OPEN-SOURCE SCRIPT

Noa: Z-distance from VWAP with Kalman Smoother

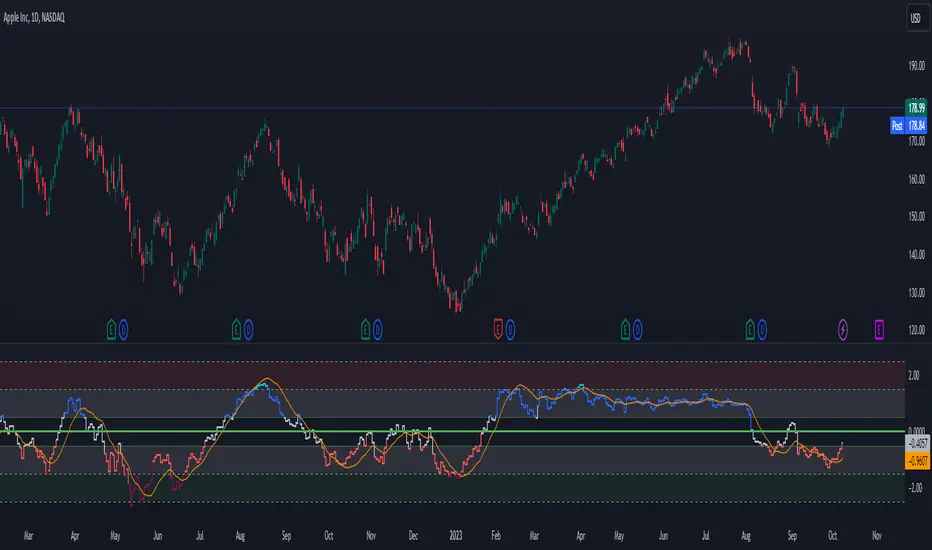

https://www.tradingview.com/x/hGvXGqUl/

Title: Noa: Z-distance from VWAP with Kalman Smoother

Description:

The "Z-distance from VWAP with Kalman Smoother" is a tool constructed on the premise that price evolves in distinct stages: normal or extreme trends (upward or downward) and transitional periods, termed as 'flips'. The Volume Weighted Average Price (VWAP) serves as a benchmark, representing the market's expectation of a fair value over a given time frame. However, since each stock trades on its unique price scale, direct comparisons are not feasible. This script introduces a standardized method, using the Z-score from the VWAP, to understand and compare these relationships across diverse scales.

Core Principles:

Stages of Price Movement:

- Prices don't move purely randomly; while they contain a random element, they oscillate in discernible patterns or stages—either maintaining a trend (normal or extreme) or undergoing transition (flip).

- VWAP as Fair Value: VWAP offers a dynamic representation of what the market perceives as fair value for a stock over a specific period.

- Standardizing Price Relations: Given the varied scales at which different stocks trade, a model was imperative to standardize these relations. The Z-score from the VWAP fulfills this role, offering a normalized measure of how far the price deviates from its perceived fair value.

Features:

Z-score Levels:

The indicator demarcates various stages of price movements, offering clarity on potential overbought or oversold conditions.

- Extreme Up Trend: Indicated when the Z-score surpasses the upper limit.

- Normal Up Trend: Represented when the Z-score lies between the flip upper and the upper limit.

- Transition (Flip): Recognized when the Z-score oscillates within the flip range.

- Normal Down Trend: Denoted when the Z-score is between the flip lower and the lower limit.

- Extreme Down Trend: Marked when the Z-score falls below the lower limit.

Visual Aids:

- Color-coded regions between specific Z-score levels and the Z-score plot itself elucidate the current market state.

- Kalman Filter: By incorporating a Kalman filter, the indicator offers a less noisy and smoother representation of the Z-score, enhancing its interpretability.

Usage:

Trend Analysis:

- The Z-score states and the color-coded plot facilitate a nuanced understanding of the prevailing market trend.

- Potential Reversal Points: Extremely positive or negative Z-scores might hint at impending reversals.

- Buy/Sell Signals: Z-score's interactions with the flip level can be interpreted as potential trading signals.

Example (for illustration purposes only):

AAPL since April 2022: The stock exited from a normal uptrend and transitioned potentially towards a downtrend. By the end of April, AAPL flipped twice before transitioning to a normal downtrend. By early May, the stock moved into an aggressive downtrend. Market buyers were able to counter this downtrend by June, but selling pressure persisted, pushing the stock back into an aggressive downtrend. By the end of June, buyers halted the aggressive selling and transitioned the stock from an aggressive to normal downtrend, then to a flip, and finally to a normal uptrend by the end of August. AAPL briefly peaked into an aggressive uptrend before being pressured back to a normal downtrend. The rest of 2022 saw AAPL attempting several short-lived uptrend flips. However, 2023 brought a change, with AAPL flipping into a normal uptrend by the end of January, maintaining it until August of that year.

