Advanced Average True RangeThis indicator allows you to improve your stop loss placement. It displays two lines based on the ATR ( Average True Range ), an upper line based on the current price + ATR and a lower line based on the current price - ATR. The ATR is multiplied by 2 but you can change this in the indicator settings.

ATR

ATR with EOM and VORTEXThis is a strategy, designed for long trends for stock and crypto market.

Its made of ATR for volatility, EOM for volume and VORTEX for the trend direction.

In this case on the ATR, I applied an EMA to check if current position is above the EMA -> bull trend, below ema -> bear trend

For EOM I am using the positive and negative value scale, if its positive we are in a bull movement, otherwise a bear movement.

Lastly for VORTEX, I took the min and max, and made an average, after that I am using the average and compare it with 1 value. Above 1 -> bull, belowe 1-> bear.

This strategy only goes long.

If you have any questions, let me know.

ATR For Stop Loss (Overlay)This script is an enhancement of ATR Indicator.

It is used to determine the stop loss position by using the ATR indicator, in conjunction with the low of the candle.

Formula = Stop Loss = Lowest(Lowest Length) - (ATR Multiplier * ATR (Smoothing, Length))

However, the user needs to manually identify the swing low for a better stop loss placement.

Parameter Information :

- Length : Period to calculate the average true range.

- Smoothing : The method used for averaging.

- ATR Multiplier : Multiplier factor to determine the Stop Loss from the lowest reference point. (1 ATR Multiplier means the stop loss would be = Low - ATR)

- Lowest Length : A total number of candle to determine the lowest reference point. (1 means only using the latest candle's low as a lowest reference point)

Have fun and good luck!

Trend Surfers - Premium Breakout + AlertsTrend Surfers - Premium Breakout Strategy with Alerts

I am happy today to release the first free Trend Surfers complete Breakout Strategy!

The strategy includes:

Entry for Long and Short

Stoploss

Position Size

Exit Signal

Risk Management Feature

How the strategy works

This is a Trend Following strategy. The strategy will have drawdowns, but they will be way smaller than what you would go through with buy and old.

As a Trend Following strategy, we will buy on strength, when a breakout occurs. And sell on weakness.

The strategy includes a FIX Stoploss determined by an ATR multiple and a trailing Stoploss/Takeprofit also determined by an ATR multiple.

You can also manage your risk by entering the maximum % you are willing to risk on every trade. Additionally, there is an option to enter how many pairs you will be trading with the strategy. This will change your position size in order to make sure that you have enough funds to trade all your favorite pairs.

Use the strategy with alerts

This strategy is alert-ready. All you have to do is:

Go on a pair you would like to trade

Create an alert

Select the strategy as a Trigger

Wait for new orders to be sent to you

Every Entry (Long/Short) will include:

Market Entry (Enter position NOW!)

Stoploss price

Position Size

Leverage

* If you do not wish to use leverage, you can multiply the Position Size by the Leverage. But doing that, you might end up with a position greater than your equity. Trading on Futures is better in order to have accurate risk management.

Exit signals:

When you receive an exit signal, you need to close the position ASAP. If you want to keep your results as close as possible to the backtest results, you need to execute quickly and follow what the strategy is telling you.

Do not try to outsmart the strategy

Leave your emotion out of trading! If you trust the strategy, you will have way better returns than if you try to outsmart it. Follow each signal you receive even if it doesn't seem logical at the moment.

Become a machine that executes. Don't look at fundamentals. Follow the trend! Trust the strategy!

I hope you enjoy it!

ATR PercentAverage True Range in Percent to price

- 2 customizable horizontal line: to be used as custom levels.

Normalized Quantitative Qualitative Estimation nQQENormalized version of Quantitative Qualitative Estimation QQE:

Normalized QQE tries to overcome the problems of false signals due to RSI divergences on the original QQE indicator.

The main purpose is to determine and ride the trend as far as possible.

So users can identify:

UPTREND : when nQQE Histogram is GREEN (nQQE is above 10)

DOWNTREND : when nQQE Histogram is RED (nQQE is below -10)

SIDEWAYS: when nQQE Histogram is YELLOW (nQQE is between -10 and 10)

Calculation is very simple;

RSI based QQE oscillates between 0-100

nQQE is simply calculated as:

nQQE=QQE-50

to make the indicator fluctuate around 0 level to get more accurate signals.

Various alarms added.

