OPEN-SOURCE SCRIPT

Tick CVD [Kioseff Trading]

Hello!

This script "Tick CVD" employs live tick data to calculate CVD and volume delta! No tick chart required.

Features

How it works

While historical tick-data isn't available to non-professional subscribers, live tick data is programmatically accessible. Consequently, this indicator records live tick data to calculate CVD, delta, and other metrics for the user!

Generally, Pine Scripts use the following rules to calculate volume/price-related metrics:

Bullish Volume: When the close price is greater than the open price.

Bearish Volume: When the close price is less than the open price.

This script, however, improves on that logic by utilizing live ticks. Instead of relying on time-series charts, it records up ticks as buying volume and down ticks as selling volume. This allows the script to create a more accurate CVD, delta, or price tick chart by tracking real-time buying and selling activity.

Price can tick fast; therefore, tick aggregation can occur. While tick aggregation isn't necessarily "incorrect", if you prefer speed and efficiency it's advised to enable "efficiency mode" in a fast market.

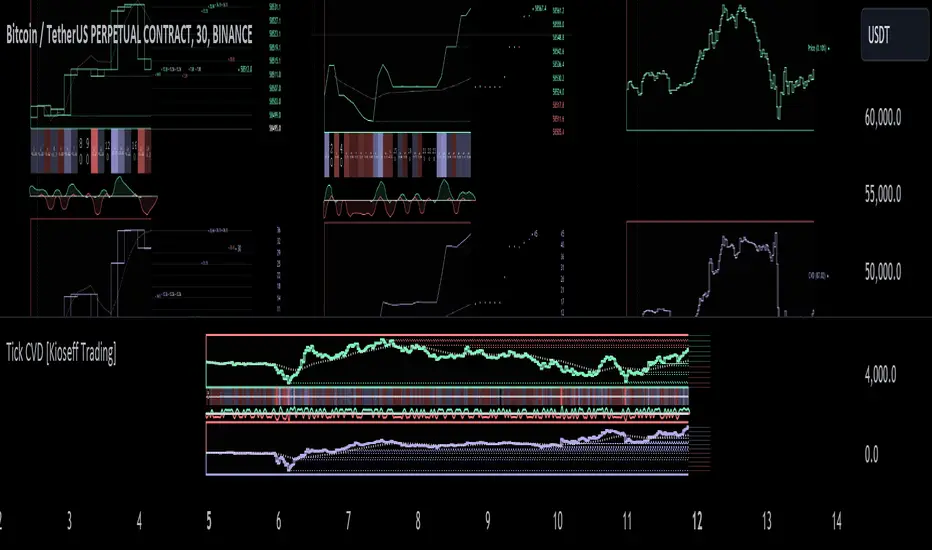

The image above highlights the tick CVD and price tick graph!

Green price tick graph = price is greater than its origin point (first script load)

Red price tick graph = price is less than its origin point

Blue tick CVD graph = CVD, over the calculation period, is greater than 0.

Red tick CVD graph = CVD is less than 0 over the calculation period.

The image above explains the right-oriented scales. The upper scale is for the price graph and the lower scale for the CVD graph.

The image above explains the circles superimposed on the scale lines for the price graph and the CVD graph.

The image above explains the "wavy" lines shown by the indicator. The wavy lines correspond to tick delta - whether the recorded tick was an uptick or down tick and whether buy volume or sell volume transpired.

The image above explains the blue/red boxes displayed by the indicator. The boxes offer an alternative visualization of tick delta, including the magnitude of buying/selling volume for the recorded tick.

Blue boxes = buying volume

Red boxes = selling volume

Bright blue = high buying volume (relative)

Bright red = high selling volume (relative)

Dim blue = low buying volume (relative)

Dim red = low selling volume (relative)

The numbers displayed in the box show the numbered tick and the volume delta recorded for the tick.

The image above further explains visuals for the CVD graph.

Dotted red lines indicate key CVD peaks, while dotted blue lines indicate key CVD bottoms.

The white dotted line reflects the CVD average of your choice: HMA, WMA, EMA, SMA.

The image above offers a similar explanation of visuals for the price graph.

