - Controls width of bullish/bearish zones

Display Settings:

• Color Bars - Option to color price bars based on trend direction

Trading Strategies

Trend Following:

• Enter long positions when the oscillator crosses above the adaptive midline

• Enter short positions when the oscillator crosses below the adaptive midline

• Use signal line crossovers for entry timing

• Monitor gradient intensity to gauge trend strength

Mean Reversion Trading:

• Look for oscillator extremes shown by intense gradient colors

• Prepare for potential reversals when the oscillator reaches upper/lower zones

• Use divergences between price and oscillator for confirmation

• Consider scaling positions based on gradient intensity

Volume Analysis:

• Use Standard Mode to identify unusual volume patterns

• Confirm breakouts when accompanied by strong oscillator readings

• Watch for divergences between price and volume-based readings

• Use extended periods in extreme zones as trend confirmation

Best Practices

• Adjust sensitivity based on the asset's typical volatility

• Use longer smoothing for swing trading, shorter for day trading

• Combine with support/resistance levels for optimal entry/exit points

• Consider multiple timeframe analysis for comprehensive market view

• Test different profile calculation periods to match your trading style

This indicator is provided for informational purposes only. Always use proper risk management when trading based on any technical indicator. Not financial advise.

Dynamic CAGR LineIndicator: Dynamic CAGR Line

Overview

This Pine Script (version 6) creates a custom indicator called "Dynamic CAGR Moving Line," designed to calculate and display the Compound Annual Growth Rate (CAGR) in percentage terms for a financial instrument, such as a stock or cryptocurrency, based on a user-defined lookback period (default: 5 years). Unlike traditional overlays that plot directly on the price chart, this indicator appears in a separate pane below the chart, providing a clear visual of how the CAGR evolves over time with each new candle.

Purpose

The indicator helps traders and investors analyze the annualized growth rate of an asset’s price over a specified historical period. By plotting the CAGR as a percentage in a separate pane, users can easily track how the growth rate changes as new price data is added, offering insights into long-term performance trends without cluttering the price chart.

How It Works

User Input:

The script begins with an input parameter, lookback_years, allowing users to define the number of years (e.g., 5) to look back for the CAGR calculation. This is a floating-point value with a minimum of 1 and a step of 0.5, adjustable via the indicator’s settings in TradingView.

Timeframe Conversion:

Assuming a daily chart, the script converts the lookback years into a number of bars using bars_per_year = 252 (the average number of trading days in a year). The total lookback period in bars is calculated as lookback_bars = math.round(lookback_years * bars_per_year). For example, 5 years equals approximately 1260 bars.

Price Data:

For each candle, the start_price is fetched from the closing price lookback_bars ago (e.g., the close price from 5 years prior), using close .

The end_price is the current candle’s closing price, accessed via close.

CAGR Calculation:

The total return is computed as (end_price - start_price) / start_price, measuring the percentage change from the start price to the current price.

To avoid division-by-zero errors, a conditional check ensures start_price != 0; if it is, the return defaults to 0.

The CAGR is then calculated using the formula: math.pow(1 + total_return, 1 / lookback_years) - 1, which annualizes the total return over the lookback period.

The result is converted to a percentage by multiplying by 100 (cagr_percent = cagr * 100).

Plotting:

The CAGR percentage is plotted as a blue line in a separate pane using plot(). The line only appears after enough data exists (bar_index >= lookback_bars), otherwise it plots na (not available).

A label is added for each candle, displaying the current CAGR percentage (e.g., "CAGR: 5.23%") near the plotted value, styled with a blue background and white text.

Usage

Chart Setup: Apply the indicator to a daily chart with sufficient historical data (e.g., more than 5 years for the default setting). It’s designed for daily timeframes but can be adapted for others by adjusting bars_per_year (e.g., 52 for weekly).

Interpretation: A positive CAGR (e.g., 5%) indicates annualized growth, while a negative value (e.g., -2%) shows an annualized decline. A flat line at 0% suggests no net change over the lookback period.

Customization: Adjust lookback_years in the settings to analyze different periods (e.g., 3 or 10 years).