Kıvanç Özbilgiç

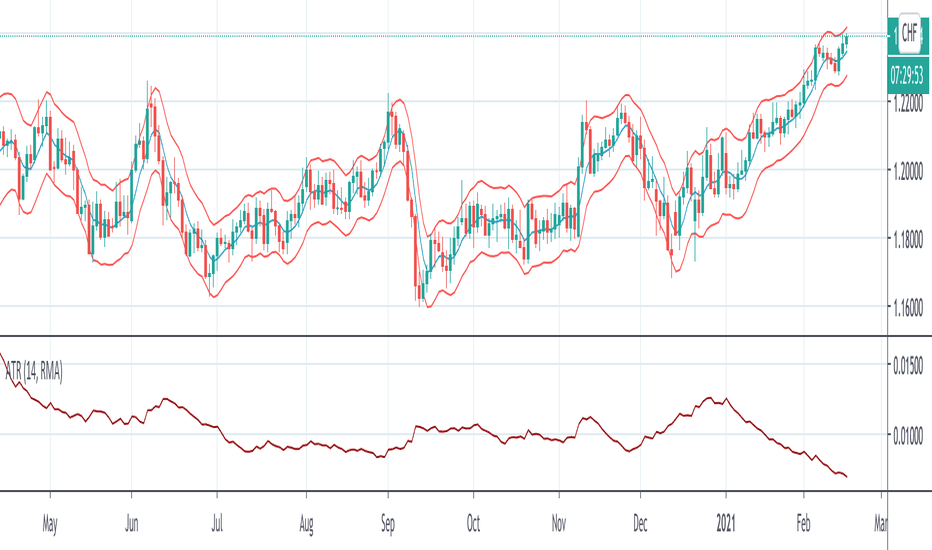

exponential moving average + ATRThis script simplifies and gives more control to the user when using EMA with ATR in a bands form.

The default values has to be changed according to your plan.

Up-Down RangeHere is an attempt to segregate ATR into ATR of up days and down days.

While setting trailing stops based on ATR, you probably need to consider more on how an instrument can drop during red days. Hence, ATR of only red days makes more compelling case than overall ATR. Another use case for this kind of indicator may be in options if you are selling puts and calls with the intent of pocketing premiums on expiry.

Parameters are as explained below:

Range Type : Different range types are tr (True Range) , close (difference between close prices), highlow (difference between high and low of candle)

Period : ATR Period

Moving Average Type : Moving Average Type for calculating ATR. Two additional types - min and max are added which calculates lowest and highest range in last n bars

HideFullAtr : Hides combined ATR if checked.

PG ATR based Stop LossA stoploss system that enables traders to exit with limited loss or even trailing loss.

Use the levels of indicator against the candle that has seen signidicant move for running positions and the candle in which a new position is taken.

Example : For long Nifty Future at 14990 levels, when Indicator is showing 14820 at bottom on a 30 min chart, 14820 can be used as a stop loss,

similarly for short conditions upper values above top of he candle will be followed.

For medium term ongoing positions, use the levels marked against candle that offered a major move, or the candles that has put the underlying in a new price zone or range.

15-30 minutes are suitable period for intraday / short term trades. Two hours or day periods can be used for positional trades.

**Queries are welcme.**

Risk Management: Position Size & Risk RewardHere is a Risk Management Indicator that calculates stop loss and position sizing based on the volatility of the stock. Most traders use a basic 1 or 2% Risk Rule, where they will not risk more than 1 or 2% of their capital on any one trade. I went further and applied four levels of risk: 0.25%, 0.50%, 1% and 2%. How you apply these different levels of risk is what makes this indicator extremely useful. Here are some common ways to apply this script:

• If the stock is extremely volatile and has a better than 50% chance of hitting the stop loss, then risk only 0.25% of your capital on that trade.

• If a stock has low volatility and has less than 20% change of hitting the stop loss, then risk 2% of your capital on that trade.

• Risking anywhere between 0.25% and 2% is purely based on your intuition and assessment of the market.

• If you are on a losing streak and you want to cut back on your position sizing, then lowering the Risk % can help you weather the storm.

• If you are on a winning streak and your entries are experiencing a higher level of success, then gradually increase the Risk % to reap bigger profits.

• If you want to trade outside the noise of the market or take on more noise/risk, you can adjust the ATR Factor.

• … and whatever else you can imagine using it to benefit your trading.

The position size is calculated using the Capital and Risk % fields, which is the percentage of your total trading capital (a.k.a net liquidity or Capital at Risk). If you instead want to calculate the position size based on a specific amount of money, then enter the amount in the Custom Risk Amt input box. Any amount greater than 0 in the Custom Risk Amt field will override the values in the Capital and Risk % fields.

The stop loss is calculated by using the ATR. The default setting is the 14 RMA, but you can change the length and smoothing of the true range moving average to your liking. Selecting a different length and smoothing affects the stop loss and position size, so choose these values very carefully.

