PROTECTED SOURCE SCRIPT

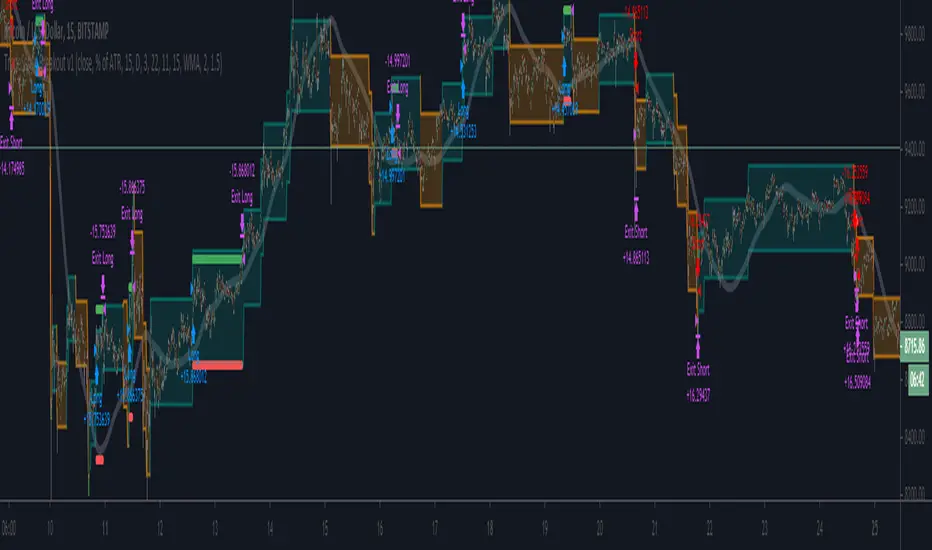

TradeSense Breakout Strategy v1

Обновлено

TradeSense is a Renko brick breakout trading system for short-term or intraday trade. It is also a trend following strategy using a confluence of multiple MA's to spot the underlying trend. Exit and Stop Loss is based on dynamic ATR to predict possible target based on ticker's real time volatility.

So far this has been back-tested on major cyrptos, and the same concept is applicable to other asset types. It is more suitable for lower timeframes (such as the 30m, 15m, and 5m) though you may try adjusting the parameters for higher timeframes.

Feel free to backtest it and comment below!

Optimum parameters:

BTCUSD-15m

- Noise Filter: 1

- ATRLength : 15

- SL coefficient : 2.0

- TP coefficient : 1.5

ETHUSD-15m

- Noise Filter: 7

- ATRLength : 16

- SL coefficient : 2.0

- TP coefficient : 1.5

So far this has been back-tested on major cyrptos, and the same concept is applicable to other asset types. It is more suitable for lower timeframes (such as the 30m, 15m, and 5m) though you may try adjusting the parameters for higher timeframes.

Feel free to backtest it and comment below!

Optimum parameters:

BTCUSD-15m

- Noise Filter: 1

- ATRLength : 15

- SL coefficient : 2.0

- TP coefficient : 1.5

ETHUSD-15m

- Noise Filter: 7

- ATRLength : 16

- SL coefficient : 2.0

- TP coefficient : 1.5

Информация о релизе

Risk level threshold - Min & Max levels are parameterized.BTCUSD 15m

- ROC Max: 22

- ROC Min: 11

- Entry: %ATR = 15%

- ATR length (SL & TP): 15

ETHUSD 15m

- ROC Max: 28

- ROC Min: 17

- Entry: %Price = 0.45%

- ATR length (SL & TP): 16

Отказ от ответственности

Все виды контента, которые вы можете увидеть на TradingView, не являются финансовыми, инвестиционными, торговыми или любыми другими рекомендациями. Мы не предоставляем советы по покупке и продаже активов. Подробнее — в Условиях использования TradingView.