MA Cross with Monthly LinesA dual-purpose trading indicator combining Moving Average (MA) crossovers with a Monthly Line Separator. It visually tracks trend shifts using MA crosses while marking monthly boundaries for clear historical reference. Ideal for traders seeking both momentum signals and structured timeframes, enhancing decision-making with a streamlined, all-in-one charting tool.

Полосы и каналы

Sigma Expected Movement)Okay, here's a brief description of what the final Pine Script code achieves:

Indicator Description:

This indicator calculates and plots expected price movement ranges based on the VIX index for daily, weekly, or monthly periods. It uses user-selectable VIX data (Today's Open / Previous Close) and a center price source (Today's Open / Previous Close).

Key features include:

Up to three customizable deviation levels, based on user-defined percentages of the calculated expected move.

Configurable visibility, color, opacity (default 50%), line style, and width (default 1) for each deviation level.

Optional filled area boxes between the 1st and 2nd deviation levels (enabled by default), with customizable fill color/opacity.

An optional center price line with configurable visibility (disabled by default), color, opacity, style, and width.

All drawings appear only within a user-defined time window (e.g., specific market hours).

Does not display price labels on the lines.

Optional rounding of calculated price levels.

ORB Lines - Opening Range Breakout [GC Trading Systems]A simple indicator that draws your opening range + custom fib extension targets.

Bollinger Bands with EMAsHere's a TradingView Pine Script indicator that includes:

Bollinger Bands with default settings (20-period SMA and 2 standard deviations).

Three EMA lines with default values of 10, 20, and 50.

Settings and style options to adjust any parameter.

Kase Permission StochasticOverview

The Kase Permission Stochastic indicator is an advanced momentum oscillator developed from Kase's trading methodology. It offers enhanced signal smoothing and filtering compared to traditional stochastic oscillators, providing clearer entry and exit signals with fewer false triggers.

How It Works

This indicator calculates a specialized stochastic using a multi-stage smoothing process:

Initial stochastic calculation based on high, low, and close prices

Application of weighted moving averages (WMA) for short-term smoothing

Progressive smoothing through differential factors

Final smoothing to reduce noise and highlight significant trend changes

The indicator oscillates between 0 and 100, with two main components:

Main Line (Green): The smoothed stochastic value

Signal Line (Yellow): A further smoothed version of the main line

Signal Generation

Trading signals are generated when the main line crosses the signal line:

Buy Signal (Green Triangle): When the main line crosses above the signal line

Sell Signal (Red Triangle): When the main line crosses below the signal line

Key Features

Multiple Smoothing Algorithms: Uses a combination of weighted and exponential moving averages for superior noise reduction

Clear Visualization: Color-coded lines and background filling

Reference Levels: Horizontal lines at 25, 50, and 75 for context

Customizable Colors: All visual elements can be color-customized

Customization Options

PST Length: Base period for the stochastic calculation (default: 9)

PST X: Multiplier for the lookback period (default: 5)

PST Smooth: Smoothing factor for progressive calculations (default: 3)

Smooth Period: Final smoothing period (default: 10)

Trading Applications

Trend Confirmation: Use crossovers to confirm entries in the direction of the prevailing trend

Reversal Detection: Identify potential market reversals when crossovers occur at extreme levels

Range-Bound Markets: Look for oscillations between overbought and oversold levels

Filter for Other Indicators: Use as a confirmation tool alongside other technical indicators

Best Practices

Most effective in trending markets or during well-defined ranges

Combine with price action analysis for better context

Consider the overall market environment before taking signals

Use longer settings for fewer but higher-quality signals

The Kase Permission Stochastic delivers a sophisticated approach to momentum analysis, offering a refined perspective on market conditions while filtering out much of the noise that affects standard oscillators.

Médias Móveis Personalizadas por TipoContains 9, 20, 50, and 200 moving averages and a VWAP, allowing selection between simple and exponential with different colors and more!

Contem medias de 9 20 50 e 200 e uma vwap podendo escolher entre simples e exponencial com diferentes cores e etc!

NISHITThis strategy is equal to the very popular "ANN Strategy" coded by sirolf2009 but without the Artificial Neural Network (ANN// Main difference besides stripping out the ANN is that I use close prices instead of OHLC4 prices

HTF Support & Resistance Zones📌 English Description:

HTF Support & Resistance Zones is a powerful indicator designed to auto-detect key support and resistance levels from higher timeframes (Daily, Weekly, Monthly, Yearly).