Credits:

This script, inspired by Z distance from VWAP by LazyBear and Kalman Smoother by alexgrover, was revamped and enriched by nord-ouestadvisors to embed these core principles and heighten its usability. A special acknowledgment to ChatGPT by OpenAI for the guidance.

Title: Noa: Z-distance from VWAP with Kalman Smoother

Description:

The "Z-distance from VWAP with Kalman Smoother" is a tool constructed on the premise that price evolves in distinct stages: normal or extreme trends (upward or downward) and transitional periods, termed as 'flips'. The Volume Weighted Average Price (VWAP) serves as a benchmark, representing the market's expectation of a fair value over a given time frame. However, since each stock trades on its unique price scale, direct comparisons are not feasible. This script introduces a standardized method, using the Z-score from the VWAP, to understand and compare these relationships across diverse scales.

Core Principles:

Stages of Price Movement:

- Prices don't move purely randomly; while they contain a random element, they oscillate in discernible patterns or stages—either maintaining a trend (normal or extreme) or undergoing transition (flip).

- VWAP as Fair Value: VWAP offers a dynamic representation of what the market perceives as fair value for a stock over a specific period.

- Standardizing Price Relations: Given the varied scales at which different stocks trade, a model was imperative to standardize these relations. The Z-score from the VWAP fulfills this role, offering a normalized measure of how far the price deviates from its perceived fair value.

Features:

Z-score Levels:

The indicator demarcates various stages of price movements, offering clarity on potential overbought or oversold conditions.

- Extreme Up Trend: Indicated when the Z-score surpasses the upper limit.

- Normal Up Trend: Represented when the Z-score lies between the flip upper and the upper limit.

- Transition (Flip): Recognized when the Z-score oscillates within the flip range.

- Normal Down Trend: Denoted when the Z-score is between the flip lower and the lower limit.

- Extreme Down Trend: Marked when the Z-score falls below the lower limit.

Visual Aids:

- Color-coded regions between specific Z-score levels and the Z-score plot itself elucidate the current market state.

- Kalman Filter: By incorporating a Kalman filter, the indicator offers a less noisy and smoother representation of the Z-score, enhancing its interpretability.

Usage:

Trend Analysis:

- The Z-score states and the color-coded plot facilitate a nuanced understanding of the prevailing market trend.

- Potential Reversal Points: Extremely positive or negative Z-scores might hint at impending reversals.

- Buy/Sell Signals: Z-score's interactions with the flip level can be interpreted as potential trading signals.

Example (for illustration purposes only):

AAPL since April 2022: The stock exited from a normal uptrend and transitioned potentially towards a downtrend. By the end of April, AAPL flipped twice before transitioning to a normal downtrend. By early May, the stock moved into an aggressive downtrend. Market buyers were able to counter this downtrend by June, but selling pressure persisted, pushing the stock back into an aggressive downtrend. By the end of June, buyers halted the aggressive selling and transitioned the stock from an aggressive to normal downtrend, then to a flip, and finally to a normal uptrend by the end of August. AAPL briefly peaked into an aggressive uptrend before being pressured back to a normal downtrend. The rest of 2022 saw AAPL attempting several short-lived uptrend flips. However, 2023 brought a change, with AAPL flipping into a normal uptrend by the end of January, maintaining it until August of that year.

Credits:

This script, inspired by Z distance from VWAP by LazyBear and Kalman Smoother by alexgrover, was revamped and enriched by nord-ouestadvisors to embed these core principles and heighten its usability. A special acknowledgment to ChatGPT by OpenAI for the guidance.

Скрипт с открытым кодом

В истинном духе TradingView автор этого скрипта опубликовал его с открытым исходным кодом, чтобы трейдеры могли понять, как он работает, и проверить на практике. Вы можете воспользоваться им бесплатно, но повторное использование этого кода в публикации регулируется Правилами поведения. Вы можете добавить этот скрипт в избранное и использовать его на графике.

Отказ от ответственности

Все виды контента, которые вы можете увидеть на TradingView, не являются финансовыми, инвестиционными, торговыми или любыми другими рекомендациями. Мы не предоставляем советы по покупке и продаже активов. Подробнее — в Условиях использования TradingView.