The image above offers an alternative view for the indicator!

The image above shows the indicator when efficiency mode is enabled. When trading a fast market, enabling efficiency mode is advised - the script will perform quicker.

Of course, thank you to RicardoSantos for his awesome library I use in almost every script :D

Thank you for checking this out!

This script "Tick CVD" employs live tick data to calculate CVD and volume delta! No tick chart required.

Features

- Live price ticks are recorded

- CVD calculated using live ticks

- Delta calculated using live ticks

- Tick-based HMA, WMA, EMA, or SMA for CVD and price

- Key tick levels (S/R CVD & price) are recorded and displayed

- Price/CVD displayable as candles or lines

- Polylines are used - data visuals are not limited to 500 points.

- Efficiency mode - remove all the bells and whistles to capitalize on efficiently calculated/displayed tick CVD and price

How it works

While historical tick-data isn't available to non-professional subscribers, live tick data is programmatically accessible. Consequently, this indicator records live tick data to calculate CVD, delta, and other metrics for the user!

Generally, Pine Scripts use the following rules to calculate volume/price-related metrics:

Bullish Volume: When the close price is greater than the open price.

Bearish Volume: When the close price is less than the open price.

This script, however, improves on that logic by utilizing live ticks. Instead of relying on time-series charts, it records up ticks as buying volume and down ticks as selling volume. This allows the script to create a more accurate CVD, delta, or price tick chart by tracking real-time buying and selling activity.

Price can tick fast; therefore, tick aggregation can occur. While tick aggregation isn't necessarily "incorrect", if you prefer speed and efficiency it's advised to enable "efficiency mode" in a fast market.

The image above highlights the tick CVD and price tick graph!

Green price tick graph = price is greater than its origin point (first script load)

Red price tick graph = price is less than its origin point

Blue tick CVD graph = CVD, over the calculation period, is greater than 0.

Red tick CVD graph = CVD is less than 0 over the calculation period.

The image above explains the right-oriented scales. The upper scale is for the price graph and the lower scale for the CVD graph.

The image above explains the circles superimposed on the scale lines for the price graph and the CVD graph.

The image above explains the "wavy" lines shown by the indicator. The wavy lines correspond to tick delta - whether the recorded tick was an uptick or down tick and whether buy volume or sell volume transpired.

The image above explains the blue/red boxes displayed by the indicator. The boxes offer an alternative visualization of tick delta, including the magnitude of buying/selling volume for the recorded tick.

Blue boxes = buying volume

Red boxes = selling volume

Bright blue = high buying volume (relative)

Bright red = high selling volume (relative)

Dim blue = low buying volume (relative)

Dim red = low selling volume (relative)

The numbers displayed in the box show the numbered tick and the volume delta recorded for the tick.

The image above further explains visuals for the CVD graph.

Dotted red lines indicate key CVD peaks, while dotted blue lines indicate key CVD bottoms.

The white dotted line reflects the CVD average of your choice: HMA, WMA, EMA, SMA.

The image above offers a similar explanation of visuals for the price graph.

The image above offers an alternative view for the indicator!

The image above shows the indicator when efficiency mode is enabled. When trading a fast market, enabling efficiency mode is advised - the script will perform quicker.

Of course, thank you to RicardoSantos for his awesome library I use in almost every script :D

Thank you for checking this out!

Скрипт с открытым кодом

В истинном духе TradingView автор этого скрипта опубликовал его с открытым исходным кодом, чтобы трейдеры могли понять, как он работает, и проверить на практике. Вы можете воспользоваться им бесплатно, но повторное использование этого кода в публикации регулируется Правилами поведения. Вы можете добавить этот скрипт в избранное и использовать его на графике.

•Access to Next-Gen Optimization Tools: kiosefftrading.com

•Discord Server: discord.gg/3cKVU28Z9Z

•Discord Server: discord.gg/3cKVU28Z9Z

Отказ от ответственности

Все виды контента, которые вы можете увидеть на TradingView, не являются финансовыми, инвестиционными, торговыми или любыми другими рекомендациями. Мы не предоставляем советы по покупке и продаже активов. Подробнее — в Условиях использования TradingView.