It displays the number of touches for each level and automatically classifies its strength (Weak – Strong – Very Strong) with full customization options.

✅ Features:

Auto-detection of support/resistance from HTFs

Strength calculation based on touch count

Clean visual display with color, size, and label customization

Ideal for scalping and intraday trading

📌 الوصف العربي:

مؤشر "HTF Support & Resistance Zones" يساعد المتداولين على تحديد أهم مناطق الدعم والمقاومة المستخرجة تلقائيًا من الفريمات الكبيرة (اليومي، الأسبوعي، الشهري، السنوي).

يعرض المؤشر عدد اللمسات لكل مستوى ويقيّم قوته تلقائيًا (ضعيف – قوي – قوي جدًا)، مع خيارات تخصيص كاملة للعرض.

✅ ميزات المؤشر:

دعم/مقاومة تلقائية من الفريمات الكبيرة

تقييم تلقائي لقوة المستويات بناءً على عدد اللمسات

عرض مرئي مرن مع تحكم بالألوان، الحجم، الشكل، والخلفية

مناسب للتداولات اليومية والسكالبينج

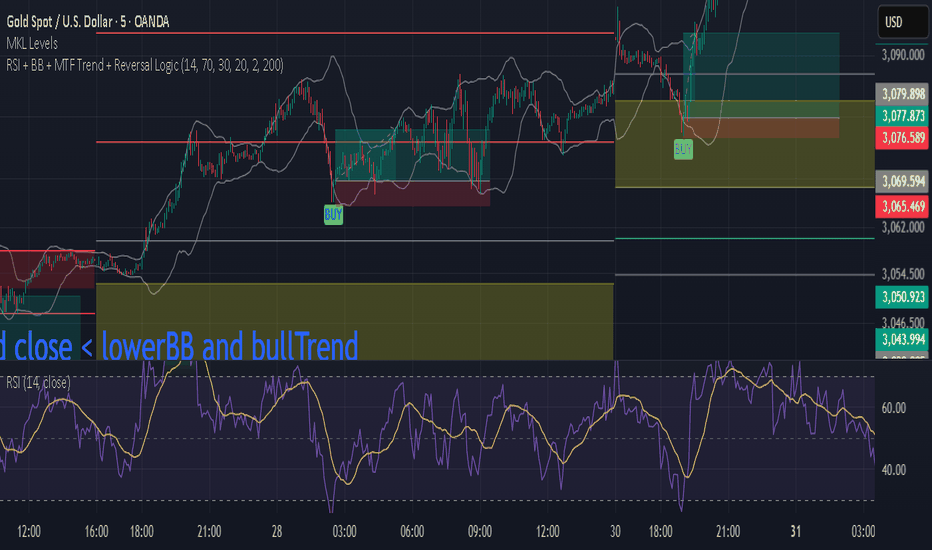

EMA Channel Key K-LinesEMA Channel Setup :

Three 32-period EMAs (high, low, close prices)

Visually distinct colors (red, blue, green)

Gray background between high and low EMAs

Key K-line Identification :

For buy signals: Close > highest EMA, K-line height ≥ channel height, body ≥ 2/3 of range

For sell signals: Close < lowest EMA, K-line height ≥ channel height, body ≥ 2/3 of range

Alternating signals only (no consecutive buy/sell signals)

Visual Markers :

Green "BUY" labels below key buy K-lines

Red "SELL" labels above key sell K-lines

Clear channel visualization

Logic Flow :

Tracks last signal direction to prevent consecutive same-type signals

Strict conditions ensure only significant breakouts are marked

All calculations based on your exact specifications

Quadruple Supertrend HTF FilterMultiple supertrend each with distinct TF, ART,& MULTIPLIER for multitimeframe analysis.

TLP Swing Chart V2 + EMA Crosssự kết của swin ema 8 21 200 và tín hiệu nến isb osb giúp nhận diện trade tốt hơn.

Optimize Head-Touch and Bottom-GuessUniquely developed to empower your predictions with smart alerts and analysis using Moving Averages, Bollinger Bands, and VWAP.

Enhanced RSI, VWAP, Pivot Points,BB, Supertrend & SAREnhanced Adaptive RSI with VWAP, Pivots, Bollinger Bands, Supertrend & SAR

This comprehensive trading indicator offers a multi-faceted approach to market analysis, combining multiple adaptive and traditional technical indicators to enhance decision-making. It is ideal for traders looking to gain insights into price momentum, support and resistance levels, and potential trend reversals.