Notes

Ensure your chart has enough data to cover the lookback period, or the line won’t appear until sufficient bars are available.

For debugging, you can temporarily plot start_price and end_price on the main chart to verify the calculation inputs.

Triple SRSI-MFI Ⅲ - Multi TimeframeTriple SRSI-MFI Ⅲ - Multi Timeframe Indicator

Description

The Triple SRSI-MFI Ⅲ - Multi Timeframe indicator is a powerful tool designed to combine Stochastic RSI (SRSI) and Money Flow Index (MFI) across multiple timeframes (higher, current, and lower). It provides a comprehensive view of market momentum and potential overbought/oversold conditions by calculating a weighted hybrid of SRSI-MFI values from three different timeframes. The indicator also integrates Bollinger Bands to help identify trend direction and volatility.

This indicator is ideal for traders who want to analyze market conditions across multiple timeframes without switching charts. It automatically adjusts settings based on the current timeframe and includes a dynamic weighting system optimized for Bitcoin volatility. Additionally, a real-time information panel displays the market state (buy/sell) and signal strength.

Key Features

Multi-Timeframe Analysis: Combines SRSI-MFI from higher, current, and lower timeframes for a holistic view.

Dynamic Weighting: Automatically adjusts weights for each timeframe based on Bitcoin volatility, with an option for manual customization.

Bollinger Bands Integration: Visualizes trend direction and volatility using Bollinger Bands, with customizable source selection.

Real-Time Info Panel: Displays market state (buy/sell) and signal strength (%) in the top-right corner of the chart.

Customizable Settings: Allows users to tweak MFI source, Bollinger Bands parameters, and visibility of individual components.

How to Use

Add to Chart: Add the "Triple SRSI-MFI Ⅲ - Multi Timeframe" indicator to your chart.

Interpret Signals:

Market State (Buy/Sell): Shown in the info panel. "Buy" when the average SRSI-MFI is above the Bollinger Bands basis, "Sell" when below.

Strength (%): The relative position of the average SRSI-MFI within the Bollinger Bands, scaled from 0% to 100%.

Overbought/Oversold Levels: The indicator plots horizontal lines at 80 (overbought) and 20 (oversold). Use these as potential reversal zones.

Combine with Price Action: Use the indicator in conjunction with price action or other tools for better decision-making.

Adjust Settings: Customize the settings (e.g., Bollinger Bands length, weights, visibility) to match your trading style.

Settings

MFI Source: Select the source for MFI calculation (default: "hlc3"). Options include "close", "open", "high", "low", "hl2", "hlc3", "ohlc4".

Bollinger Bands:

Length: Period for Bollinger Bands calculation (default: 20).

Multiplier: Standard deviation multiplier for the bands (default: 2.0).

Source: Choose which SRSI-MFI value to use for Bollinger Bands ("averageHybrid", "hybrid_higher", "hybrid_current", "hybrid_lower"; default: "hybrid_higher").

Weights:

Auto Weight Enabled: Enable/disable automatic weights based on Bitcoin volatility (default: true).

Higher/Current/Lower Weights: Manually set weights for each timeframe if auto-weight is disabled (defaults: 1.5, 1.0, 0.5).

Indicator On/Off:

Toggle visibility for Higher SRSI-MFI, Current SRSI-MFI, Lower SRSI-MFI, Average SRSI-MFI, and Bollinger Bands.

How It Works

SRSI-MFI Calculation:

Stochastic RSI (SRSI) and Money Flow Index (MFI) are calculated for three timeframes: higher, current, and lower.

The hybrid value (SRSI * (MFI / 100)) is computed for each timeframe.

Weighted Average:

The hybrid values are combined into a weighted average (averageHybrid) using dynamic or manual weights.

Bollinger Bands:

Bollinger Bands are applied to the selected source (e.g., hybrid_higher) to identify trend direction and volatility.

Relative Position:

The position of averageHybrid within the Bollinger Bands is scaled to a percentage (0% to 100%) for strength assessment.

Visualization:

Plots individual SRSI-MFI lines, Bollinger Bands, and overbought/oversold levels.