The ATR Factor is a multiplier of the ATR. The ATR Factor can be used to adjust the stop loss and move it outside of the market noise. For the more volatile stock, increase the factor to lower the stop loss and reduce the chance of getting stopped out. For stocks with less volatility , you can lower the factor to raise the stop loss and increase position size. Adjusting the ATR Factor can also be useful when you want the stop loss to be at or below key levels of support.

The Market Session is the hours the market is open. The Market Session only affects the Opening Range Breakout (ORB) option, so it’s important to change these values if you’re trading the ORB and you’re outside of Eastern Standard Time or you’re trading in a foreign exchange.

The ORB is a bonus to the script. When enabled, the indicator will only appear in the first green candle of the day (09:30:00 or 09:30 AM EST or the start time specified in Market Session). When using the ORB, the stop loss is based on the spread of the first candle at the Open. The spread is the difference between the High and Low of the green candle. On 1-day or higher timeframes, the indicator will be the spread of the last (or current) candle.

The output of the indicator is a label overlaying the chart:

1. ATR (14 RMA x2) – This indicated that the stop loss is determined by the ATR. The x2 is the ATR Factor. If ORB is selected, then the first line will show SPREAD, instead of ATR.

2. Capital – This is your total capital or capital at risk.

3. Risk X% of Capital – The amount you’re risking on a % of the Capital. If a Custom Risk Amt is entered, then Risk Amount will be shown in place of Capital and Risk % of Capital.

4. Entry – The current price.

5. Stop Loss – The stop loss price.

6. -1R – The stop loss price and the amount that will be lost of the stop loss is hit.

7. – These are the target prices, or levels where you will want to take profit.

This script is primarily meant for people who are new to active trading and who are looking for a sound risk management strategy based on market volatility . This script can also be used by the more experienced trader who is using a similar system, but also wants to see it applied as an indicator on TradingView. I’m looking forward to maintaining this script and making it better in future revisions. If you want to include or change anything you believe will be a good change or feature, then please contact me in TradingView.

Electrified Aggressive Momentum SignalWhat this can be used for:

If you've already decided you want to trade a symbol, this can identify points of momentum alignment.

If a strong move has recently happened and you're looking for a change in momentum.

How it works:

This is a weighted combination of a Stochastic RSI and two modified SuperTrend (ATR Trailing Stop) indicators:

The Stochastic RSI signal is based upon aligned momentum and is negated at the overbought and oversold points.

The SuperTrend formula uses high and low values for calculation and both fast and slow can be adjusted for sensitivity.

Philosophy:

Signals have to be useful to humans. If a signal occurs to late, you've missed it. The intent of this indicator is to assist in timing a trade at very short time-frames. It assumes your conviction about a trade already exists, but you are trying to get an optimal entry.

Opposing momentum (weak signal) within an uptrend can be a sign that you should wait before entering. The frequency of a signal can indicate the strength of the trend. As the frequency of the aligned signal value decreases so does the reward vs risk.

ATR Without OutliersIt is an ATR indicator which filters out outliers.

Outliers are values which are higher than the standard deviation of the true range.

It may be better than normal ATR for stop loss, because it does not keep large values after pump or dump.

It is very useful for high volatile markets like crypto markets.

Rectangular ATR LevelsHelpful in forming Support resistance Judgements

Rectangular ATR Levels

is calculated using multipliers of the ATR value at the Previous Day's Close and plotting them on current day price movements as levels

Enjoy!

Arnaud Legoux Moving Average With ATR BandsArnaud Legoux Moving Average With ATR Bands to get an idea of the volatility.

Tiger's Stop - Objective Stoploss SettingTrading is a lot about risk management too. I created this script to help with setting and moving a proper stop-loss. It plots an area that is a result of adding and subtracting both average true range and something I call "false range".

►The Average True Range is calculated as the candle's high-low. If there is a gap, it is added to complete the result.

►My own False Range just candle bodies. It is calculated as an absolute value of (close-open).

Then, Rolling Moving Average is applied on both ATR and False Range to get an idea of how far the price tends to extend out of pure randomness. The resulting value is multiplied by a Multiplier.

The next step is an addition of the values to the higher part of the candle for short or a lower part of the candle for long. I prefer a special calculation instead of using Highs and Lows because it allows for more precise observation and stop-loss set up for less wicky symbols.

►►►Additional Functions

• Smoothing - applies moving average to candles from which range distance is calculated. This can achieve good smoothness but higher values will lead to using outdated price in the SL area calculation.

• Enable/Disable - if you know the direction you are going to trade in, it is good to disable either Long Stop-Loss Area or Short Stop-Loss Area. Just untick it in the settings.

►►►Actual Using

Before using the script to set your stop-loss, check the historical data and find a similar set-up. Is it engulfing you use as a trigger? Find a different one and see how effective the stop-loss based on the ATR*multiplier was. This will help you to optimize Multiplier value. A picture shows such research for a double top. You should find more similar situations to find an optimal value.