Key Features and Benefits

Adaptive RSI (ARSI)

Tracks market momentum using an adaptive Relative Strength Index, which responds to changing market conditions.

Smoothed with a Simple Moving Average for better clarity.

Provides buy and sell signals with clear visual markers.

VWAP (Volume Weighted Average Price)

Displays Daily, Weekly, Monthly, and Approximate Quarterly VWAP levels.

Useful for identifying fair market value and institutional activity.

Pivot Points with Camarilla S3 and R3

Calculates dynamic support and resistance levels.

Helps traders set effective entry and exit points.

Adaptive Bollinger Bands

Adjusts dynamically to market volatility.

Helps traders identify overbought and oversold conditions.

Adaptive Supertrend

Generates trend-following signals based on volatility-adjusted values.

Provides clear buy and sell markers with color-coded trend identification.

Adaptive Parabolic SAR

Assists in trailing stop-loss placement and identifying trend reversals.

Particularly useful in trending markets.

How to Use

Trend Identification: Follow the Supertrend and SAR for clear directional bias.

Support and Resistance: Use Pivot Points and VWAP levels to gauge market sentiment.

Volatility Management: Monitor Bollinger Bands for breakout or reversal opportunities.

Momentum Analysis: Track ARSI movements for early signals of trend continuation or reversal.

This indicator is a powerful all-in-one solution for day traders, swing traders, and even longer-term investors who want to optimize their trading strategy.

Ahmed Mo3Ty - Bollinger Bands 1Buy:

Enter long when price closes above upper Bollinger Band (plot green arrow)

Close long when price closes below lower Bollinger Band

Sell:

Enter short when price closes below lower Bollinger Band (plot red arrow)

Close short when price closes above upper Bollinger Band

Important: For successful investment in the financial markets, I advise you to use the following combination and not rely solely on technical analysis tools (experience + risk management plan + psychological control + combining technical analysis with fundamental analysis).

Risk Warning: This indicator is not a buy or sell recommendation. Rather, it is for educational purposes and should be combined with the previous combination. Any buy or sell order is yours alone, and you are responsible for it.

Four MAs with Bands Pack by Rising Falcon# **Four MAs with Bands Pack by Rising Falcon**

## **Overview**

The **Four MAs with Bands Pack** is a dynamic multi-moving average indicator designed to enhance trend identification, momentum analysis, and volatility assessment. It allows traders to configure and visualize up to four different moving averages (MAs) with an optional **higher timeframe Hull MA (HMA)** for advanced trend confirmation. The indicator also incorporates **band structures** around each MA, providing additional insights into price volatility, breakout zones, and trend strength.

---

## **Fundamental Aspects**

Moving Averages (MAs) are a foundational tool in technical analysis, widely used to **smooth out price fluctuations** and identify directional bias over time. This indicator leverages four MAs of varying lengths to **capture different time horizons** of market trends, making it useful for:

- **Short-Term Analysis (Scalping):** Fast MAs (e.g., 20, 50) respond quickly to price action, allowing traders to catch early trend shifts.

- **Mid-Term Analysis (Swing Trading):** Medium-length MAs (e.g., 100) help validate trend continuation.

- **Long-Term Analysis (Position Trading):** Slow MAs (e.g., 200) provide macro trend direction and filter noise from short-term fluctuations.

By **color-coding** the MAs based on trend direction and incorporating a **band system**, the indicator helps traders identify price momentum shifts, consolidation zones, and potential breakout opportunities.

---

## **Technical Aspects**

### **1. Configurable Moving Averages**

Each of the four MAs can be customized using three calculation methods:

- **SMA (Simple Moving Average):** A traditional average of past prices, best for stable trend confirmation.

- **EMA (Exponential Moving Average):** Gives more weight to recent price action, making it more reactive to new trends.

- **WMA (Weighted Moving Average):** Assigns greater importance to more recent data, reducing lag while maintaining smoothness.

#### **Formulae:**

1. **SMA:**

\

2. **EMA:**

\

where \( k = \frac{2}{N+1} \)

3. **WMA:**

\

where \( W_i \) is the weight assigned to each period.

Each moving average has an optional **higher timeframe setting**, allowing traders to plot an MA from a larger timeframe on their current chart for **multi-timeframe analysis (MTA)**. This is useful for confirming trends and filtering noise from lower timeframes.