A real-time info panel provides market state and signal strength.

Notes

This indicator is best used as part of a broader trading strategy. It is not a standalone signal generator and should be combined with other forms of analysis.

The automatic weights are optimized for Bitcoin (BTC) volatility. For other assets, you may need to adjust the weights manually.

The indicator may require sufficient historical data to calculate higher and lower timeframe values accurately.

Support & Resistance with RSI BreakoutsThe script is a TradingView Pine Script (v5) indicator that identifies support and resistance levels using RSI (Relative Strength Index) breakouts. Here’s a breakdown of what it does:

Features:

RSI Calculation:

The script calculates the 14-period RSI (default) using the closing price.

The user can modify the RSI period through an input setting.

Buy and Sell Signals:

A buy signal is triggered when RSI drops below 20 (indicating oversold conditions).

A sell signal is triggered when RSI rises above 80 (indicating overbought conditions).

Visual Representation:

Buy signals are marked with a green upward arrow (↑) below the price bars.

Sell signals are marked with a red downward arrow (↓) above the price bars.

The arrows help traders easily spot potential trade opportunities.

Usage:

This script is useful for traders looking to buy at oversold conditions and sell at overbought conditions based on RSI.

It works best when combined with other indicators or price action strategies to confirm signals.

5-Min ORB with Volume SpikeThis indicator identifies Opening Range Breakouts (ORB) based on the high and low of the first 5 minutes of the trading day and confirms the breakout with a volume spike.

🔍 What It Does:

Automatically captures the Opening Range High and Low from 9:30 AM to 9:35 AM (configurable).

Plots green (high) and red (low) lines across the chart once the opening range is set.

Highlights long breakout signals when price breaks above the OR High with above-average volume.

Highlights short breakout signals when price breaks below the OR Low with above-average volume.

Volume confirmation is based on a customizable 20-period simple moving average (SMA) of volume.

⚙️ Best Used On:

5-minute or lower intraday charts (e.g., SPY, QQQ, futures, etc.)

Highly liquid, high-volatility instruments

U.S. equity market open (customizable for other sessions)

📈 Trading Edge: This strategy helps traders identify strong, momentum-driven breakouts early in the trading session — especially when confirmed by increased institutional activity (volume spike).

HILo Ema Squeeze BandsThis indicator combines uses ema to identify price squeeze before a big move.

The ema gets initialised at new high low. It used 3 ema's lengths. For result use x, 2x ,4x ie 50, 100, 200 or 100,200,400 and so on . On more volatile asset use a higher settings like 100,200,400. The inner band is divided into 4 zones, which can give support resistance. As you use it you will become aware of subtle information that it can give at times. Like you may be able to find steps at which prices move, when the market is trending

Just like in Bollinger bands, in a trending market the price stays within sd=1 and sd=2 so does in the inner band the price will remain in band1 and band2. But Bollinger band cannot print steps this indicator shows steps

Daily & Multi-Day High/LowDaily & Multi-Candle High/Low Indicator

This indicator clearly highlights essential price levels directly on your chart, significantly improving your trading decisions:

First Candle High/Low (Session Open):

Quickly identify the high and low of the first candle each trading day, ideal for session-open traders.

Previous Day's High/Low:

Automatically plots the highest and lowest prices from the previous trading day, crucial for daily breakout or reversal strategies.

Multi-Candle High/Low (Customizable Period):

Easily track the highest and lowest points of the last X candles (default: 108 candles). Perfect for spotting key support and resistance zones.

Customization Options:

Adjust colors, line styles (solid, dashed, dotted), and line thickness directly from the settings for personalized visibility.

Ideal for day traders, swing traders, and price-action traders looking for clear and actionable daily levels on their charts.

Double Bollinger Bands MTF and Price projectionI did this script because I wanted to project prices over future bars quickly because I am a options trader.

