OPEN-SOURCE SCRIPT

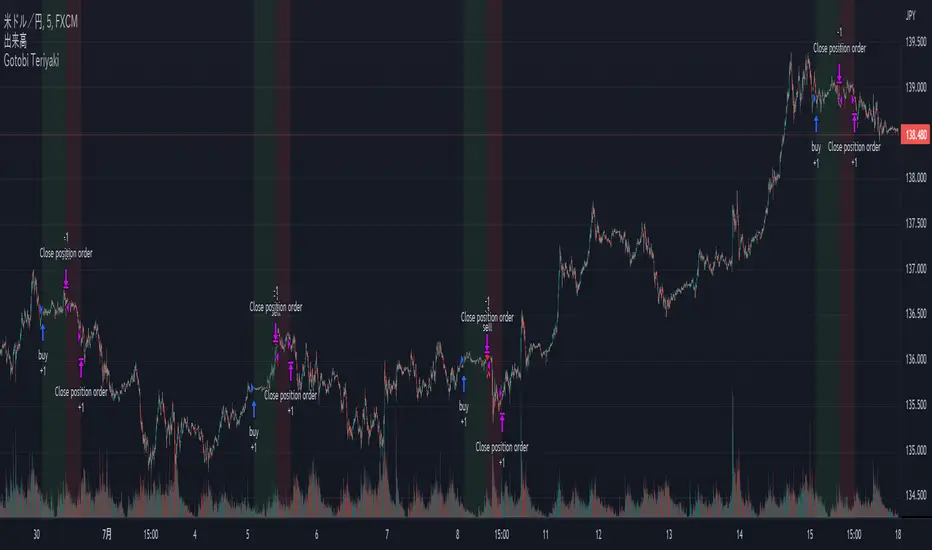

Gotobi Teriyaki

Обновлено

USDJPY Anomaly.

This anomaly originated in Japan.

Buy from 2:00 pm Japan time.

Sell at 9:55 Japan time.

Japanese importers often settle payments to suppliers in dollars, and exchange yen for dollars on settlement days (days falling on a 5 or 10, so-called goto days).

Therefore, on goto days, there is sometimes a shortage of dollars held by financial institutions. This is called the "middle price shortage," and financial institutions purchase dollars through the foreign exchange market to resolve the middle price shortage.

As a result, the dollar currency is bought and USD/JPY depreciates against the yen. Since the yen has historically appreciated against the dollar, exporting companies make forward exchange contracts with financial institutions as a risk hedge.

Financial institutions are therefore forced to procure dollars in the market because they do not have enough dollars in their balance sheets to deliver to exporters.

Five days is called "GO" in Japanese.

Ten days is called "TO" in Japanese.

In Japanese, a day is called "BI".

Now I can eat teriyaki all day long :)

ドル円ゴトー日ストラテジーを作ってみました。

This anomaly originated in Japan.

Buy from 2:00 pm Japan time.

Sell at 9:55 Japan time.

Japanese importers often settle payments to suppliers in dollars, and exchange yen for dollars on settlement days (days falling on a 5 or 10, so-called goto days).

Therefore, on goto days, there is sometimes a shortage of dollars held by financial institutions. This is called the "middle price shortage," and financial institutions purchase dollars through the foreign exchange market to resolve the middle price shortage.

As a result, the dollar currency is bought and USD/JPY depreciates against the yen. Since the yen has historically appreciated against the dollar, exporting companies make forward exchange contracts with financial institutions as a risk hedge.

Financial institutions are therefore forced to procure dollars in the market because they do not have enough dollars in their balance sheets to deliver to exporters.

Five days is called "GO" in Japanese.

Ten days is called "TO" in Japanese.

In Japanese, a day is called "BI".

Now I can eat teriyaki all day long :)

ドル円ゴトー日ストラテジーを作ってみました。

Информация о релизе

delete day % 10 == 0Скрипт с открытым кодом

В истинном духе TradingView автор этого скрипта опубликовал его с открытым исходным кодом, чтобы трейдеры могли понять, как он работает, и проверить на практике. Вы можете воспользоваться им бесплатно, но повторное использование этого кода в публикации регулируется Правилами поведения. Вы можете добавить этот скрипт в избранное и использовать его на графике.

Отказ от ответственности

Все виды контента, которые вы можете увидеть на TradingView, не являются финансовыми, инвестиционными, торговыми или любыми другими рекомендациями. Мы не предоставляем советы по покупке и продаже активов. Подробнее — в Условиях использования TradingView.