---

### **2. Dynamic Bands & Volatility Visualization**

Each moving average has an associated band, defined by:

- **Upper Band:** The MA value at the current bar.

- **Lower Band:** The MA value from two bars ago (**lagging component** for trend assessment).

- **Color Coding:**

- **Green:** Uptrend (price above the moving average).

- **Red:** Downtrend (price below the moving average).

- **Orange:** Neutral (no strong trend bias).

The band thickness and transparency are customizable, helping traders **visually assess market conditions**:

- **Expanding Bands:** Increased price volatility (potential breakout).

- **Contracting Bands:** Reduced volatility (possible consolidation).

Mathematically, the **band region is defined by**:

\

This concept is similar to **Keltner Channels** or **Bollinger Bands**, but instead of standard deviations, it uses historical MA differences to capture trend momentum.

---

### **3. Trend Alerts & Crossover Signals**

To assist traders in making timely decisions, the indicator generates alerts when **fast MAs cross slow MAs**:

- **Bullish Crossover (Uptrend Confirmation):**

\

- **Bearish Crossover (Downtrend Confirmation):**

\

- These alerts can be used to set up **automated notifications** for trade entries/exits.

---

## **How to Use This Indicator**

### **Scalping Strategy**

1. Use **shorter length MAs (20, 50)** with **higher timeframe Hull MA** enabled.

2. Look for **bullish crossovers** of fast MAs over slow MAs.

3. Ensure the band is **expanding** before entering a trade.

4. Exit when the opposite crossover occurs or when bands **contract**.

### **Swing Trading Strategy**

1. Use a combination of **medium and long MAs (50, 100, 200)** for trend confirmation.

2. Look for **price pullbacks** into the bands before **trend continuation**.

3. Set alerts for **crossovers** to validate trend direction.

### **Trend Reversal Strategy**

1. Look for **bearish crossovers** near resistance levels for short trades.

2. Wait for **bullish crossovers** at support levels for long trades.

3. Confirm with **higher timeframe MA direction** to reduce false signals.

---

## **Key Benefits**

✅ **Versatile:** Works for scalping, swing trading, and trend following.

✅ **Multi-Timeframe Support:** View higher timeframe MAs for broader trend validation.

✅ **Customizable:** Adjust MA type, length, color coding, and band visibility.

✅ **Alerts:** Automatic notifications for trend shifts and crossovers.

✅ **Clear Visualization:** Helps traders identify breakout zones, volatility spikes, and reversals.

---

## **Final Thoughts**

The **Four MAs with Bands Pack by Rising Falcon** is an advanced yet intuitive tool for traders looking to enhance their trend-following strategies. By combining **multiple moving averages, band structures, and trend color coding**, it provides a comprehensive view of price action, helping traders make **informed trading decisions** with greater confidence.

Bollinger Band Long & Short Strategy### **Strategy Summary: Bollinger Band Long & Short Strategy**

#### **Bollinger Band Setup:**

- Uses a **20-period Simple Moving Average (SMA)** as the basis.

- **Standard deviation multiplier = 1.5**.

- Calculates **upper** and **lower Bollinger Bands**.

#### **Entry Conditions:**

- **Short Trade:**

- A candle must fully form **above** the upper Bollinger Band.

- The **low of this candle** must be broken by one of the **next four candles**.

- A **short position** is then entered.

- **Long Trade:**

- A candle must fully form **below** the lower Bollinger Band.

- The **high of this candle** must be broken by one of the **next four candles**.

- A **long position** is then entered.

#### **Risk Management:**

- **Stop Loss:**

- **Short Trade:** High of the candle that formed outside the upper Bollinger Band.

- **Long Trade:** Low of the candle that formed outside the lower Bollinger Band.

- **Position Sizing:**

- The number of shares/contracts is calculated such that the **maximum loss per trade is INR 4000**.

- **Risk-to-Reward Ratio:**

- **Target Profit = 3x Risk (1:3 R:R).**

- Once **1:2 profit is reached, the stop loss moves to breakeven**.

- The trade is **closed at 1:3 profit**.

#### **Additional Features:**

- **Trades are only considered if the breakout happens within four candles** after the alert candle.

- **Bollinger Bands are plotted for visibility** on the chart.

Let me know if you need any modifications! 🚀

[TABLE] Moving Average Stage Indicator Table📈 MA Stage Indicator Table

🧠 Overview:

This script analyzes market phases based on moving average (MA) crossovers, classifying them into 6 distinct stages and displaying statistical summaries for each.