Options:

Time frame: Default is Chart

Some times I prefer using 15 m with period 200 on a daily chart in a fast moving market. But you can chose what suites you

BB inner deviation 1 is default

When BB inner deviation=1 the outer will be 2X if its 0.5 outer will be 1

Moving Average type : Default EMA

Project next bar in label Default is off

This will calculate a linear projection of price of each band for the number of bars requested and print them in the label. It does not plot the future values

Using: in a trending market the prices will be generally be between band1 and band 2

and other times between -band1 and +band1. The projection can assist in optimal option strategy. Also in a fast moving market I would use 10 period ema for accurate price projections and others 20

Adaptive Regression Channel [MissouriTim]The Adaptive Regression Channel (ARC) is a technical indicator designed to empower traders with a clear, adaptable, and precise view of market trends and price boundaries. By blending advanced statistical techniques with real-time market data, ARC delivers a comprehensive tool that dynamically adjusts to price action, volatility, volume, and momentum. Whether you’re navigating the fast-paced world of cryptocurrencies, the steady trends of stocks, or the intricate movements of FOREX pairs, ARC provides a robust framework for identifying opportunities and managing risk.

Core Components

1. Color-Coded Regression Line

ARC’s centerpiece is a linear regression line derived from a Weighted Moving Average (WMA) of closing prices. This line adapts its calculation period based on market volatility (via ATR) and is capped between a minimum of 20 bars and a maximum of 1.5 times the user-defined base length (default 100). Visually, it shifts colors to reflect trend direction: green for an upward slope (bullish) and red for a downward slope (bearish), offering an instant snapshot of market sentiment.

2. Dynamic Residual Channels

Surrounding the regression line are upper (red) and lower (green) channels, calculated using the standard deviation of residuals—the difference between actual closing prices and the regression line. This approach ensures the channels precisely track how closely prices follow the trend, rather than relying solely on overall price volatility. The channel width is dynamically adjusted by a multiplier that factors in:

Volatility: Measured through the Average True Range (ATR), widening channels during turbulent markets.

Trend Strength: Based on the regression slope, expanding channels in strong trends and contracting them in consolidation phases.

3. Volume-Weighted Moving Average (VWMA)

Plotted in orange, the VWMA overlays a volume-weighted price trend, emphasizing movements backed by significant trading activity. This complements the regression line, providing additional confirmation of trend validity and potential breakout strength.

4. Scaled RSI Overlay

ARC features a Relative Strength Index (RSI) overlay, plotted in purple and scaled to hover closely around the regression line. This compact display reflects momentum shifts within the trend’s context, keeping RSI visible on the price chart without excessive swings. User-defined overbought (default 70) and oversold (default 30) levels offer reference points for momentum analysis."

Technical Highlights

ARC leverages a volatility-adjusted lookback period, residual-based channel construction, and multi-indicator integration to achieve high accuracy. Its parameters—such as base length, channel width, ATR period, and RSI length—are fully customizable, allowing traders to tailor it to their specific needs.

Why Choose ARC?

ARC stands out for its adaptability and precision. The residual-based channels offer tighter, more relevant support and resistance levels compared to standard volatility measures, while the dynamic adjustments ensure it performs well in both trending and ranging markets. The inclusion of VWMA and scaled RSI adds depth, merging trend, volume, and momentum into a single, cohesive overlay. For traders seeking a versatile, all-in-one indicator, ARC delivers actionable insights with minimal noise.

Best Ways to Use the Adaptive Regression Channel (ARC)

The Adaptive Regression Channel (ARC) is a flexible tool that supports a variety of trading strategies, from trend-following to breakout detection. Below are the most effective ways to use ARC, along with practical tips for maximizing its potential. Adjustments to its settings may be necessary depending on the timeframe (e.g., intraday vs. daily) and the asset being traded (e.g., stocks, FOREX, cryptocurrencies), as each market exhibits unique volatility and behavior.

1. Trend Following

• How to Use: Rely on the regression line’s color to guide your trades. A green line (upward slope) signals a bullish trend—consider entering or holding long positions. A red line (downward slope) indicates a bearish trend—look to short or exit longs.

• Best Practice: Confirm the trend with the VWMA (orange line). Price above the VWMA in a green uptrend strengthens the bullish case; price below in a red downtrend reinforces bearish momentum.

