OPEN-SOURCE SCRIPT

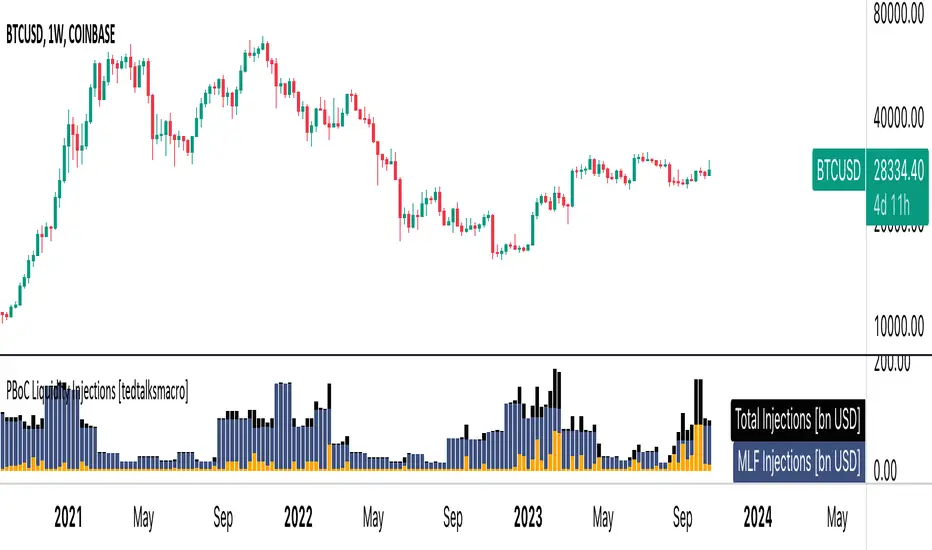

PBoC Liquidity Injections [tedtalksmacro]

Обновлено

This script shows open market operations by the world's fourth largest central bank (by assets) - the people's bank of china.

Use this script on the 1D timeframe and higher to understand where there are periods of heightened intervention by the PBoC where financial conditions in China are loosened! Looser financial conditions often correlate with higher risk asset prices.

Takes into account:

- PBoC RR operations [ CNLIVRR]

CNLIVRR]

Use this script on the 1D timeframe and higher to understand where there are periods of heightened intervention by the PBoC where financial conditions in China are loosened! Looser financial conditions often correlate with higher risk asset prices.

Takes into account:

- PBoC RR operations [

Информация о релизе

title updatesИнформация о релизе

Total Social Financing added to give more rounded view of injections.Информация о релизе

Reserve Ratio Requirements added to demonstrate whether bank reserves are falling or increasing.Информация о релизе

Title updateИнформация о релизе

This PBoC Liquidity Injections indicator tracks the major liquidity operations by the People's Bank of China - namely the Reverse Repo (RRP) and Medium-term Lending Facility (MLF).It can provide insights into China's monetary policy stance and serve as an indicator for risk assets:

Increased PBoC liquidity injections suggest an accommodative/dovish monetary policy. This provides more liquidity into the Chinese economy and financial system.

Higher liquidity typically correlates with stronger performance of risk assets like stocks and commodities. The added liquidity can spur economic growth and investing activity.

Decreased PBoC liquidity injections imply a tighter monetary policy. Reducing system liquidity tends to negatively impact risk sentiment.

Tighter liquidity can precede pullbacks in stocks and commodities, as it tightens financial conditions. Fears of slower growth in China also weigh on global risk appetite.

So monitoring the stacked bar chart of RRP and MLF gives a quick glance on China's monetary policy. Rising liquidity stacks signal supportive conditions for risk assets. Falling liquidity suggests potential headwinds for stocks/commodities and upside for safe haven assets.

The indicator visualizes the liquidity flows from China's central bank. Analysts watch these measures closely to gauge China's economic trajectory and its implications for global markets.

Скрипт с открытым кодом

В истинном духе TradingView автор этого скрипта опубликовал его с открытым исходным кодом, чтобы трейдеры могли понять, как он работает, и проверить на практике. Вы можете воспользоваться им бесплатно, но повторное использование этого кода в публикации регулируется Правилами поведения. Вы можете добавить этот скрипт в избранное и использовать его на графике.

Отказ от ответственности

Все виды контента, которые вы можете увидеть на TradingView, не являются финансовыми, инвестиционными, торговыми или любыми другими рекомендациями. Мы не предоставляем советы по покупке и продаже активов. Подробнее — в Условиях использования TradingView.