🔍 Key Features:

• Classifies market condition into Stage 1 to Stage 6 based on the relationship between MA1 (short), MA2 (mid), and MA3 (long)

• Provides detailed stats for each stage:

• Average Duration

• Average Width (MA distance)

• Slope (Angle) - High / Low / Average

• Shows current stage details in real-time

• Supports custom date range filtering

• Choose MA type: SMA or EMA

• Optional background coloring for stages

• Clean summary table displayed on the chart

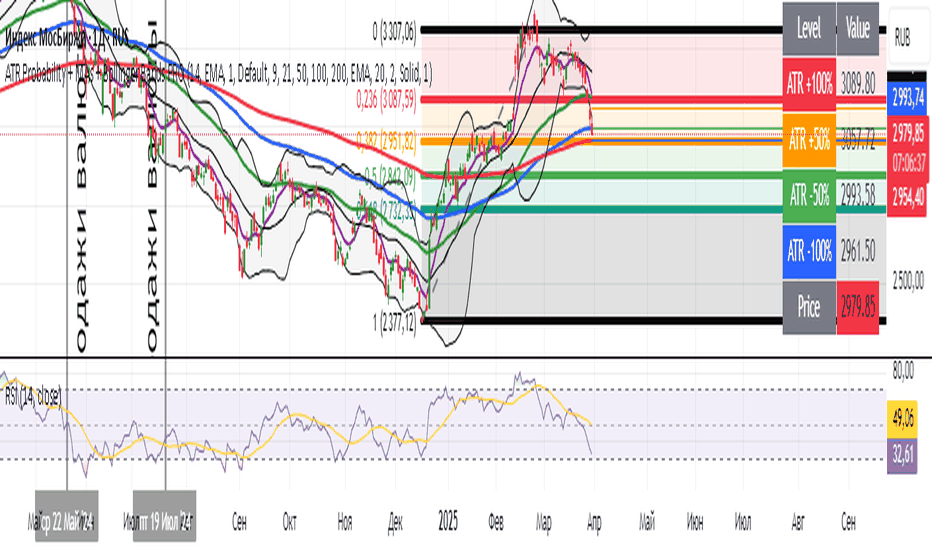

ATR Probability + MAs + Bollinger Bands PROATR Probability + MAs + Bollinger Bands

Made by DeepSeek))

Fibonacci BB Strategy with RSI + 2% Exit📈 Fibonacci BB Strategy with RSI + 2% Profit Exit

This strategy combines a VWMA-based Bollinger Band system with RSI confirmation and a 2% profit-taking mechanism, offering a balanced blend of trend and momentum trading.

🔍 Key Features:

✅ VWMA-Based Bands: Uses a 200-period Volume Weighted Moving Average (VWMA) to create dynamic support and resistance bands with standard deviation. Helps capture trend direction with volume-weighted precision.

✅ Entry Signals:

Long Entry: When price crosses above the upper VWMA band.

Short Entry: When price crosses below the lower VWMA band.

✅ Exit Conditions:

Profit Target: Positions close automatically at a 2% profit (customizable).

RSI-Based Exit:

Longs close when RSI < 30 (oversold).

Shorts close when RSI > 70 (overbought).

✅ Built-in Risk Management: Avoids greed-based exits by locking in profits early or exiting on reversal signals.

⚙️ User Inputs:

VWMA length (default: 200)

Deviation multiplier for bands (default: 3.0)

RSI length (default: 14)

Profit target in % (default: 2%)

🧠 How to Use:

Works best in strong trending markets.

Can be combined with higher-timeframe trend filters or volume analysis.

Suitable for both swing trading and intraday strategies.

Volume Delta Divergence + Bollinger Bands (Filtered)📌 Volume Delta Divergence with Bollinger Bands (Filtered)

This script combines Volume Delta Divergence detection with Bollinger Bands to help identify high-probability buy and sell signals based on volume behavior and price action.

🔍 Key Features:

✅ Divergence Detection: Identifies when price moves in one direction (green/red candle), but the delta volume (buy vs sell volume) moves in the opposite direction — a common sign of hidden weakness or strength.

✅ Volume Strength Filter: Filters out weak divergence signals by checking if the delta volume is significantly larger than its historical average (user-defined lookback).

✅ Breakout Confirmation: A signal is only triggered when the next candle breaks the high or low of the divergence candle.