• Adjustment: For short timeframes like 15-minute crypto charts, lower the Base Regression Length (e.g., to 50) for quicker trend detection. For weekly stock charts, increase it (e.g., to 200) to capture broader movements.

2. Channel-Based Trades

• How to Use: Use the upper channel (red) as resistance and the lower channel (green) as support. Buy when the price bounces off the lower channel in an uptrend, and sell or short when it rejects the upper channel in a downtrend.

• Best Practice: Check the scaled RSI (purple line) for momentum cues. A low RSI (e.g., near 30) at the lower channel suggests a stronger buy signal; a high RSI (e.g., near 70) at the upper channel supports a sell.

• Adjustment: In volatile crypto markets, widen the Base Channel Width Coefficient (e.g., to 2.5) to reduce false signals. For stable FOREX pairs (e.g., EUR/USD), a narrower width (e.g., 1.5) may work better.

3. Breakout Detection

• How to Use: Watch for price breaking above the upper channel (bullish breakout) or below the lower channel (bearish breakout). These moves often signal strong momentum shifts.

• Best Practice: Validate breakouts with VWMA position—price above VWMA for bullish breaks, below for bearish—and ensure the regression line’s slope aligns (green for up, red for down).

• Adjustment: For fast-moving assets like crypto on 1-hour charts, shorten ATR Length (e.g., to 7) to make channels more reactive. For stocks on daily charts, keep it at 14 or higher for reliability.

4. Momentum Analysis

• How to Use: The scaled RSI overlay shows momentum relative to the regression line. Rising RSI in a green uptrend confirms bullish strength; falling RSI in a red downtrend supports bearish pressure.

• Best Practice: Look for RSI divergences—e.g., price hitting new highs at the upper channel while RSI flattens or drops could signal an impending reversal.

• Adjustment: Reduce RSI Length (e.g., to 7) for intraday trading in FOREX or crypto to catch short-term momentum shifts. Increase it (e.g., to 21) for longer-term stock trades.

5. Range Trading

• How to Use: When the regression line’s slope is near zero (flat) and channels are tight, ARC indicates a ranging market. Buy near the lower channel and sell near the upper channel, targeting the regression line as the mean price.

• Best Practice: Ensure VWMA hovers close to the regression line to confirm the range-bound state.

• Adjustment: For low-volatility stocks on daily charts, use a moderate Base Regression Length (e.g., 100) and tight Base Channel Width (e.g., 1.5). For choppy crypto markets, test shorter settings.

Optimization Strategies

• Timeframe Customization: Adjust ARC’s parameters to match your trading horizon. Short timeframes (e.g., 1-minute to 1-hour) benefit from lower Base Regression Length (20–50) and ATR Length (7–10) for agility, while longer timeframes (e.g., daily, weekly) favor higher values (100–200 and 14–21) for stability.

• Asset-Specific Tuning:

○ Stocks: Use longer lengths (e.g., 100–200) and moderate widths (e.g., 1.8) for stable equities; tweak ATR Length based on sector volatility (shorter for tech, longer for utilities).

○ FOREX: Set Base Regression Length to 50–100 and Base Channel Width to 1.5–2.0 for smoother trends; adjust RSI Length (e.g., 10–14) based on pair volatility.

○ Crypto: Opt for shorter lengths (e.g., 20–50) and wider widths (e.g., 2.0–3.0) to handle rapid price swings; use a shorter ATR Length (e.g., 7) for quick adaptation.

• Backtesting: Test ARC on historical data for your asset and timeframe to optimize settings. Evaluate how often price respects channels and whether breakouts yield profitable trades.

• Enhancements: Pair ARC with volume surges, key support/resistance levels, or candlestick patterns (e.g., doji at channel edges) for higher-probability setups.

Practical Considerations

ARC’s adaptability makes it suitable for diverse markets, but its performance hinges on proper calibration. Cryptocurrencies, with their high volatility, may require shorter, wider settings to capture rapid moves, while stocks on longer timeframes benefit from broader, smoother configurations. FOREX pairs often fall in between, depending on their inherent volatility. Experiment with the adjustable parameters to align ARC with your trading style and market conditions, ensuring it delivers the precision and reliability you need.