Ultimately, the indicator still gives you relatively a lot of freedom with your stop-loss settings (at least, that is with the default settings). You need to decide how loose stop-loss you want to set. Average True Range is the furthermost part which will make for a very large stop-loss, on the other hand, False Range might be triggered by a villainous wick unnecessarily. The choice should depend on the specific symbol you trade and perhaps, you will learn to set stops regardless of the indicator.

A little trick : 1. You can set the loosest stop-loss and set a TradingView alert for where the tightest stop-loss would be. When alerted, you will get the opportunity to reconsider the trade and take a loss if needs be or exit if a candle closes there. 2. Mostly for cryptocurrencies, you can set the tightest stop-loss to protect yourself from sudden spikes. If the price approaches it slowly enough, you can move the stop-loss to the further part of the channel. This is not the same as moving stop-loss indefinitely with hopes of reversal if you plan it from the beginning and a smaller stop is meant to protect you from spikes that are not always predictable and drive to both directions.

►►►Advantages of trailing stop-loss

I usually stick with my original stop-loss instead of moving to break even. If my entry area was functional support once, it may work again and is, therefore, still a good entry zone. But an alternative used to preserve as much of the profit as possible is trailing.

Trailing is setting a specific value in ticks or a calculation of how to move the stop-loss whenever the price moves in your favor. Tiger's Stop can be used this way. Whenever there is a new value as the candle closes and that value is closer to price than your current stop-loss, you can update it. However, if it moves further from your price, don't change the stop-loss. This can be a little tiresome if you do it manually but should be worth the effort.

I usually start trailing only after the price moves significantly in my favor that allowing it to return to the entry price would not make any sense.

►►►Feedback and optimization

The preview chart is chosen entirely at random and the values are not optimized for any specific symbol. If you opt to use it, let me know which values work for you the best, I'll add it to the description when I update it.

Furthermore, let me know if you think any sort of alerts would be useful with my script.

Good luck!

Trend MagicTrend Magic is originally a MT platform (MetaTrader) indicator and it can be used with any forex trading systems / strategies for additional confirmation of trading entries or exits. Converted the MT platform code to TradingView Pine version 4. Also you can use Multiple Time Frame.

It also works well with Crypto and Stock Markets.

Trend Magic consists of two main calculation parts as momentum and volatility:

First part is ATR based (like ATR Trailing Stop) logic, second part is all about CCI which also determines the color of Trend Magic.

Blue: when CCI is positive

Red: when CCI is negative

Also added alert condition regarding price crosses :

when LOW CrossesAbove TM

and HIGH CrossesBelow TM

Enjoy

Kıvanç Özbilgiç

VR-MASTThis is a my script for a super simple trading strategy - ZEST.

Identify Zone of Value, Enter on pullback, place proper Stop Loss and set achievable Targets.

So, to identify Zone of Value, I have EMA in my script.

20EMA generally acts as a dynamic Support/Resistance zone.

For Buy Stop Loss, we have 1ATR below Swing Low.

Then, we have SuperTrend for Trailing Stop Loss.

Moving average of 1-period Percent ChangeAnother way of finding the average range of the bars using 1 period percentage change of the price and taking an average of them. It's given in percentages and the absolute value of the average can be shown when the option is turned on, or the average including the up and down bars can be shown. Perhaps an alternative way of looking at volatility or range of the bars. If you prefer a line version over histogram, just simply change the style under the settings of the indicator.

VWAP-ATR-SSLThis is an experimental idea to transform the original script created by @Fleite28 in a kind of SSL with volatility bands.

@Fleite28 has made all script and he have all credits, I just give him this idea.

I'm using this indicator to confirm:

1-potential bull trend (when you have 2x green lines with support)

2-potential bear trend (2x lines red - resistance)

3-consolidations (inside green support and red resistance).

Try to use this with a Market Profile Volume and some trend lines.

HalfTrendA popular trend indicator based on ATR. Similar to the SuperTrend but uses a different trend's identification logic.

I am publishing a disclosed code without license. Remember that in the future you may see a lot of paid IO scripts called BuySellScalper, Trend Trader Karan, Trend Trader and etc (by other authors) which will be based on this script. I found the same script on Ebay for $10 with a free shipping. Beware, always check and follow one Russian wisdom: "Do not pay for something you can get for free".

Running Bound based on ATR multiplierThis script basically uses default ATR and then

Multiplies with ATR multiplier (3 for crypto and 2 for forex) - you can change the values from the settings if you like

Adds/subtracts from the current price

And tries to find a bound on both side of price

VBand StrategyVBand Strategy is simply used Vwap funcation and atr 14 for find the entry and exit points. This simple Strategy.