✅ Bollinger Bands Overlay: Adds standard Bollinger Bands (20-period SMA ± 2 standard deviations by default) for trend and volatility analysis.

✅ Clean Signal Display: Plots "BUY" and "SELL" labels only when strong divergences occur, reducing noise and false signals.

⚙️ User Inputs:

Custom timeframe for volume delta analysis

Delta volume average lookback period

Bollinger Band settings (length & deviation)

🧠 How to Use:

Use the divergence signals in conjunction with Bollinger Band positioning.

Consider SELL signals stronger when they occur near the upper Bollinger Band, and BUY signals near the lower band.

Combine with price action or RSI for added confluence.

02 SMC + BB Breakout (Improved)This strategy combines Smart Money Concepts (SMC) with Bollinger Band breakouts to identify potential trading opportunities. SMC focuses on identifying key price levels and market structure shifts, while Bollinger Bands help pinpoint overbought/oversold conditions and potential breakout points. The strategy also incorporates higher timeframe trend confirmation to filter out trades that go against the prevailing trend.

Key Components:

Bollinger Bands:

Calculated using a Simple Moving Average (SMA) of the closing price and a standard deviation multiplier.

The strategy uses the upper and lower bands to identify potential breakout points.

The SMA (basis) acts as a centerline and potential support/resistance level.

The fill between the upper and lower bands can be toggled by the user.

Higher Timeframe Trend Confirmation:

The strategy allows for optional confirmation of the current trend using a higher timeframe (e.g., daily).

It calculates the SMA of the higher timeframe's closing prices.

A bullish trend is confirmed if the higher timeframe's closing price is above its SMA.

This helps filter out trades that go against the prevailing long-term trend.

Smart Money Concepts (SMC):

Order Blocks:

Simplified as recent price clusters, identified by the highest high and lowest low over a specified lookback period.

These levels are considered potential areas of support or resistance.

Liquidity Zones (Swing Highs/Lows):

Identified by recent swing highs and lows, indicating areas where liquidity may be present.

The Swing highs and lows are calculated based on user defined lookback periods.

Market Structure Shift (MSS):

Identifies potential changes in market structure.

A bullish MSS occurs when the closing price breaks above a previous swing high.

A bearish MSS occurs when the closing price breaks below a previous swing low.

The swing high and low values used for the MSS are calculated based on the user defined swing length.

Entry Conditions:

Long Entry:

The closing price crosses above the upper Bollinger Band.

If higher timeframe confirmation is enabled, the higher timeframe trend must be bullish.

A bullish MSS must have occurred.

Short Entry:

The closing price crosses below the lower Bollinger Band.

If higher timeframe confirmation is enabled, the higher timeframe trend must be bearish.

A bearish MSS must have occurred.

Exit Conditions:

Long Exit:

The closing price crosses below the Bollinger Band basis.

Or the Closing price falls below 99% of the order block low.

Short Exit:

The closing price crosses above the Bollinger Band basis.

Or the closing price rises above 101% of the order block high.

Position Sizing:

The strategy calculates the position size based on a fixed percentage (5%) of the strategy's equity.

This helps manage risk by limiting the potential loss per trade.

Visualizations:

Bollinger Bands (upper, lower, and basis) are plotted on the chart.

SMC elements (order blocks, swing highs/lows) are plotted as lines, with user-adjustable visibility.

Entry and exit signals are plotted as shapes on the chart.

The Bollinger band fill opacity is adjustable by the user.

Trading Logic:

The strategy aims to capitalize on Bollinger Band breakouts that are confirmed by SMC signals and higher timeframe trend. It looks for breakouts that align with potential market structure shifts and key price levels (order blocks, swing highs/lows). The higher timeframe filter helps avoid trades that go against the overall trend.

In essence, the strategy attempts to identify high-probability breakout trades by combining momentum (Bollinger Bands) with structural analysis (SMC) and trend confirmation.

Key User-Adjustable Parameters:

Bollinger Bands Length

Standard Deviation Multiplier

Higher Timeframe

Higher Timeframe Confirmation (on/off)

SMC Elements Visibility (on/off)

Order block lookback length.

Swing lookback length.

Bollinger band fill opacity.

This detailed description should provide a comprehensive understanding of the strategy's logic and components.

***DISCLAIMER: This strategy is for educational purposes only. It is not financial advice. Past performance is not indicative of future results. Use at your own risk. Always perform thorough backtesting and forward testing before using any strategy in live trading.***