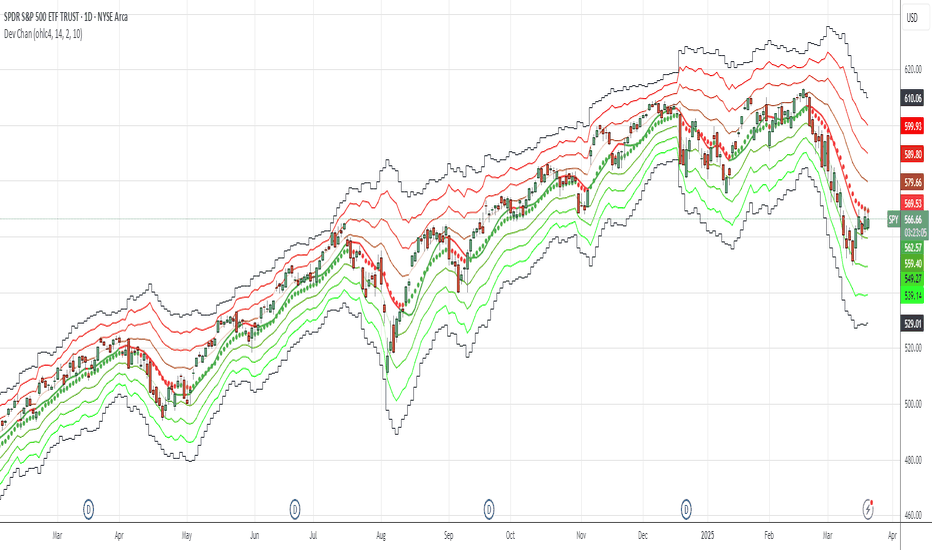

Deviation ChannelsIndicator Name: Deviation Channels (Dev Chan)

Why Use This Indicator?

Visualize Volatility Ranges:

The indicator plots Keltner Channels at four levels above and below an average line, letting you easily see how far price has deviated from a typical range. Each “dev” line highlights potential support or resistance during pullbacks or surges.

Color-Coded Clarity:

Each band shifts color intensity depending on whether the current price is trading above or below it, letting you spot breakouts and rejections at a glance. Meanwhile, the Fast SMA (default 10) also changes color – green if price is above, red if below – adding a quick momentum read.

Adjustable Source & Length:

Choose your input source (open, close, ohlc4, or hlc3) and set your Keltner length to suit different asset classes or timeframes. Whether you want a tighter, more reactive channel or a smoother, longer-term reading, the script adapts with minimal effort.

A Simple Trading Approach

Identify Trend with Fast SMA:

If the Fast SMA (default length 10) is green (price above it), treat that as a bullish environment. If it’s red (price below), favor bearish or neutral stances.

Wait for Price to Reach Lower/Upper Deviations:

In a bullish setup (Fast SMA green), watch for price to dip into one of the lower channels (e.g., -1 Dev or -2 Dev). Such pullbacks can become potential “buy the dip” zones if price stabilizes and resumes upward momentum.

Conversely, if the Fast SMA is red, watch for price to test the upper channels (1 Dev or 2 Dev). That might be a short opportunity or a place to close out any remaining longs before a deeper correction.

Manage Risk with Channel Levels:

Place stop-losses just beyond the next “dev” band to protect against volatility. For example, if you enter on a bounce at -1 Dev, consider placing a stop near -2 Dev or -3 Dev, depending on your risk tolerance.

Take Profits Gradually:

In an uptrend, you might scale out of positions as price moves toward higher lines (e.g., 1 Dev or 2 Dev). Conversely, if price fails to hold above the Fast SMA or repeatedly closes below a key band, it might be time to exit.

Disclaimer: No single indicator is foolproof. Always combine with sound risk management, observe multiple timeframes, and consider fundamental factors before making trading decisions. Experiment with the Keltner length and Fast SMA fastLength to find the sweet spot for your market and time horizon.